Energy prices play a key role in the determination of food prices. The post-2006 boom of food prices was partly driven by higher energy costs, and the weakness in energy prices since 2014 is expected to hold food commodity prices down in the future as well.

Agriculture is energy intensive: fuel is a key cost component of producing and transporting food commodities, which include maize, wheat, rice, soybeans, and palm oil. While improved overall crop conditions have also played a role in lowering prices, the impact of lower energy prices has been far greater, an analysis in the July Commodity Markets Outlook says.

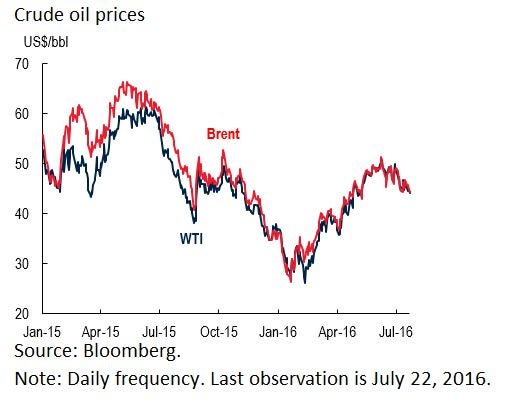

Energy prices fell 45 percent in 2015 and are forecast to drop 16 percent this year. Food prices are expected to average 26 percent below highs reached in 2011. Not only does energy make up more than 10 percent of the cost of agricultural production, energy price fluctuations affect incentives and policy support for the production of biofuels as an alternative energy source to oil.

The diversion of some food crops to biofuels production has been an important driver of food commodity demand. During the past decade, the largest source of growth in demand for grains and oilseeds was biofuels production. Almost half of biofuels production comes from maize-based ethanol in the United States while sugar-based ethanol from Brazil and edible oil-based biodiesel and ethanol in the European Union also contribute large shares to the total.

In addition to energy costs, agriculture prices are also affected by exchange rates movements, GDP and monetary conditions, and stock-to-use ratios (measures of how well supplied food markets are relatively to demand).

- A 10 percent increase in oil prices is associated with an almost 2 percent increase in food prices.

- A 10 percentage point increase in the stock-to-use ratio is associated with a more than 3 percent drop in food prices.

- A 10 percent appreciation of the U.S. dollar is linked to a 5 percent decline in food commodity prices.

- And a 10 percent increase in GDP is associated with a 6 percent decline in food prices (in keeping with the so-called Engel’s Law, which says that as income increases, the share of food expenditures declines).

Scrutiny of these drivers helps explain declines in food prices after 2011. In that period, maize prices have fallen by 43 percent, wheat by 42 percent, rice by 25 percent, and soybeans fell by 23 percent. About one-third of this decline can be explained by the oil price drop. One-sixth of the decline is attributable to a rise in incomes during that period.

For commodity-related information please visit: http://www.worldbank.org/en/research/commodity-markets

Join the Conversation