Most commodity prices fell in the third quarter of 2015 as a result of abundant supplies and weak demand, leading to a further downward revision in price forecasts for 2015 and 2016.

Our quarterly Commodities Markets Outlook report analyzes markets for major commodities groups and forecasts prices for 46 commodities from bananas to zinc. The price declines are part of a five-year-long commodities slump.

Notably, we lowered our 2015 forecast for crude oil prices to $52 per barrel from the $57 per barrel anticipated in our previous report. The downward revision reflects further slowing of global economic performance, and the expectation that Iranian oil exports will rise after international sanctions are lifted.

Within a few months of sanctions being lifted, Iran could increase its crude oil production toward pre-sanction levels of 3.6 million barrels per day, the report says.

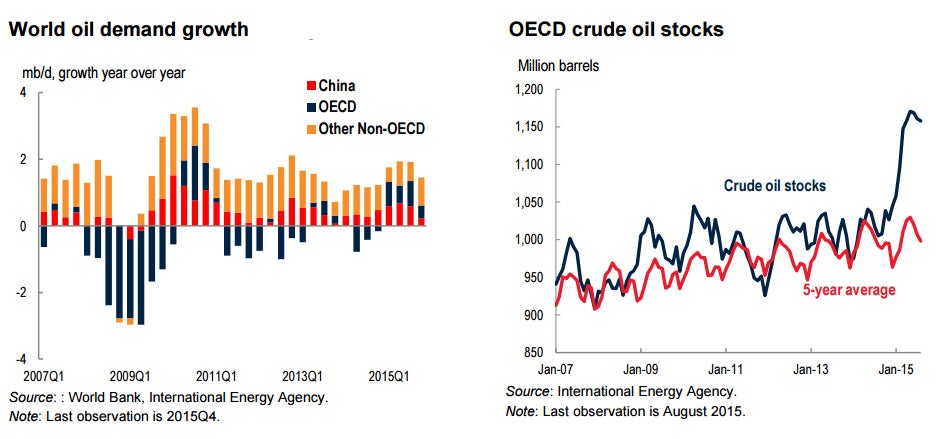

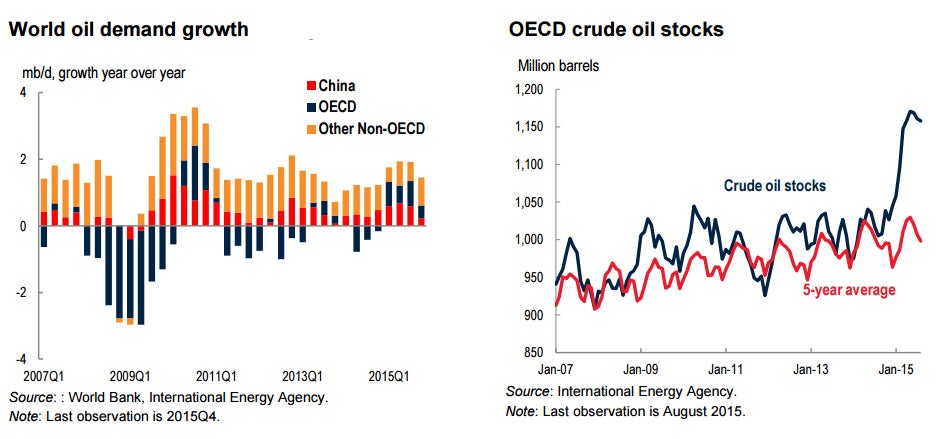

Overall, energy prices dropped 17 percent in the third quarter from the previous three-month period as oil prices weakened, and are expected to average 43 percent lower in 2015 than in 2014. Even though oil consumption growth has risen this year, in part because of lower prices, especially for gasoline, and even though global production is plateauing, oil supplies continue to outpace demand. Crude oil inventories have soared in advanced economies, with much of the increase in North America.

Excluding energy, commodities fell by 5 percent in the quarter, and non-energy commodities are down more than a third from their early-2011 peak. Again, abundant inventories and weak demand are behind the softness. Agriculture prices fell 2.4 percent in the August-September period and have declined for six consecutive quarters. This is despite concerns that the current episode of the El Nino weather pattern, which can constrain crops through drought or flooding, particularly in the Southern Hemisphere, may be one of the strongest in decades.

Our report examines in depth the potential impact from El Nino and finds that it is unlikely to cause price spikes in global markets. However, it may cause disruptions in local markets.

Looking ahead, all commodity prices are expected to decline in 2015, mainly owing to abundant supplies, and, in the case of industrial commodities, slowing demand in China and emerging markets. In addition to downward revisions to oil prices, natural gas prices are expected to move sharply lower, and coal prices are expected to fall as a result of slowing demand from China.

Non-energy prices are expect to fall across the board as well. Metals prices, led by iron-ore, are seen falling by 19 percent, while agriculture prices are projected to fall 13 percent, led by edible oils and meals.

Our quarterly Commodities Markets Outlook report analyzes markets for major commodities groups and forecasts prices for 46 commodities from bananas to zinc. The price declines are part of a five-year-long commodities slump.

Notably, we lowered our 2015 forecast for crude oil prices to $52 per barrel from the $57 per barrel anticipated in our previous report. The downward revision reflects further slowing of global economic performance, and the expectation that Iranian oil exports will rise after international sanctions are lifted.

Within a few months of sanctions being lifted, Iran could increase its crude oil production toward pre-sanction levels of 3.6 million barrels per day, the report says.

Overall, energy prices dropped 17 percent in the third quarter from the previous three-month period as oil prices weakened, and are expected to average 43 percent lower in 2015 than in 2014. Even though oil consumption growth has risen this year, in part because of lower prices, especially for gasoline, and even though global production is plateauing, oil supplies continue to outpace demand. Crude oil inventories have soared in advanced economies, with much of the increase in North America.

Excluding energy, commodities fell by 5 percent in the quarter, and non-energy commodities are down more than a third from their early-2011 peak. Again, abundant inventories and weak demand are behind the softness. Agriculture prices fell 2.4 percent in the August-September period and have declined for six consecutive quarters. This is despite concerns that the current episode of the El Nino weather pattern, which can constrain crops through drought or flooding, particularly in the Southern Hemisphere, may be one of the strongest in decades.

Our report examines in depth the potential impact from El Nino and finds that it is unlikely to cause price spikes in global markets. However, it may cause disruptions in local markets.

Looking ahead, all commodity prices are expected to decline in 2015, mainly owing to abundant supplies, and, in the case of industrial commodities, slowing demand in China and emerging markets. In addition to downward revisions to oil prices, natural gas prices are expected to move sharply lower, and coal prices are expected to fall as a result of slowing demand from China.

Non-energy prices are expect to fall across the board as well. Metals prices, led by iron-ore, are seen falling by 19 percent, while agriculture prices are projected to fall 13 percent, led by edible oils and meals.

Join the Conversation