Unsplash

Unsplash

Crypto-asset transaction volumes have seen rapid growth globally driven by retail and institutional adoption, particularly since the beginning of the COVID-19 pandemic and against a backdrop of extraordinary loose global financial conditions. In light of its growing scale, diversity, complexity, and interconnectedness with the regulated financial system which may amplify risks, understanding the main drivers behind crypto-assets usage is relevant for policy makers, users, and industry alike.

While Bitcoin, other crypto-assets, including stablecoins, are currently not widely used as a medium of exchange, some recent research finds evidence that bitcoin has been used as a vehicle for domestic transactions and international payments (e.g., Graf von Luckner, et al (2021)). Additional relevant factors for crypto-assets adoption may also include high expected returns from speculative investment (Auer and Tercero-Lucas (2021)), their role as a perceived macro hedge protecting against macro-financial instability and excessive inflation despite their high volatility (Blau et al (2021) and Conlon, et al (2021)), and regulatory arbitrage, particularly related to illicit activity. Given their ease of storage and portability, crypto-assets may also support people “living under the threat of harm by their families, people in their communities, or repressive governments” (Peirce (2021)). Regarding Decentralized Finance (DeFi), Harvey et al. (2021) concludes it has potential to overcome the inherent challenges of the traditional financial sector of centralized control, limited access, inefficiency, opacity, and lack of inter-operability.

In a new paper (Feyen et al (2022)), we document the rise in on-chain crypto-assets activity around the world at the country level--transactions that are directly recorded on the distributed ledger that underpins a crypto-asset--and empirically investigate the association of crypto-asset volumes across countries with key global and domestic macroeconomic drivers.

Rapid rise of crypto activity around the world

Although data gaps are significant (e.g., IMF (2021)), it appears that crypto-assets activity is a global phenomenon. Some industry estimates claim that 100-200 million people around the world own or use crypto-assets in 2021, including in many emerging market and developing economies (EMDEs).

We use a large global monthly country-panel of on-chain crypto-asset transaction volumes of value sent in US Dollars provided by Chainalysis, a global blockchain analysis company, to investigate the potential drivers of crypto-assets activity in various ways. The sample spans the period April 2019 – June 2021 and covers 174 countries and 114 different crypto-assets. We mapped all crypto-assets into four groups: 1) Bitcoin; 2) Ethereum; 3) Stablecoins; and 4) Decentralized Finance (DeFi) and Others.

Total crypto-assets on-chain volume over the past two years surged to a total of US$2.8 trillion in the first half of 2021 alone. Figure 1 illustrates that the volumes in ether (40%) and stablecoins (24%) has gained more share over time compared to bitcoin (24%). DeFi and other crypto-assets represent 12%. When looking at crypto activity by transaction size, we find that large value transfers ($2.69 trillion) dwarf smaller transaction size transfers ($119 billion), suggesting a disproportionately large role of institutional activity.

Figure 1: Total Crypto-assets Volume by Type of Crypto-asset

US Dollars

All Transaction Sizes (in US$)

Sources: Chainalysis; World Bank staff calculations.

