As most manufacturers around the world can attest, trade credit is an important source of external financing for firms of all sizes. Suppliers—some of whom may be small or credit constrained—generally offer working capital financing to their buyers, reported as accounts receivables (e.g. McMillan and Woodruff, 1999). Research has also demonstrated that trade credit can act as a substitute for bank credit during periods of monetary tightening or financial crisis (see, for example, Love et al., 2007).

Trade credit, however, is not used for financing purposes alone. Trade credit, it has been argued, is a way for a supplier to engage in price discrimination, giving favored or more powerful clients longer terms (see, for example, Giannetti, Burkart, and Ellingsen, 2011). Furthermore, trade credit may simply be customary in an industry, with this particular custom driven by economic rationales such as allowing buyers time to assess the quality of the supplied goods (Lee and Stowe, 1993).

Studies have explored the supply and demand of trade credit around the world (for instance, Petersen and Rajan, 1997; Johnson, McMillan and Woodruff, 2002). Yet, in part due to the lack of detailed contract-level data on trade credit terms, little is known about how the contract terms of trade credit vary across buyer and supplier characteristics. For example, what is the typical contract period of trade credit? Which types of buyers receive longer net days (days before payment is due)? Which types of firms are offered early payment discounts?

In a new paper with Luc Laeven and Raghu Rajan, we address these questions using a unique database that includes contract information for about 30,000 supplier transactions for 56 large buyers in the United States and Europe. The data includes detailed information on contract terms:

- The contract size (the amount in trade credit to spend in U.S. dollars);

- Net days (days within which the buyer has to pay the amount owed);

- Discount days (days within which the buyer has to pay to get the full discount);

- Discount rate (the size of the discount if the amount is paid by the discount date); and,

- Currency of the transaction

What really sets our dataset apart from the earlier survey-based work, however, is that our data has bilateral contract information, allowing us to control both for buyer and supplier firm characteristics and analyze both sides of the buyer-seller transaction, whereas earlier work only analyzed one side of the buyer-seller transaction. Equally important, we also have multiple contracts for the same buyer and supplier firms, rather than a firm-average response as in previous datasets. This allows us to include firm fixed effects in our empirical analysis, thereby correcting for time-invariant firm characteristics that might determine the choice of credit terms. Our data set does have limitations: the number of buyers is small (a total of 56), which limits our analysis of buyer characteristics, and we have relatively little information about the sellers in our sample.

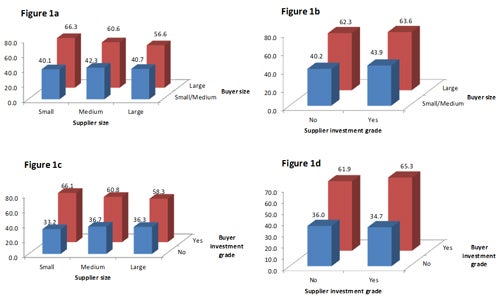

We start by summarizing typical trade credit contracts terms, such as number of discount days, discount rate, and net days, and analyze how they relate to buyer and seller characteristics (Figure 1).

Figure 1: Net Days for Suppliers and Buyers of Different Size and Ratings

(Click the image to view a larger version)

We argue that it is hard to conclude that trade credit is primarily a cheap way for suppliers to provide buyers financing in our sample (most of our buyers are larger and better rated than our suppliers, and still get credit); rather, non-financing motives seem to be operative. In particular, large, investment-grade buyers get long terms from small suppliers. We believe this is consistent with relatively untrusted suppliers extending longer terms to buyers as a guarantee of product quality. However, this leaves suppliers exposed to riskier credits.

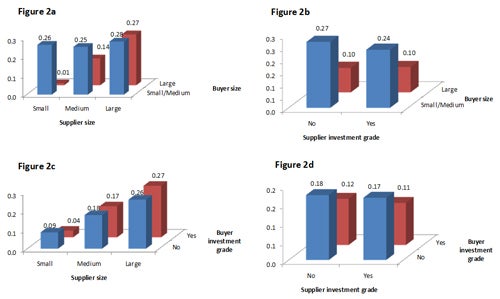

This is where discounts help (Figure 2). Riskier buyers are offered discounts to repay early so that suppliers can offer warranties about the quality of the product supplied even while containing the credit risk in their trade credit portfolio.

Figure 2: Discount Frequency for Suppliers and Buyers of Different Size and Ratings (%)

(Click the image to view a larger version)

In a multivariate framework we find that the largest and most creditworthy buyers receive contracts with the longest maturities, as measured by net days, from smaller suppliers. This is consistent with a market power explanation (smaller suppliers are squeezed more by large buyers) as well as the view that credit may be a means for small suppliers to warranty quality to their large buyers. However, if the buyer’s bargaining power is the primary rationale for trade credit, it is puzzling that the large rated buyers do not swap the credit (which the supplier can ill afford and the buyer does not need) for a discount. Instead, it is the small unrated buyer who are typically offered a discount. One explanation is that there may be non-financial intrinsic value in trade credit – for example as a warranty of product quality – that is lost when the buyer is offered and takes a discount. Nevertheless, trade credit discounts may still be offered to the riskiest buyers in order to reduce the overall risk of the supplier’s credit portfolio, and achieve an optimal mix of warranty and risk.

Our work provides more evidence that the motivations for trade credit are both intriguing and suggestive of the richness of financial contracting. These findings also suggest that credit constrained firms that are forced to finance longer credit maturities might welcome alternative ways to warranty the quality of their goods. For example, credible government and private sector third-party inspections can certify goods before delivery. Finally, we leave open for future research questions such as the impact of shocks, such as the 2008 financial crisis, on the provision and terms of open trade credit accounts.

References:

Giannetti, Mariassunta, Mike Burkart, and Tore Ellingsen, 2011. What You Sell is What You Lend? Explaining Trade Credit Contracts. Review of Financial Studies 24, 1261–98.

Johnson, Simon, John McMillan and Christopher Woodruff, 2002. Courts and Relational Contracts. Journal of Law, Economics and Organization 18, 221–77.

Lee, Yul W. and John D. Stowe, 1993. Product Risk, Asymmetric Information, and Trade Credit. Journal of Financial and Quantitative Analysis 28, 285–300.

Love, Inessa, Lorenzo Preve, and Virginia Sartia-Allende, 2007. Trade Credit and Bank Credit: Evidence from Recent Financial Crises. Journal of Financial Economics 83, 453–69.

McMillan, John and Christopher Woodruff, 1999. Interfirm Relationships and Informal Credit in Vietnam. Quarterly Journal of Economics 114, 1285–1320.

Join the Conversation