Global commodity prices underwent an exceptionally strong and sustained boom beginning in 2000. Unlike a typical price cycle, this boom has been characterized as a “super cycle”, i.e., a demand-driven surge in commodity prices lasting possibly decades rather than years. Many researchers say this is the fourth “super cycle” of the past 150 years. The price super cycle has been attributed to strong growth in emerging markets.

During 2002-12 emerging markets grew 6 percent per year, the highest rate in any 10 -year period over the past four decades. Analysts have focused on the two most populous countries, China and India, which grew at an annual pace of 10.3 and 7.4 percent, respectively. By 2014, the two countries together accounted for over one-third of global population and one-sixth of global GDP.

The role of China and India in global commodity markets came to the fore in the context of the 2008 food price spikes. Some argue that rapid income growth in emerging economies, including China and India, was a key factor behind increases in food commodity prices after 2007. Others, however, point to the broadly stable share of China and India in agricultural food commodity consumption. The focus section of the recently published Commodity Markets Outlook, analyses China’s and India’s role in commodity consumption and finds three broad patterns.

First, China has played a very important role in metal and energy (especially coal) consumption. Today China accounts for about half of global consumption in these two commodities.

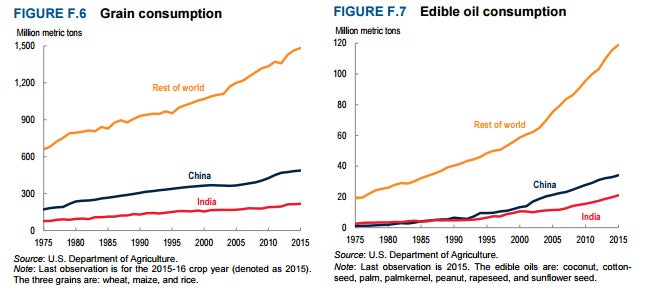

Second, and despite popular opinions, neither China nor India played a key role in grain consumption. These countries’ share in world grain consumption is, in fact marginally lower today than it was two decades ago (the shares today are about 22 percent for China and 10 percent for India)—note that consumption also includes grains than go for industrial use and animal feed. The reason for such dichotomy between industrial and food commodities reflects difference in the way these two commodities respond to income growth: High income elasticity of the later versus low elasticity of the former. This is also known as Engel’s Law, named after the German statistician Ernst Engel who, in the mid-19 century observed that that poor families spend a greater proportion of their assets on food than their wealthier counterparts. In simpler terms, the Law says that as income grows, people consume more industrial goods and services (such as cars, refrigerators, and vacations than, maize and rice).

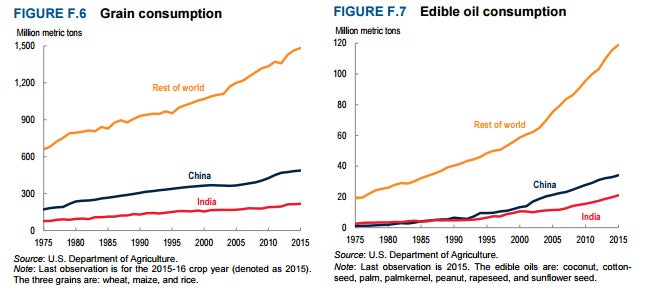

Third, there is an exception in the food category, that of edible oils. Consumption of these food items has increased a lot, not only by just by China and India but also for the entire world. And, there is a simple explanation for this. As people become wealthier, they tend to eat in restaurants and also consume more food in packaged form. The edible oil content of both restaurant and packaged food is higher than home-cooked meals.

During 2002-12 emerging markets grew 6 percent per year, the highest rate in any 10 -year period over the past four decades. Analysts have focused on the two most populous countries, China and India, which grew at an annual pace of 10.3 and 7.4 percent, respectively. By 2014, the two countries together accounted for over one-third of global population and one-sixth of global GDP.

The role of China and India in global commodity markets came to the fore in the context of the 2008 food price spikes. Some argue that rapid income growth in emerging economies, including China and India, was a key factor behind increases in food commodity prices after 2007. Others, however, point to the broadly stable share of China and India in agricultural food commodity consumption. The focus section of the recently published Commodity Markets Outlook, analyses China’s and India’s role in commodity consumption and finds three broad patterns.

First, China has played a very important role in metal and energy (especially coal) consumption. Today China accounts for about half of global consumption in these two commodities.

Second, and despite popular opinions, neither China nor India played a key role in grain consumption. These countries’ share in world grain consumption is, in fact marginally lower today than it was two decades ago (the shares today are about 22 percent for China and 10 percent for India)—note that consumption also includes grains than go for industrial use and animal feed. The reason for such dichotomy between industrial and food commodities reflects difference in the way these two commodities respond to income growth: High income elasticity of the later versus low elasticity of the former. This is also known as Engel’s Law, named after the German statistician Ernst Engel who, in the mid-19 century observed that that poor families spend a greater proportion of their assets on food than their wealthier counterparts. In simpler terms, the Law says that as income grows, people consume more industrial goods and services (such as cars, refrigerators, and vacations than, maize and rice).

Third, there is an exception in the food category, that of edible oils. Consumption of these food items has increased a lot, not only by just by China and India but also for the entire world. And, there is a simple explanation for this. As people become wealthier, they tend to eat in restaurants and also consume more food in packaged form. The edible oil content of both restaurant and packaged food is higher than home-cooked meals.

Join the Conversation