Editor’s Note: This is the fourth in a series of posts that preview the findings of the forthcoming Financing Africa: Through the Crisis and Beyond regional flagship report, a comprehensive review documenting current and new trends in Africa’s financial sectors and taking into account Africa’s many different experiences. The report was prepared by the African Development Bank, the German Federal Ministry for Economic Cooperation and Development and the World Bank. In this post, the authors focus on the regulatory and supervisory challenges for financial systems in Africa.

In our previous contributions, we stressed the importance of competition in the banking system and the financial system at large. However, this also poses additional challenges for regulators and supervisors. The recent Nigerian experience of widespread and systemic fragility linked to (though not necessarily caused by) rapid changes in market structure and capital structure of banks shows that regulators and supervisors have to develop the capacity to monitor such changes carefully. It also shows that increased competition has to be accompanied by improvements in governance. Similarly, expanding financial service provision beyond banking poses additional challenges to regulators and supervisors. This concerns not only the challenges in the supervision of insurance companies and pension funds, but also coordination between bank and telecom regulators. It also requires an open and flexible regulatory and supervisory approach that balances the need for financial innovation with the need to watch for fragility emerging in new forms.

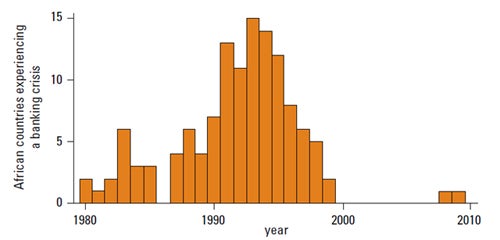

We find that African financial systems have come a long way in terms of financial stability. While in 1995 a third of all countries in the continent were suffering a systemic banking crisis, fragility has subsided across the continent (Figure 1). Today, most African banking systems are stable, well-capitalized and well, if not over-liquid to a degree that undermines their ability to intermediate efficiently. Having said this, there is still hidden or silent fragility in several Central and West African countries. Among the smaller financial systems, Togo has several banks with a high level of non-performing loans and insufficient capital-asset ratios, with effectively 50% of its banking system in distress, the result of governance deficiencies as well as political and economic turmoil over the past two decades. In Cote d’Ivoire, a large number of banks, mostly local or regional, were facing difficulties in 2008, mostly related to the accumulation of public sector arrears, lending to risky sectors, and governance problems, with the government taking control of three banks and recapitalizing them.

Figure 1: Systemic Banking Crises in Africa, 1980 to 2009

Supervisory frameworks – unfinished business

This overall positive development has been partly due to a regulatory upgrade, although this has come without a similar upgrade in supervisory capacity. Review and subsequent reform of banking sector legislation has been undertaken in a number of countries over recent years. Many countries have complemented legislative reform with an overhaul of the corresponding regulations. On the other hand, there are still deficiencies in the regulatory framework, especially when it comes to the independence of supervisors, risk management and the resolution capacity of supervisors.

In most African countries supervisory resources, including qualified staff and availability of analytical tools, are limited. Many regulators are not independent from the Ministry of Finance or other government agencies in their decision making, and legal frameworks often limit the corrective and remedial powers of supervisors to intervene in failing banks. Critically, supervisory processes focus on compliance with regulatory standards, but are not set-up to identify and manage the changing risks in the banking system. In addition, the ability to monitor risks on the institutional and systemic level is hampered by insufficient data quality and reporting processes. These deficiencies weigh even more heavily in an increasingly globalized world.

The weakest point in the financial supervisory framework in most countries, however, continues to be the bank resolution system, i.e. the capacity to intervene in a failing bank in a timely fashion to prevent economic damage and contagion. The current crisis and the often bungled attempts of OECD countries to deal with their failing banks have put this issue high on the agenda. One dimension where quick progress could be made is fire drills, simulation exercises and contingency plans. The introduction of deposit insurance, on the other hand, does not seem very practical in this context. Apart from the traditional moral hazard concerns, the small number of banks imposes an important constraint, as the failure of a single bank, not even the largest, would exhaust the fund. Where deposit insurance already exists, on the other hand, transforming it from a paybox scheme into an integral part of failure resolution, as is happening in Kenya and Uganda, might improve efficiency and crisis preparedness. It would help align incentives as deposit insurers would then have not only the incentives but also the tools to minimize losses for the insurance fund.

In addition to the domestic dimension to failure resolution, the cross-border dimension has become increasingly important given the international character of Africa’s banking systems. Recent reforms of the international supervisory architecture have focused on the creation of colleges of supervisors for all internationally operating banks. The representation of African supervisors in these supervisory colleges remains a weak point given the current asymmetry of the size of operations of large international banks between developed markets and most African markets. For example, activities of an international banking group in Africa may make up a very small part of its total balance sheet, but that bank may be of disproportionate systemic importance for certain African countries. Closer to home, the emergence of regional banks headquartered in African jurisdictions requires closer cooperation of banking supervisors across the region. African home supervisors need to champion regional college agreements and bilateral Memorandums of Understanding to facilitate cooperation processes. Restrictions to information sharing relating to confidentiality of banking information need to be addressed to enable regulators to pass on information to other regulators. The recent European experience, however, suggests that Colleges of Supervisors and Memorandums of Understanding are necessary but not sufficient tools for coordination in cases of idiosyncratic or systemic fragility. In the end, Memorandums of Understanding are legally non-binding documents and even within a college of supervisors, it is the home country supervisor who takes the final decision.

