Hammering a a percent sign—an illustration of interest rate drop | © shutterstock.com

Hammering a a percent sign—an illustration of interest rate drop | © shutterstock.com

Since 2012, central banks around the world have gradually pushed interest rates below zero. Once an intellectual curiosity, today interest rates are negative in countries accounting for 25% of world GDP and more than $17 trillion worth of securities offer a negative yield (BIS 2019). Moreover, going negative is increasingly regarded as a serious policy option. Given the long-term decline in nominal interest rates, the ability to lower real interest rates by cutting policy rates below zero may help in responding to economic downturns (Rogoff 2017). As governments seek to combat the recession brought on by COVID-19, discussions around the effectiveness of negative rates remain high on the policy agenda (Tenreyro 2021). However, it is unclear how exactly negative rates transmit to real economic activity through the banking system. A particular concern is that long spells of sub-zero rates could increase the risk of financial disruptions or discourage banks from performing financial intermediation (Eggertsson et al. 2019).

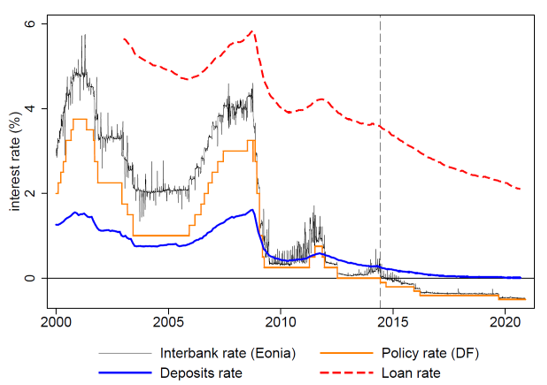

Figure 1: Deposit facility rate, Eonia rate, and rates on loans and overnight deposits for households and non-financial corporations (weighted average) in the euro area.

Measuring the impact of negative rates on bank lending

In a recent paper (Grandi and Guille 2018), we empirically study the transmission of negative rates in France and the euro area using bank and confidential bank-firm-level data. In line with Heider, Saidi, and Schepens (2019), we exploit the imperfect transmission of negative rates to deposits to identify the impact of negative rates on banks’ activities. While negative policy rates substantially lowered short-term rates and lending rates, transmission to retail deposit rates was limited (see figure 1). The presence of cash and fear of deposit withdrawals likely made European banks reluctant to charge negative nominal rates on deposits, especially on those held by households and small businesses (ECB 2020). As a result, the funding costs of deposit-dependent banks face a hard floor at zero. This friction, in turn, creates variation in how negative rates affect different banks: after a rate cut in negative territory, banks with large shares of deposits should experience a compression in net interest margins (i.e., the spread between the rate earned on loans and that paid on deposits) relative to banks that are mostly funded on wholesale markets.

In principle, negative rates may have different outcomes on lending. On the one hand, the squeeze in margins could erode equity and, in turn, limit banks’ ability to supply loans (Brunnermeier and Koby 2018; Eggertsson et al. 2019). On the other hand, banks may attempt to preserve their profitability by increasing lending, especially to riskier borrowers, and by investing in higher-yielding assets (Bottero et al. 2019; Bubeck, Maddaloni, and Peydró 2020). Our strategy is to test both hypotheses using a differences-in-differences setup to compare the evolution in lending by banks with high and low shares of deposits (i.e., treated and control groups, respectively) before and after the introduction of negative rates by the European Central Bank (ECB).

Negative rates are associated with more lending and risk taking

Using credit registry data for France, we show that negative rates transmit to bank lending via deposits. First, banks most reliant on deposits extended more loans relatively to other banks after the ECB lowered the policy rate below zero in June 2014. The effect is economically sizable: after the policy rate crossed zero, a one-standard-deviation increase in banks’ deposits-to-assets ratio is associated with a 13% increase in loans to non-financial corporations and households. Second, the increase in lending is strongest for banks that rely on checking account deposits by households, confirming the importance of retail deposits for the transmission of negative rates. Third, negative rates are associated with search-for-yield, as treated banks increase their asset share of corporate loans and private debt securities by more than control banks following the introduction of the policy.

