Global commodity prices strengthened in the first quarter of 2018 and are expected to be higher on average this year than in 2017. Broad-based price increases have been supported by both demand—as economic growth has strengthened—and supply factors, including restraint by major oil producers, trade tensions, and economic sanctions.

The Commodity Market Outlook can downloaded here.

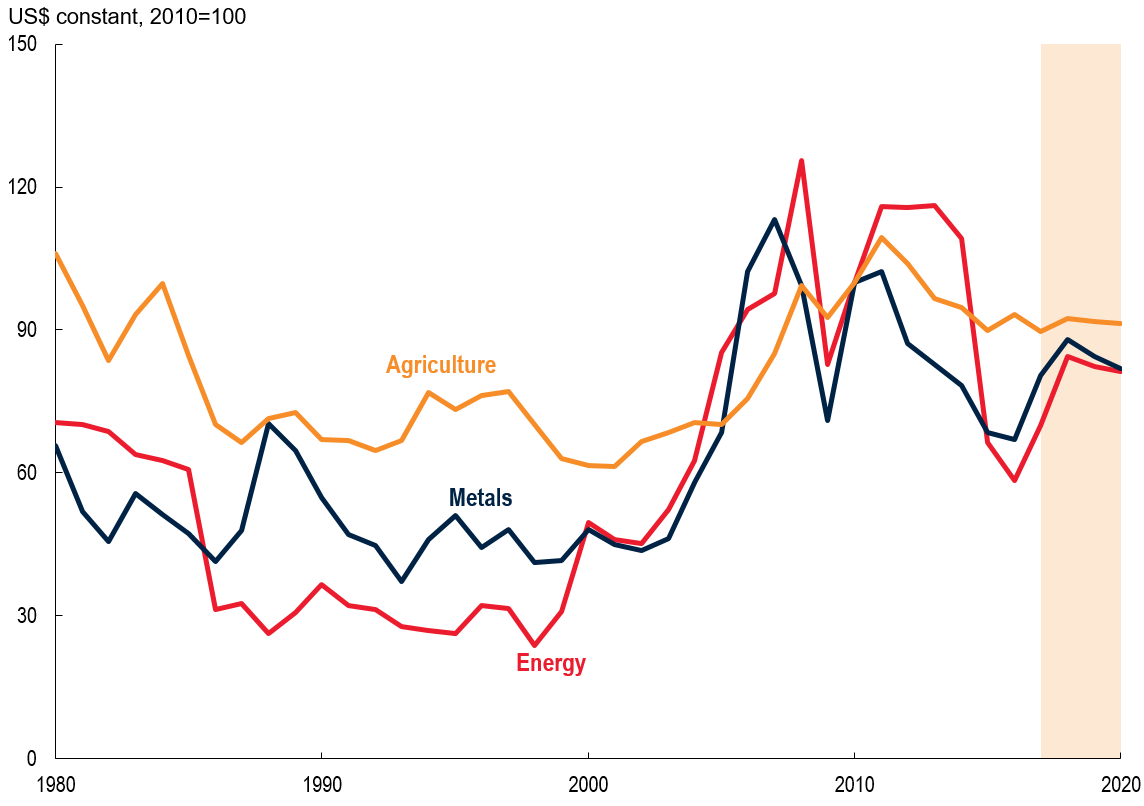

Figure 1. Commodity price indexes, monthly

Source: World Bank.

Note: Last observation is March 2018.

Energy Up as Oil Inventories Draw Down

Energy prices surged 10 percent in the first quarter of 2018 (quarter over quarter), led by oil and natural gas. Oil prices rose 10 percent, averaging $64.60 per barrel over the quarter, and have more than doubled since bottoming out in early 2016. Strong oil demand and greater-than-expected compliance by the 22 Organization of the Petroleum Exporting Countries (OPEC) members and non-OPEC producers to their agreed production cuts helped draw inventories down.

Meanwhile, rising geopolitical concerns, especially the prospect of renewed sanctions against Iran, and tensions between Iran and Saudi Arabia in Yemen, boosted oil prices in late March and April to $74 per barrel. The gains have supported a recovery in U.S. shale production, with total crude production increasing by more than 1.1 million barrels per day in January 2018 relative to the previous year.

Environmental Policies, Trade Frictions, Sanctions Roil Metals Prices

Non-energy commodity prices rose 4 percent (q/q) in the first quarter of 2018. Metals prices increased over 4 percent due to strengthening global demand and concerns about tightening global supplies. Chinese producers curtailed output of aluminum and steel over the winter to meet pollution goals, although production rose in non-restricted areas.

