Why do emerging market policymakers complain both when their currencies appreciate and when they depreciate? Why do they march behind the Brazil’s Finance minister’s denunciation of the Fed’s QE as an act of “currency war” and, a few months later, behind the India central bank governor’s condemnation of the possible withdrawal of the very same QE? Why is it that the introduction of the euro may have made it more difficult for peripheral European countries to bounce back from recessions? What do Argentina, Indonesia, Brazil and Sweden have in common? Is the euro more similar to the old French Franc, Deutsche Mark or, God forbid, the Italian Lira? The answers to these apparently unrelated questions may lie in a little studied characteristic of currencies, their behavior over the business cycle.

This is the issue we explore in a recent paper, where we compute a currency cyclicality index (CCI), which equals the correlation between the cyclical component of GDP and the cyclical component of the exchange rate. The index tells us whether a currency has a tendency to appreciate in good times and depreciate in bad times, or the other way around. Using a financial jargon, we christen as procyclical the currencies that appreciate in good times and depreciate in bad ones (positive CCI) and countercyclical those that, instead, appreciate in bad times and depreciate in good ones (negative CCI). The CCI, computed for a large number of countries over a long window of time (1975-2013) is depicted in Chart 1 below.

Chart 1: Currency Cyclicality Index

Note: Correlations between Nominal effective exchange rates and GDP are calculated using quarterly data and HP trend filtered series, over the 1997_2013 period. Two-tail tests with significance at 10 percent level are used to divide the countries into procyclical (positive and significant correlation), countercyclical (negative and significant correlation) and acyclical (non-significant).

Just looking at the chart it is evident that procyclical currencies are more common among emerging economies, while countercyclical ones are common among advanced economies and commodity exporters. Indeed, commodity exporters from emerging markets such as Chile, Argentina, Brazil and Russia belong to the procyclical currencies’ group, and so do advanced commodity exporting countries, such as New Zealand, Australia, Finland and Iceland. Finally, while “refuge” advanced economies such as Switzerland, Germany/Eurozone, Japan and the US have countercyclical currencies; no emerging economy with independent currency has. The only emerging economies with countercyclical currency in our sample are Euro Zone periphery countries that “inherited” a countercyclical currency—the euro that, as we will document below, has a degree of cyclicality similar to that of the old Deutsche Mark.

Beyond these figures, the analysis unveils a number of empirical regularities that may shed some light on the determinants of the degree of cyclicality of a currency, and on the associated policy tradeoffs. First, countries with procyclical currencies tend to be more exposed to commodity price shocks and are more likely to receive procyclical capital inflows than countries with countercyclical currencies. Second, countries with procyclical currencies (and an open capital account) may find it difficult to pursue countercyclical monetary policy because it could exacerbate exchange rate fluctuations. If this is the case, then emerging markets “cyclical complaining” is nothing but a symptom of the well-established “fear of floating.”

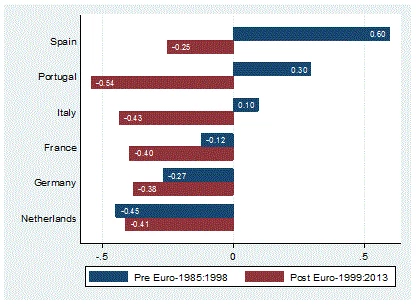

While the analysis looks at the determinants of currency cyclicality and at why it matters for policy, it does not provide any a priori reasons why a country should do better with a procyclical than with a countercyclical currency. Different forces are in play and they create a number of trade-offs. On the one hand, in countries with procyclical currencies, the exchange rate acts as an automatic stabilizer: it depreciates when growth is low, boosting exports, and it appreciates when economic growth is high, reducing domestic demand. However, since countries with procyclical currencies are less able to pursue countercyclical monetary policy, they might be less able to avoid the credit booms that often end up in a bust and in turn lead to financial crises. On the other hand, in countries with countercyclical currencies, monetary policy is much easier to pursue: what stabilizes domestic demand also stabilizes the exchange rate. However, for export oriented countries with a large manufacturing base, procyclical currencies have the nice property of leading to “competitive devaluations” in bad times. This may be one of the reasons why the adoption of the (countercyclical) euro had created significant problems for Eurozone periphery countries as they struggled to recover from recession. To see whether this is the case we look at the currency cyclicality index for a number of European countries (Germany, The Netherlands, France, Italy, Spain, and Portugal) before and after the adoption of the euro, see Chart 2.

Chart 2: Currency Cyclicality, before and after the euro

The results are quite staggering. While before the adoption of the euro, Germany and the Netherland had countercyclical currencies, Spain and Portugal procyclical ones, and France and Italy in between, with the adoption of the euro they all inherited the same degree of cyclicality of the old Deutsche Mark. This puts highly indebted aka “peripheral” countries (in quotes because two of the three large signatories of the treaty of Rome may belong to this list) in a difficult situation. The countercyclical nature of the euro does not allow for competitiveness to improve in bad times, while debt overhang warns against increasing competitiveness through real price adjustment (deflation). Of course the degree of cyclicality of a currency is not fixed, and this is why a more aggressive ECB monetary policy stance could play a role. But, would then Mr. Draghi be accused of triggering a new currency war? Qui vivra verra…

Join the Conversation