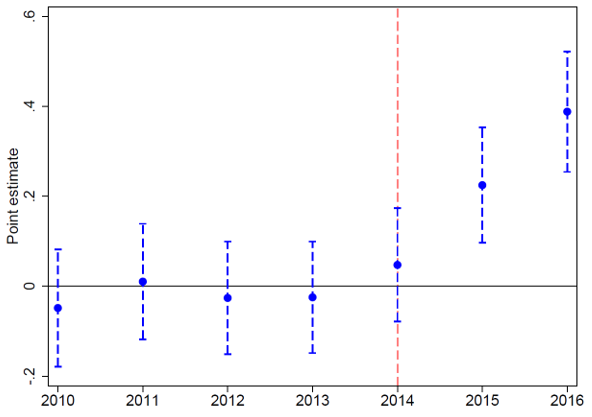

Figure 2: Difference in lending between treated and control banks over time. The red line corresponds to the year when the ECB first lowered the deposit facility rate below zero.

Do these results hold outside France? We run similar tests on a sample covering all euro area countries and show that our results have broader external validity. High deposits banks in the euro area expand credit by more and take up more risk with respect to other banks in the years following the introduction of negative rates. Consistent with the timing of their implementation, figure 2 shows that lending by treated banks increased substantially after 2014 relative to control banks. Similarly, figure 3 reveals a positive relationship between banks’ deposits ratio and the change in lending between the pre/post negative rates period, indicating that banks with larger shares of deposits experienced higher lending growth since the introduction of negative rates.

Figure 3: Change in lending between pre/post negative rates across 100 percentiles of banks’ deposits ratios (weighted by loans in each percentile).

Policy implications

Our findings suggest that negative rates are effective in stimulating the economy when nominal interest rates hit the zero lower bound, via an increase in bank lending. This effect is stronger for banks more reliant on retail deposits and comes at the price of greater risk taking. This evidence hence cautions policy makers that the additional accommodation provided by venturing into negative territory should be weighed against the potential build-up of risk in the banking system and attending concerns for financial stability. In addition, the finding that negative rates have a stronger impact on high deposits banks has institutional and distributional implications. First, because of differences in the structure of deposit markets across countries, negative rates may transmit heterogeneously across members of the euro area. Second, banks more reliant on deposits are more likely to lend to small and medium-size enterprises, which in turn are overwhelmingly dependent on banks for external finance. By encouraging high deposits banks to lend, negative rates may therefore help in easing credit conditions, particularly for the most financially constrained borrowers.

References

BIS (2019) “Quarterly Review". International banking and financial market developments, September 2019.”

Bottero, M. et al. (2019) “Negative Monetary Policy Rates and Portfolio Rebalancing: Evidence from Credit Register Data,” IMF Working Paper (44).

Brunnermeier, M. and Koby, Y. (2018) “The Reversal Interest Rate,” NBER Working Paper. Cambridge, MA (25406).

Bubeck, J., Maddaloni, A. and Peydró, J.-L. (2020) “Negative Monetary Policy Rates and Systemic Banks’ Risk-Taking: Evidence from the Euro Area Securities Register,” Journal of Money, Credit and Banking, 52 (S1), pp. 197-231.

ECB (2020) "Financial Integration and Structure in the Euro Area."

Eggertsson, G. et al. (2019) “Negative Nominal Interest Rates and the Bank Lending Channel,” NBER Papers. Cambridge, MA (25416).

Grandi, P. and Guille, M. (2018) "The Upside Down: Banks, Deposits and Negative Rates", Working Paper.

Heider, F., Saidi, F. and Schepens, G. (2019) “Life Below Zero: Bank Lending under Negative Policy Rates,” Review of Financial Studies, 32(10), pp. 3728–3761.

Rogoff, K. (2017) “Dealing with Monetary Paralysis at the Zero Bound,” Journal of Economic Perspectives. American Economic Association, 31(3), pp. 47–66.

Tenreyro, S. (2021) “Let’s Talk about Negative Interest Rates", Speech given at the UWE Bristol webinar, Bank of England.

Join the Conversation