This blog post is based on de Soyres, Frohm, Gunnella and Pavlova (2018), “Bought, Sold and Bought Again: Complex value chains and export elasticities”, World Bank Policy Research Working Paper Series No. 8535.

Economics textbooks outline a clear-cut relationship between movements in a country’s exchange rate and its export volumes. When the currency depreciates, export volumes are expected to increase by some amount. By how much exports increase is called the exchange rate elasticity of exports. Yet, some recent episodes of significant exchange rate movements, such as those in Japan (2012–2014) and the United Kingdom (2007–2009), were not associated with very large movements in trade volumes.1 This perceived unresponsiveness of exports to exchange rate fluctuations has raised the question among some commentators as to whether the exchange rate elasticity of export volumes have changed or even become zero.

Latest research suggests that global value chains (GVC) and more generally the development of international production could be one important part of the answer. Firms increasingly (1) use imports to produce exports and (2) export inputs that are re-exported further by their trading partners. One example of (1) could be a car manufacturer in Germany that exports finished products to the Mexico. The car manufacturer imports parts and components, for example the gear box or the microchips that connect the car to the internet, to produce the exported car. In (2) the same German manufacturer can export inputs (gear boxes or microchips) to a subsidiary or other firm in Mexico that assembles a finished car for exports and final consumption in the United States. Alternatively, the domestic value-added embedded in the German exports to Mexico can also be returned to Germany for final consumption (as re-imported exports). With such complex linkages in the production process of exporters, the consequences of a currency devaluation for export volumes depend on the details of both upstream and downstream interconnections with other countries: where do all (direct and indirect) imported inputs come from and what is the destination of final demand associated with each international trade.

Literature

A greater share of imported inputs in exports imply that any export price competitiveness gained by currency depreciation is partly offset by increasing costs of those imported inputs. Using a panel of 46 countries over the period 1996–2012, Ahmed, Appendino and Ruta (2015) shows that GVC participation lowers the elasticity of manufacturing exports to the real effective exchange rate (REER) by 22 percent on average and by close to 30 percent for countries with highest GVC participation. Arbatli and Hong (2016) finds that growing participation in global production chains and rising export complexity of products are important determinants of Singapore’s export elasticities. Imbs and Mejean (2017) confirms that trade elasticities can differ because of the specialization of consumption, of production, or because of international differences in sector level trade elasticities.Other factors that could reduce the responsiveness of exports to exchange rate movements relate to the increasing use of pricing-to-market strategies among large exporters that tend to keep their export prices stable and absorb any variability in the exchange rate in their markups. Based on Belgian firm-product-level data, Amiti, Itskhoki and Konings (2014) finds that import intensity and market share are key determinants of exchange rate pass-through.

New Results

A new paper (de Soyres, Frohm, Gunnella and Pavlova (2018)) uses sectoral data for 40 countries and 33 sectors between 1995 and 2009 and apply recent advances in the value-added decomposition of trade flows to precisely pin down the importance of three key measures of international production fragmentation.

- First, the paper finds that an increase in the export’s share of foreign value-added from a country with a different currency (called the FV index) reduces the change in export price in response to exchange rate movements; hence lessening the associated change in export volumes.

- Second, it is shown that a greater share of exports that return as imports in a country sharing the same currency (the RDV index) weakens the exchange rate responsiveness of exports. Simply put: if the final demand driving one’s exports is located at home or in a country with the same currency, a devaluation can do little to boost those trade flows.

- Third, an increase in the share of exports used in the destination country to produce further re-exports which are ultimately consumed in a third country (the IV index) increases the responsiveness of trade flows to the direct trading partner’s nominal effective exchange rate, creating significant inter-dependence across countries. This mechanism underlines the high degree of international interconnection that characterize today’s production processes.

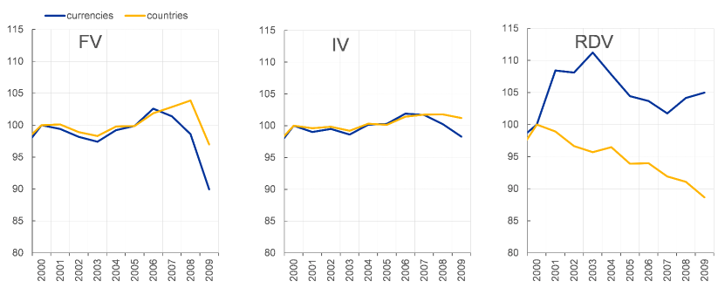

When assessing the consequences of currency movements on exports, one must be cautious about accounting for the extent of currency unions and currency pegs. Indeed, when measuring the share of foreign value added in exports, one should not account for imports stemming from countries sharing the same currency as the price of those are not affected by a devaluation. The same argument applies when constructing the domestic value added that is re-imported home or the share that is re-exported and absorbed in a third country: the definition of what is home and foreign must be based on currency, not countries. As shown in figure 1, the time series variation of indices based on countries and currencies do not display the same properties.

