|

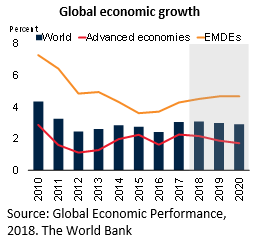

2018 started with the good news. The World Bank’s Global Economic Prospects and the IMF’s World Economic Outlook both show that the global economy is in a recovery. Furthermore, it is expected that the upturn is broad-based as the growth is increasing in more than half of the world economies. Global Economic Prospects report that in advanced economies, growth in 2017 is estimated to have rebounded to 2.3 percent while emerging and developing economies (EMDEs) were projected to have higher-than-expected growth of 4.3 percent. Overall, global growth is projected to edge up to 3.1 percent in 2018.

Over the last decade debt managers, like the central bankers, fiscal policy managers and regulators, had to deal with the global financial crisis. During this period, while debt levels were increasing in many countries, thanks to the unconventional monetary policies, interest rates went down, maturities lengthen up to 100 years, and portfolio capital flows moved across markets. In the end, those were very unusual times. Now the question is: Is this the end of the global crisis? Are we back to the “normal” times?

Indeed, it doesn’t look so.

|

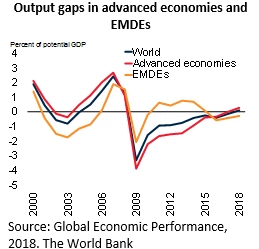

The Global Economic Prospects Report emphasizes that global growth is sustainable over a couple of years but is projected to slow down as potential growth is likely to decline over the next 10 years. During this period, it is expected that the global output gap will almost close and the global inflation, triggered by the supply-side constraints, will likely increase in the medium-term. Although yield curves may tend to stay the same in the short-term, it is anticipated that the changing global inflation outlook, supported by the increasing commodity prices and the tapering of asset purchasing programs, will gradually move the funding costs to a higher level in the medium-term.

|

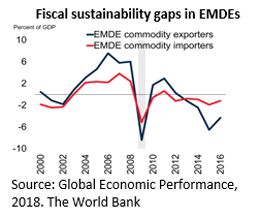

In order to increase the potential growth, the Global Economic Prospects Report suggests improvements in education and health systems; high-quality investment; and labor market, governance, and business climate reforms to yield substantial long-run growth dividends and thus contribute to poverty reduction. This implies that, governments will soon be at a crossroad about how to finance the investments and reforms necessary to increase production capacity and economic growth. Countries, generating new revenues through the windfall of higher short-term economic growth, may consider using these funds to invest in economic and social reforms, limiting the pressure on the public finances. For countries facing significant fiscal sustainability gaps, most likely finance the implementation of the reforms from the debt markets, a step that will send debt levels higher.

|

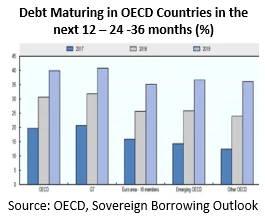

Furthermore, debt managers need to rollover substantial amount of debt redemption, as indicated by a recent OECD survey. Total debt service for the next 12 months will be 20 percent of the marketable debt and it will reach up to 40 percent in 3 years.

|

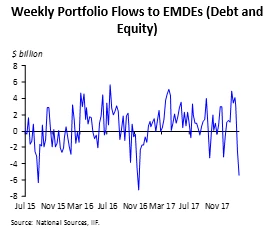

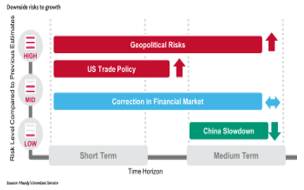

As highlighted by the Global Economic Prospects Report, the global economic outlook is subject to downside risks such as the possibility of financial stress. However, uncertainty remains elevated due to other factors such as the consequences of Brexit, possible changes to trade policies in US, and the concerns due to the increasing political tension in Middle East. In the end, financial markets are functioning but vulnerable, as the recent IIF report shows that EMDEs portfolio outflows in February 2018 were the sharpest since the US Presidential election.

Given that the governments will continue to borrow, either to support the economic growth or to rollover their current debt, it is anticipated that the government debt markets will stay exposed to the volatilities in financial markets and borrowing costs will likely increase due to the inflationary pressures and fiscal sustainability gaps in EMDEs. Although such gaps are relatively small in commodity importers, debt levels are increasing both for governments and private sector.

|

In summary, the global economic and financial outlook implies that monetary policy in major advanced economies will further normalize and global financing conditions will remain benign. However, government debt will remain high and given the vulnerabilities to a large variety of external factors, including geopolitical risks, increasing protectionism in trade policy and environmental risks, debt managers should consider developing a holistic perspective to manage the risks where market-based mitigation is possible.

Join the Conversation