Looking beyond banks – how to regulate the non-banking sector?

The regulation of insurance companies and pension funds has often been neglected, especially when financial sector supervision has been housed in Finance Ministries with few staff, weak regulatory frameworks and no supervisory powers. As important as capital and governance regulations, however, are consumer protection regulations to increase trust in these institutions. In recent times, fortunately, this has started to improve as regulatory and supervisory functions have been moved to either the central bank or to dedicated non-bank regulatory agencies as is the case in Botswana and Zambia.

Another reform suggestion in the recent post-crisis debate has been the extension of the regulatory boundary, i.e. extending financial sector regulation and supervision to non-bank financial corporations such as private equity funds. This trend towards extending the regulatory perimeter conflicts not only with the lack of the necessary human and financial resources in many low-income countries, but also with the transaction costs that the expansion of regulation would have on emerging components of the financial system, such as certain over-the-counter (OTC) markets or capital funds. In a nutshell, expanding the regulatory net to include nonbank financial institutions that serve households with less financial exposure might be more important than expanding it toward products and markets mostly used by more educated and sophisticated segments of the population.

One of the areas with the most rapid changes over the past decade or so has been the regulation of institutions that serve the bottom-of-the-pyramid. Many African countries have by now introduced some kind of special regulatory framework for microfinance institutions (MFIs) or are in the process of doing so. In a third of countries, on the other hand, MFIs still fall either implicitly or explicitly under the banking or non-bank financial institution (NBFI) regulatory framework or they are left out completely.

A question many countries across the continent have been struggling with is whether micro-finance or cooperative institutions should be regulated and supervised to the same extent as banks. A global consensus has developed towards extending prudential regulation and supervision only to deposit-taking institutions, while it is important to avoid burdensome prudential regulation for non-prudential purposes. Deposit-taking microfinance institutions can certainly do with lower reporting requirements and lower absolute minimum capital standards, but they possibly need higher requirements for capital and liquidity ratios. There is an argument for higher capital-adequacy ratios for MFIs as their loan portfolios are typically more concentrated geographically and sectorally and for that reason tend to be more volatile. Rules such as limits to unsecured lending as a ratio of equity should not be imposed on MFIs as most if not all of microlending is uncollateralized. It is important not to impose overburdening activity or geographic restrictions on such institutions, as this might undermine their viability.

Focusing on users – consumer protection

Consumer protection has gained increasing importance throughout the world. Across the industrialized world, the aftermath of the global crisis has seen a re-emphasis on protecting unsophisticated consumers of financial services against buying products they do not need or that expose their livelihood to extreme risk. This focus on consumer protection relates both to savings/investment and credit products. It is closely related to the theme of financial literacy discussed earlier, but focuses more on the market-harnessing role of regulation and imposes restrictions on financial service suppliers rather than focusing on (potential) consumers.

What are the instruments of consumer protection? In line with the motto that “sunshine is the best disinfectant” disclosure requirements are one of the most basic and important tools. A step up from pure disclosure rules (which can be enforced by bank supervisors or even on an industry-basis by the banking association) are consumer protection rules that prohibit financial institutions from selling specific products to all but sophisticated clients (such as corporate clients or high-wealth individuals) or imposes affordability tests on financial institutions before extending credit. Such regulation imposes regulatory compliance costs on financial institutions, which might prevent the broadening of the financial system and requires additional institutional capacity on the authorities’ side. A final set of rules imposes certain minima or maxima on costs of financial services, including usury interest rate. Such interest rate ceilings (in the case of credit) or floors (in the case of savings products), however, can easily turn into a restrictive tool that reduces access to services by riskier customers and customers with a need for smaller transactions and who are thus costlier for financial institutions. A third of countries in Africa still have usury ceilings in place, and a fourth impose deposit interest rate floors. This high rate, however, is driven by the West African currency union. On the other hand, few countries impose limits on fees. This obviously makes interest rate ceilings and floors less effective, as fees are a popular escape route for banks facing restrictions on interest rates.

We argue that the minimal consumer protection framework should aim for (i) transparency, (ii) fair treatment and (iii) recourse possibilities. Important to note is that one size does not fit all. Middle-income countries such as South Africa can afford sophisticated institutional structures. Given the rapid increase in consumer credit, there is also a stronger need for such protection mechanisms in these economies. In the specific case of South Africa, this has also to be seen in the context of the consumer credit boom the country experienced in the early years of the 21st century. Small and low-income countries, on the other extreme, might not have the necessary resources and capacities to implement such a system and have to rely more on disclosure standards and self-regulatory initiatives. However, there is also less of a need for a sophisticated set of instruments for consumer protection in the banking system, given the low outreach of banks in these countries. Higher emphasis in such countries might have to be put on detecting early trends of pyramid schemes in the informal sector.

In summary, Africa has made enormous progress toward a more stable financial system. Progress in expanding access and lengthening contracts – the ultimate objectives of financial development – requires further regulatory and supervisory upgrades and a smart rather than holistic adoption of regulatory reforms in developed economies.

Join the Conversation