Figure 1: time series properties of three indices of Global Value Chains (GVC) participation.

From de Soyres, Frohm, Gunnella and Pavlova (2018). Computations based on WIOD database. Indices are normalized at 100 in 2000 and show differences in time series properties of indices based on countries (yellow) and currencies (blue). FV is the foreign value added in exports, IV is the domestic value added in exports thatis used for re-exports and ultimately absorbed abroad, RDV is the domestic value added in exports that ultimately returns home.

Interestingly, estimates presented in figure 2 show that not only a higher participation in international production decreases the exchange rate elasticity of exports; but also that it is possible for a currency devaluation to actually reduce a sector’s export to a specific destination. As a polar case, imagine a sector that sources a significant share of its input from a country with a different currency, sells its good abroad which are then re-imported back for domestic consumption. In such a case, due to the foreign value-added part, a devaluation would increase the production price in domestic currency. Moreover, since final demand is located at home, consumers simply see an increase in the final price and hence decrease consumption. The fact that the good was exported and re-imported back means that the lower domestic consumption will translate into a decrease in the country’s exports. Such a negative effect of devaluation on export volumes underlines the importance of using precise input-output data when forecasting the effect of currency changes.

Figure 2 : elasticity of export volumes to exchange rates for different quantiles of FV and RDV indices.

From de Soyres, Frohm, Gunnella and Pavlova (2018). The horizontal axis corresponds to the different quantiles of both FV and RDV indices observed in the data and based on currencies. The curve plots the corresponding elasticity of export volumes to exchange rates. For sectors with the highest level of both FV and RDV, the corresponding elasticity is negative, meaning that a devaluation would decrease exports.

Policy Perspective

In order to precisely assess the consequences of international input-output linkages on exchange rate elasticities, policy makers would do well to precise indices of global value chain participation based on currencies rather than countries. This would allow them to track the origin of the imported inputs but also the country of final consumption for all their exports.

Looking ahead, the development of global value chains is likely to decrease the sensitivity of exports to exchange rates. But this conjecture depends on where countries expand their international footprint. For example, for countries developing a “regional” value chain, several forces are at play: sourcing inputs form a country with the same currency has no impact on the relationship between exports and exchange rate, but exports returning to a country with the same currency decreases the elasticity. Hence, future developments in international linkages might have different impact depending on the joint evolution of both global value chain participation and common currency areas.

References

- Ahmed, Swarnali, Maximiliano A. Appendino, and Michele Ruta. (2015) “Depreciations without exports? Global value chains and the exchange rate elasticity of exports”, World Bank Policy Research Working Paper No. 7390

- Arbatli, Elif and Gee Hee Hong (2016), “Singapore’s Export Elasticities: A Disaggregated Look into the Role of Global Value Chains and Economic Complexity” IMF Working paper WP/16/52

- Amiti, Mary, Oleg Itskhoki, and Jozef Konings. (2014) "Importers, exporters, and exchange rate disconnect." American Economic Review 104.7: 1942–78.

- Boehm, Christoph, Aaron Flaaen, and Nitya Pandalai-Nayar. (2018) “Input Linkages and the Transmission of Shocks: Firm-Level Evidence from the 2011 Tōhoku Earthquake”, Review of Economics and Statistics, forthcoming.

- Boz, Emine, Gita Gopinath, and Mikkel Plagborg-Møller. (2017) “Global trade and the dollar” National Bureau of Economic Research, No. w23988.

- Demian, Calin-Vlad, and Filippo di Mauro. (2017) “The exchange rate, asymmetric shocks and asymmetric distributions”, International Economics.

- de Soyres, François, Erik Frohm, Vanessa Gunnella and Elena Pavlova (2018), “Bought, Sold and Bought Again: Complex value chains and export elasticities”, World Bank Policy Research Working Paper Series No. 8535.

- Imbs, Jean, and Isabelle Mejean. (2017) “Trade elasticities”, Review of International Economics 25.2: 383–402.

- Johnson, Robert C., and Guillermo Noguera. (2017) “A Portrait of Trade in Value-Added over Four Decades”, Review of Economics and Statistics 99.5: 896–911.

1See for example Leigh, Lian, Poplawski-Ribeiro and Tsyrennikov (2015), “Exchange rates and trade flows: disconnected?”, Chapter 3 in World Economic Outlook, IMF, October.

Join the Conversation