This book looks at the evolution of commodity markets, the challenges they pose for emerging markets, and policy tools available. / World Bank

This book looks at the evolution of commodity markets, the challenges they pose for emerging markets, and policy tools available. / World Bank

Commodity markets are constantly evolving, reflecting growth in population and income as well as changes in relative prices, technological advances, and government policies . Our recent book looks at the evolution of commodity markets, the challenges they pose for emerging markets, and policy tools available to respond to these challenges.

Commodities’ long-term trends differ

Over the past half-century, prices of agricultural commodities, adjusted for inflation, have been on a long-term downward path, reflecting the increases in productivity and low-income elasticity of demand . In contrast, energy prices have risen since the early 20th century, as demand has increased in line with income, and suppliers have been forced to turn to less accessible sources. The long-run trends in metal prices have been mixed, as their high-income elasticities of demand have led to a major rise in consumption, while extraction processes have been enhanced by ongoing technological progress, boosting supply.

Driven by China, demand for industrial commodities has risen dramatically

China now accounts for more than half of global metal consumption, up from 5 percent in the 1990s. While other countries have reached similar levels of global demand during their industrialization, the speed at which China achieved this is unique—it took just 25 years to reach half of global metals demand, compared to 64 years in the U.K. and 68 years in the U.S.

Technological developments boosted food production

Global production of food has risen rapidly over the past century, enabling a four-fold increase in global population. However, the amount of land used in agriculture has seen only a modest rise . The massive increase in food production is largely due to improvements in agricultural yields—the amount produced on a given area of land. For example, in the U.S. maize yields have tripled since 1950, and some emerging market agricultural producers such as Argentina have seen similar increases. However, yields among low-income countries are still much lower than in other countries.

Substitution shifted patterns of demand

Routine and reversible adjustments among similar commodities (for example, natural gas for coal in electricity generation, or plastic for paper in packaging) have impacted the demand. However, substitutions can also be transformative—where a new commodity or product partially or completely replaces the incumbent. These are driven by new technologies (and in some cases by policy decisions) and can trigger major changes in patterns of commodity demand. One notable example of this is the transition from sailing ships to coal-powered steamships to oil motorships. These transitions led to major shifts in commodity demand, both in terms of the structure of the ship and its fuel—steel and iron replaced wood for the bodies of ships, while coal and later oil replaced cotton and linen sail cloth.

The energy market has continued to evolve

The move to a low-carbon emission economy is currently transforming energy markets. Technology and policies will profoundly transform the structure of commodity consumption over the next few decades, including less demand for fossil fuels and more demand for metals and other materials required to produce clean energy . Energy transitions have occurred several times over the past 200 years, as new fuels have emerged and risen in importance. There are two important lessons from these transitions. First, global consumption of individual fuels has almost always continued to rise, even when a new fuel emerges (that is, the emergence of new fuels leads to an overall increase in energy consumption, rather than replacing existing fuels). Second, transitions take time. It took 50 years for coal to reach 50 percent of global energy and 40 years for crude oil.

The challenge of commodity price volatility for commodity-exporting economies

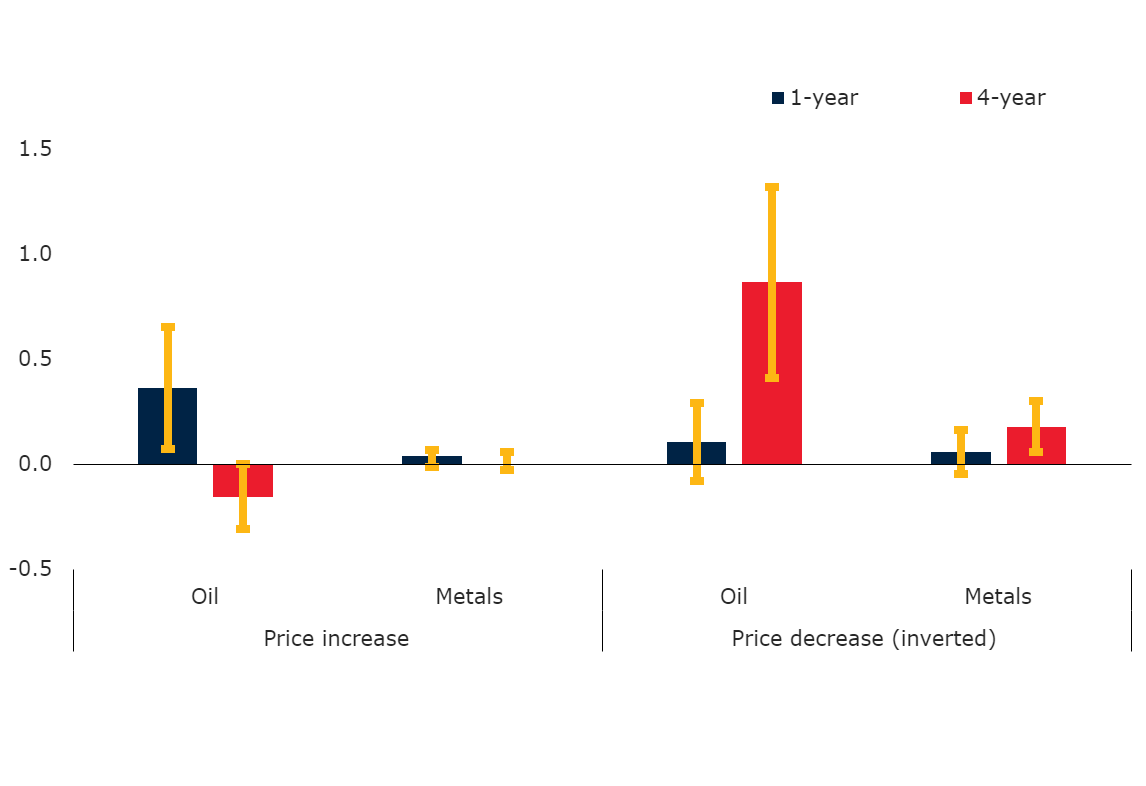

Large shifts in the demand and supply of commodities, along with price booms and busts and differing long term trends, pose challenges for commodity-exporting emerging market and developing economies (EMDEs). Commodities are critical sources of revenue for almost two-thirds of EMDEs, and their macroeconomic performance is heavily linked to commodity price changes . Both oil and metal price shocks appear to have asymmetric impacts on economic growth in energy and metal exporters: Price increases have been associated with small, temporary accelerations in output growth while price declines have been associated with more pronounced or longer-lasting growth slowdowns.

Note: Cumulative impulse responses of output growth for 153 EMDEs (34 are energy exporters for oil and 31 are metal exporters for metals), from a local projection estimation. Dependent variable is output growth after 10 percentage point change in oil/metals price growth.

Source: Baffes, J., and P. Nagle. 2022. Commodity Markets: Evolution, Challenges, and Policies. World Bank.

Join the Conversation