This blog is the fifth in a series of ten blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook. Earlier blogs are here.

The World Bank’s Beverage Price Index is projected to stabilize in 2019 after a more than 5 percent decline in 2018 from the previous year. Beverage prices declined almost 9 percent in the third quarter (q/q), with roughly similar losses across all three components (coffee, cocoa, and tea), reflecting more supplies than expected in all markets.

Beverage price index

Coffee

A modest recovery in coffee prices is expected in 2019 after declines this year. Arabica coffee prices are expected to average $2.85/kg in 2018, down 14 percent from last year and Robusta prices are set to decline 18 percent in 2018.

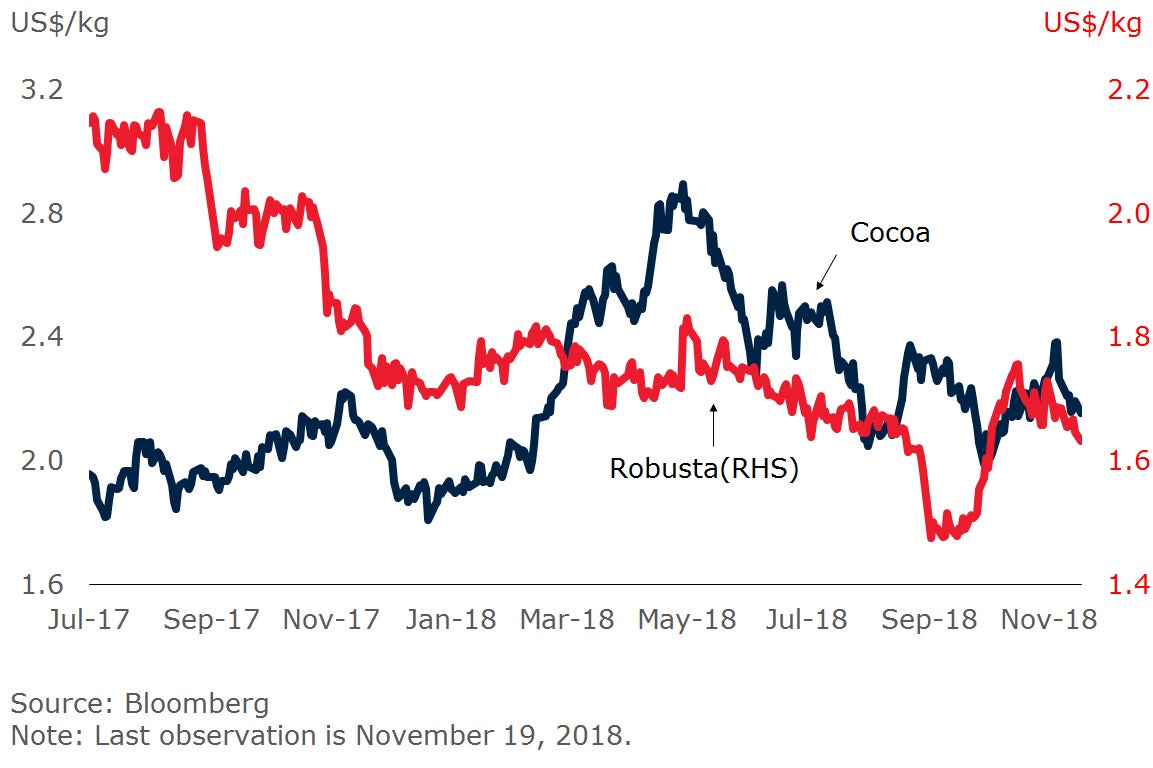

Both Arabica and Robusta prices declined in 2018 Q3 (down 7 and 8 percent, respectively), with the former reaching a 10-year low. The bearish sentiment reflects upward revisions to production estimates for Brazil and Vietnam, the world’s largest coffee suppliers, and, to a lesser extent, downward revisions to consumption estimates. Global coffee production is projected to increase 7 percent in 2018-19. The weakness of the Brazilian currency boosted coffee prices received by producers in domestic currency terms, in turn increasing exports from Brazil and further depressing world prices. However, the appreciation of the real since early October reversed that trend.

