Barbara Buchner is senior director at the Climate Policy Initiative and lead author of the Global Landscape of Climate Finance reports.

In December 2015, countries will gather in Paris to finalize a new global agreement to tackle climate change. Decisions about how to unlock finance in support of developing countries’ low-carbon and climate-resilient development will be a central part of the talks, and understanding where the world stands in relation to these goals is a more urgent task than ever.

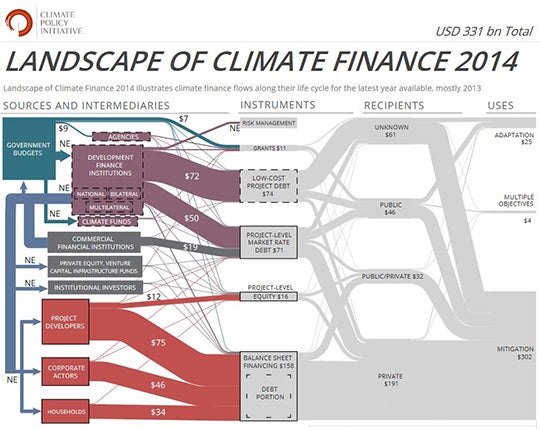

Climate Policy Initiative’s Global Landscape of Climate Finance 2014 offers a view of where and how climate finance is flowing, drawing together the most comprehensive information available about the scale, key actors, instruments, recipients, and uses of finance supporting climate change mitigation and adaptation outcomes.

Climate finance has fallen, mainly due to reductions in solar PV costs

Overall, the gap between the finance needed to deal with climate change and the finance delivered is growing while total climate finance has fallen for two consecutive years. This could put globally agreed temperature goals at risk and increase the likelihood of costly climate impacts.

To provide a reference point, the International Energy Agency estimates that in the energy sector alone, an additional USD 1.1 trillion is needed every year on average between 2011 and 2050, to keep global temperature rise below 2 degrees Celsius.

Our latest analysis shows that in 2013, annual global climate finance flows totaled approximately USD 331 billion, USD 28 billion below 2012 levels. In cumulative terms, the world is falling behind its low-carbon and climate-resilient investment goals. Much of the drop was in the private sector. While the private sector continued to provide the majority of climate finance, about US 193 billion or 58% in 2013, its total was down by about USD 31 billion from 2012.

Dollar totals don’t tell the entire story, though. Around 80% of the fall in private investment resulted from lower costs for some renewable technologies (particularly solar PV), where efficiencies are increasing and unit costs are coming down. In 2013, it cost USD 40 billion less to achieve the same level of solar deployment than in 2012.

Development finance institutions are a significant driver of climate finance

Public actors and intermediaries contributed at levels similar to 2012, committing 42% or USD 137 billion to climate action in 2013. Our analysis confirms that public actors, and especially development financial institutions (DFIs), remain key drivers of the climate finance system.

While private actors provide the majority of total investment flows, DFIs like the World Bank Group are able to bridge viability gaps and cover risks that private actors are unable or unwilling to bear.

DFIs play an important role in financing low-carbon and climate-resilient development, with commitments reaching USD 126 billion in 2013, or 38% of total climate finance flows, largely on par with 2012 levels. National DFIs, such as the Chinese Development Bank, contributed USD 69 billion (55% of all DFI flows).

Out of the three types of investment instruments we tracked – grants, low-cost debt, and capital instruments – DFIs channeled most of their 2013 investment (57%) through low-cost debt, helping to lower capital costs of low-carbon and climate-resilient investments. Total investment in low-cost debt, including concessional loans, made up USD 74 billion, of which 98% originated from DFIs.

Flows from developed to developing countries are decreasing

One key topic of interest on the road to Paris is how much investment flows across borders from developed to developing countries.

In 2013, the amount of climate finance invested in developed countries (OECD countries for this study) and developing countries (non-OECD in this study) was split almost equally. While nearly three-quarters of total flows were spent in the country of origin, we tracked USD 34 billion, or 10% of climate finance, flowing from developed to developing countries — USD 8 billion less than in 2012.

As with previous years, the developed-to-developing country flows are mostly public resources — 94%. The predominance of public resources is striking and might be partially explained by the lack of data on private investment in adaptation and energy efficiency.

What’s next?

Efforts to scale up climate finance investment to support the transition to a low-carbon and climate-resilient global economy are at a critical juncture this year. Our Global Landscape of Climate Finance 2014 provides clear lessons for policy makers about where policy and public resources might be focused to help drive increased action:

1. Domestic policy frameworks are critical for mobilizing finance, particularly in the case of private investors.

2. Less finance is not necessarily a negative sign. Policymakers should not focus their efforts solely on mobilizing finance but also on decreasing technology costs.

3. Public resources, including from DFIs, remain key drivers of the climate finance system, bridging viability gaps and covering risks that private actors are unable or unwilling to bear.

Image: Climate finance flows, as tracked by CPI. Visit ClimateFinanceLandscape.org for more information and an interactive version of the chart.

Join the Conversation