Hands holding cellphones with digital finance concept | © shutterstock.com

Hands holding cellphones with digital finance concept | © shutterstock.com

The practical value of mobile-enabled digital financial services (DFS) has become clear with COVID-19 shutdowns and social distancing. But a flurry of recent papers building on earlier work shows the virtues of DFS for reducing poverty and driving development even without a pandemic. Few development interventions boast as much rigorous evidence with consistently positive outcomes as DFS. Large positive impacts on remittances, consumption, and labor force productivity have been documented across countries as varied as Bangladesh, Kenya, Uganda, Tanzania, and Mozambique. Even as many COVID-19-related cash transfer programs rush to incorporate DFS and as industry groups document steep growth in DFS use, I still find myself wondering, “Why with such robust evidence are more policy makers not enthusiastic about DFS and why isn’t DFS more commonly integrated across other development interventions? ”

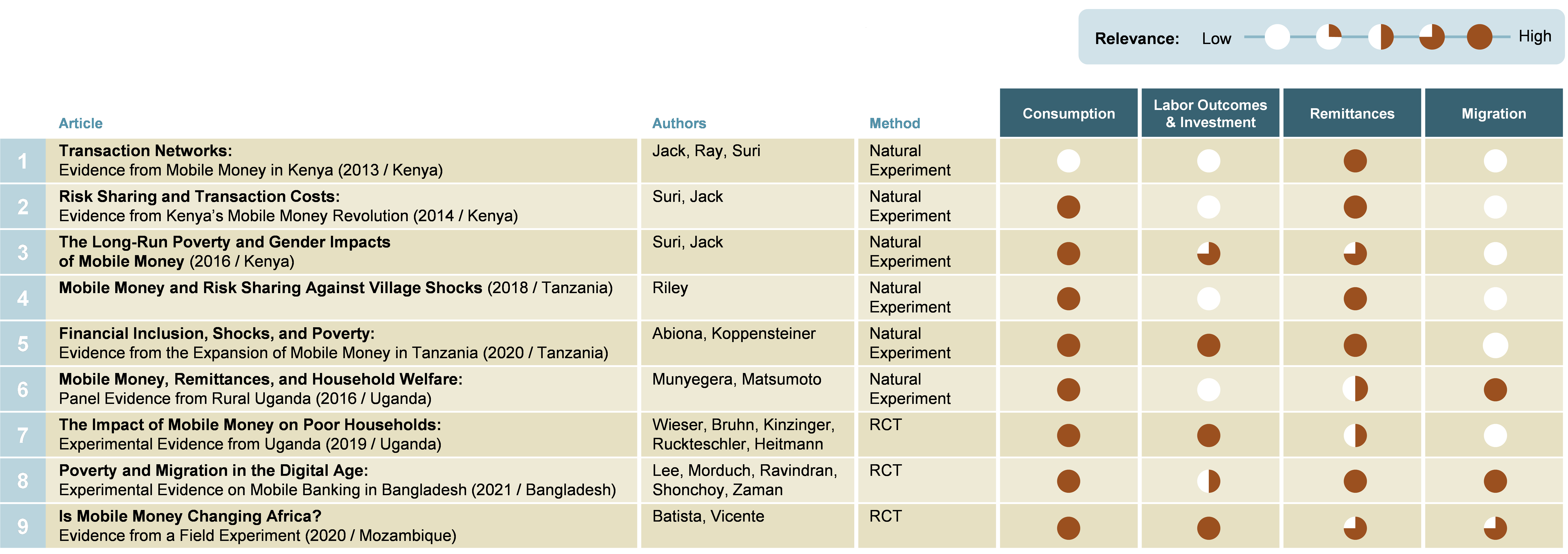

No fewer than nine rigorous studies on the impacts of introducing mobile-enabled DFS in five countries on two continents, including randomized trials and natural experiments, and nationally representative and targeted samples, find remarkably similar positive results. For example, in northwestern Bangladesh, adoption of mobile money led to a 26% increase in urban-rural remittances and a 7.5% increase in consumption back home. A hemisphere away, in southern Mozambique, vulnerable households experiencing emergency shocks received 210% greater value of remittances and maintained 39% higher consumption in regions with mobile money access than those in regions without.

Table. Rigorous Studies of Impacts from Adopting Mobile-enabled Digital Transfers

Beyond these indicators of impact, the research is also consistent in identifying the key mechanisms through which DFS improves welfare: faster and cheaper intra- and inter-household transfers received from more diverse networks of social contacts in response to household shocks. And, unlike many other important consumption-boosting and labor force productivity-enhancing development interventions, such as cash transfers and vocational training, which require direct income redistribution or subsidy, DFS is broadly a scalable and profitable private sector phenomenon. However, there may be a specific role for subsidizing encouragements for consumers to adopt, as in the studies in northwestern Bangladesh and southern Mozambique, and for driving rural expansion of agent networks, as in the RCT in northern Uganda.

Despite this evidence and potential for scale, even in countries with robust digital finance systems, many common pro-poor interventions, from cash transfers to vaccine campaigns, still fail to integrate mobile-enabled DFS payment channels for transfers, wages, and payments. So why isn’t DFS more ubiquitous?

More effectively translating the robust evidence on DFS transfers for policy makers across policy silos is certainly needed. Recent less academic literature reviews here and here provide some guidance. [Disclosure: I developed the latter document.] But frankly, the large volume of studies on financial inclusion generally and even digital finance, in particular, sometimes makes it difficult for researchers and non-researchers alike to parse the literature. Indeed, a flood of promising new research suggests that DFS can be impactful across newer use cases, such as worker wage payments, last mile vaccine delivery, microfinance disbursements, and cash transfer and workfare payments.

But let’s defer discussion of those studies and use cases to another time, so we can focus and be crystal clear in translating the evidence. For transferring funds to vulnerable friends and relatives during times of emergency and for migrants remitting earnings back home to family in the countryside – two of the core “naturally occurring” financial use cases relevant to poor communities in low- and middle-income countries – there is robust evidence that the introduction of mobile-enabled DFS increases consumption, reduces poverty, and generally advances development.

Of course, the devil is often in the details. Real institutional, competitive, and regulatory limitations may provide structural constraints to deeper adoption of DFS. Transitioning finance and public services, such as social protection schemes, to digital and specifically mobile platforms also imposes new risks that may intimidate cautious or capacity-constrained policy makers (and funders).

However, let us not be intimidated by the details. We have examples of how (and how not) to monitor and manage implementation risks through high-frequency monitoring that combines demand- and supply-side data sources (see here and here and here). There are comprehensive reference guides (see here and here) that anticipate diverse regulatory regimes and policy alternatives. And researchers are actively focusing on issues of consumer protection, competition topics, taxation considerations, and ways to optimize digital finance to empower women (see here and here). [Disclosure: Many of the links are to projects supported by my own work.]

Rarely is the evidence for interventions to combat poverty so clear and robust as that related to mobile-enabled DFS. And rarely are the interventions examined so commercially scalable. Of course, mobile-based financial systems are nothing near a silver bullet, are not without new risks, and are not entirely free. But with appropriate policy, regulation, and incentives to jumpstart systems in countries that lack them, to deepen last mile reach in countries that do, and to diversify adoption across public and private sector use cases everywhere, there is still plenty of low-hanging development benefit to reap. There may be various obstacles to deeper DFS adoption and integration, but lack of evidence is not one of them.

Join the Conversation