Arabica coffee price vis-à-vis BLR/USD

Coffee production

Cocoa

Cocoa prices are expected to gain 2 percent in 2019, following a projected increase of 13 percent in 2018, as consumption is expected to outpace production in both years.

Following strong gains earlier in the year, cocoa prices plunged nearly 13 percent in the third quarter in response to upwardly revised estimates of global output. Most of the cocoa production growth is expected to come from West Africa, notably Côte d’Ivoire, the world’s dominant cocoa producer.

Cocoa and Robusta coffee price

Cocoa production

Tea

Tea prices (3-auction average) are expected to gain 1 percent in 2019, following a projected decline of 9 percent in 2018.

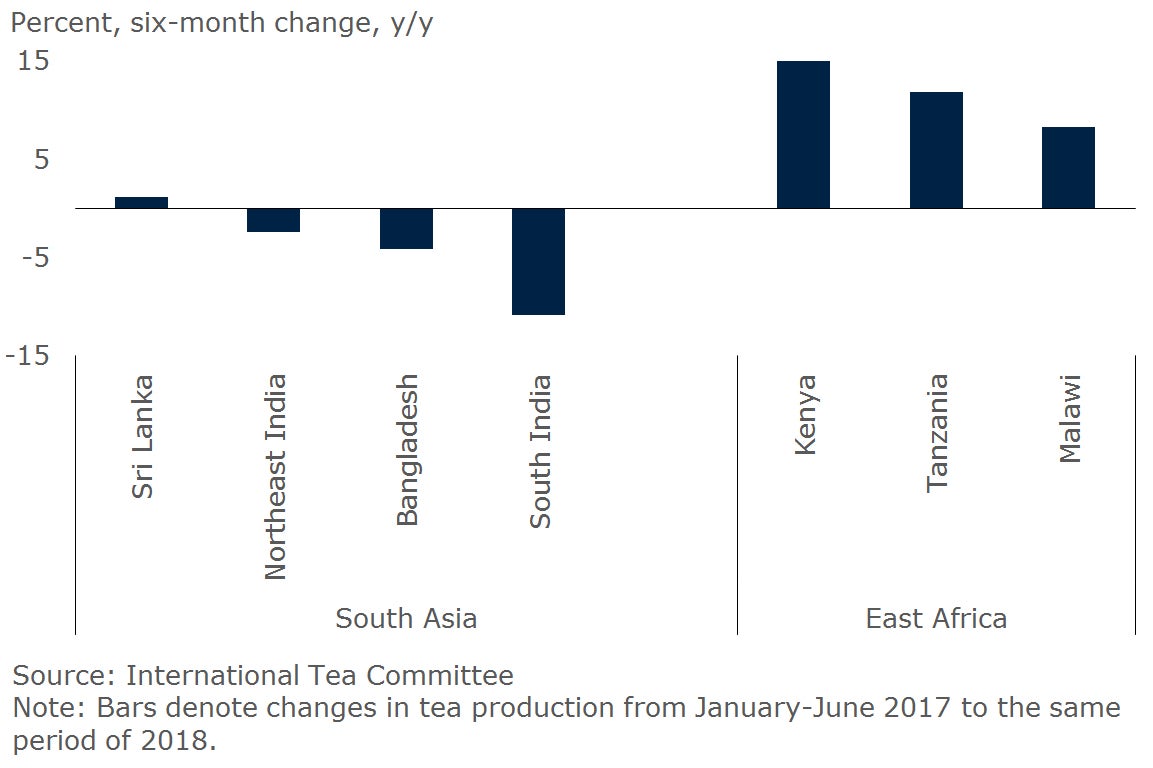

Global tea prices declined more than 5 percent in the third quarter of 2018 (q/q), in response to large drops at Colombo and Mombasa auctions (down 9 and 7 percent respectively). The Mombasa auction price weakness reflects favorable weather conditions in East Africa that boosted the crop by 17 percent from 2017. Prices at the Kolkata auction, however, held steady due to a poor crop in Kerala, one of India’s key tea producing regions.

Tea production

Join the Conversation