In April, the trade tensions between the United States and China initially weighed on all metals prices. However, aluminum prices subsequently rebounded to a seven-year high following the imposition of sanctions by the United States on the largest Russian aluminum producer (which accounts for more than 6 percent of global supply). Nickel prices also rose amid fears that sanctions could extend to other Russian metals producers. Russia accounts for 9 percent of global nickel production.

Precious metals prices gained 4 percent on expectations of rising inflation, a weaker dollar and heightened concerns about geopolitical risks. Agricultural prices gained 4 percent, the largest quarterly increase in the past two years, largely due to lower wheat and maize plantings in the United States and a La Niña-related impact on banana production in Central America and soybean production in Argentina.

Robust Demand to Push Prices Higher

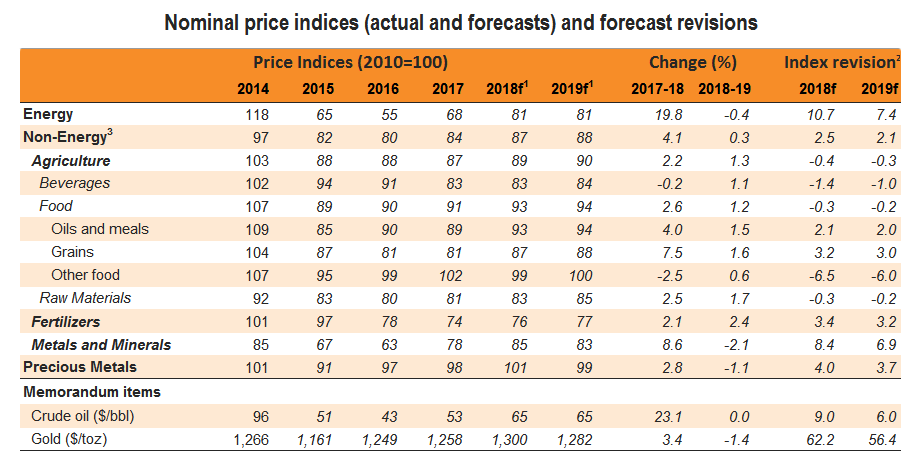

More than half of commodity prices (and all non-coal energy prices) are expected to increase in 2018—although four-fifths of them will remain below peaks crested in 2011.

Energy prices are forecast to rise 20 percent in 2018—a 16 percentage point upward revision from October 2017—and stabilize in 2019. Non-energy prices are projected to gain more than 4 percent in 2018 before levelling off in 2019. Both categories are upwardly revised by more than 2 percentage points for both 2018 and 2019 from the previous forecast. If additional tariffs or sanctions were implemented, the outlook for commodity prices would change in the short-term; however, these effects would likely unwind over the medium-term, as producers and consumers find new distribution channels, export markets or sources of finance.

Oil prices are anticipated to average $65 per barrel in 2018 and 2019 on robust demand and continued production restraint by OPEC and non-OPEC producers, notwithstanding increases in U.S. shale oil production. Higher oil prices are expected to eventually feed into higher natural gas prices while coal prices will continue to decline as energy demand shifts towards less polluting sources.

Upside risks to the forecasts include potential supply losses arising from geopolitical events, a deterioration in Venezuela, deeper cuts by OPEC and non-OPEC countries or an extension of the agreement to a longer-term horizon. Conversely, a weakening of the agreement, or further efficiency gains among U.S. shale producers, could depress prices.

Figure 2. Commodity price indexes, annual

Source: World Bank.

Note: Shaded area (2018-20) denotes forecast.

Metals boosted by demand

Metals prices are projected to increase 9 percent in 2018 due to a further pickup in demand. An 11 percent decline in iron ore prices—reflecting stronger production, especially in China—is expected to be more than offset by projected increases in all other base metals prices. Nickel prices are expected to remain 30 percent higher than in 2017, despite a slight moderation from their recent sharp rise, reflecting hopes for buoyant electric vehicle demand and the risk of Russian sanctions.

Upside price risks to the forecast include more robust global demand than expected and production shortages. Supply could be curtailed by a slower ramp-up of new capacity, further sanctions against metal exporters, and policy changes in China. Downside risks stem from slower growth, the easing of pollution-related policies, and the reintroduction of idle capacity in China.

Agricultural prices are forecast to gain 2.2 percent in 2018 and a further 1.3 percent in 2019. Grain prices and oils and meal prices are projected to gain 8 percent and 4 percent, respectively, in 2018, mainly due to lower plantings. A key policy risk is the introduction of countervailing duties on soybeans by China in response to U.S. tariffs, which would likely depress prices.

Source: World Bank.

Join the Conversation