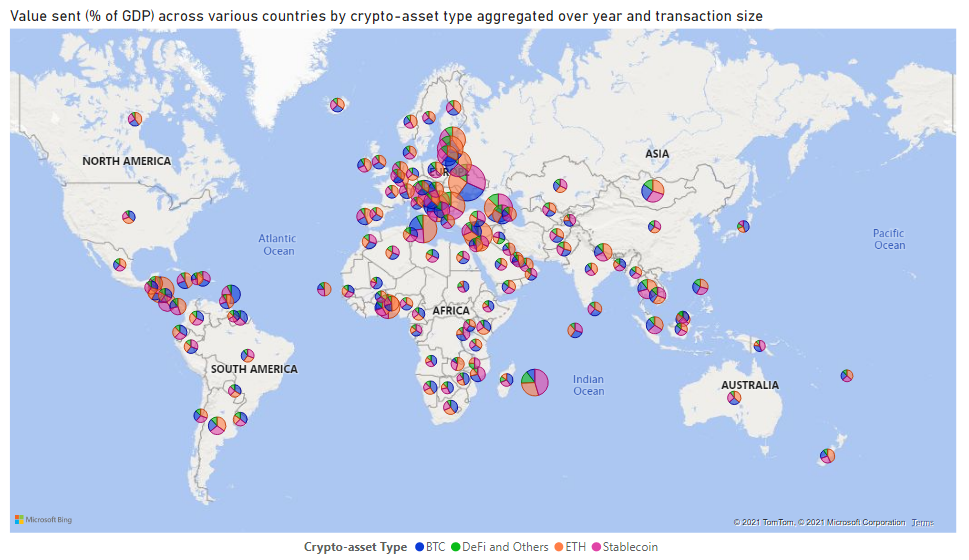

Figure 2 shows that the geographical distribution of crypto-assets activity is global. Annualized total volumes of crypto-assets activity for 2021 relative to GDP have become noticeable, particularly in regions like Latin America and the Caribbean (median: 0.07% of GDP), Sub-Saharan Africa (median: 0.06% of GDP) and Europe and Central Asia (median: 0.10% of GDP). Activity is relatively limited in lower- and middle-income countries and is dominated by bitcoin and ether. Smaller transactions still represent a minor fraction (7%) of total volumes across countries. The share of stablecoins also remains relatively low with 16% of the overall volume.

Figure 2: Total Crypto-assets Volume by Type of Crypto-asset (April 2019-June 2021)

% of GDP

By Type of Crypto-asset

Source: Chainalysis; World Bank staff calculations.

Note: A map of crypto-assets activity scaled by a country’s GDP – larger bubbles indicate higher activity relative to the size of the economy. The bubble sizes representing the relative values sent (% of GDP).

Macro-financial drivers of crypto-asset activity

The empirical findings suggest that crypto-asset volumes are strongly associated with a set of forward-looking global macro-financial factors--which may ultimately shape domestic macro-financial conditions --rather than recent domestic macroeconomic developments. For example, controlling for a range of global and domestic factors, a 10-basis-point increase in monthly U.S. inflation expectations (on a 5-year, 5-year forward basis as embedded in U.S. Treasury yields) increases monthly crypto volumes by about 28 basis points. In contrast, country-level macroeconomic indicators (e.g., inflation and the exchange rate) do not appear to be strongly related with country-level volumes.

Country-level volumes also move in the opposite direction of gold prices, suggesting that crypto-assets are perceived to some extent as a substitute for gold, a traditional global inflation hedge . The results further imply that crypto-assets are perceived as a speculative, “risk on” asset class with higher volumes when real U.S. Treasury yields, a proxy for global financial conditions, are lower. Crypto volumes also appear to be supported by a momentum effect in crypto-asset prices further suggesting that speculative motives play a role. Volumes also tend to be higher in countries with higher ICT penetration and higher reliance on remittances.

Conclusion

Crypto-assets are increasingly regarded as an emerging and diverse asset class as economic functions and risks differ across crypto-assets (e.g., unbacked crypto-assets, stablecoins, and DeFi).

While not a panacea to overcome financial sector challenges, crypto-assets and the underlying technology hold promise for financial innovation, inclusion, efficiency, transparency, and capital formation . However, in a context of their decentralized and cross-border nature which poses international regulatory arbitrage challenges, crypto-assets also present several serious risks, including to financial integrity, consumer and investor protection, fair competition, monetary sovereignty, capital control enforcement, and taxation (e.g., FATF (2021), G7 (2019)). Further, while crypto-assets still constitute a small portion of the global financial system, they could ultimately pose risks to global financial stability (e.g., FSB (2022)).

Join the Conversation