The rewards of innovation for developing nations do not require much convincing. Poverty alleviation, faster economic growth, greater job creation, and higher worker remuneration are just some of the potential benefits. The idea of innovation as a key driver of development can be traced back to the seminal works of economists such as Joseph Schumpeter. Thus, it is no surprise that on July 30 and 31, 2013 a group of innovation leaders from 18 countries gathered in Santiago, Chile for the first pan Latin American Innovation Summit. The event was kicked off by Sebastian Piñera, then President of Chile, who had announced a national innovation budget of $1 billion. What about the private sector? An important driver of innovation is Research and Development (R & D) spending by businesses. Evidence shows that firms that invest in R&D and other innovation-related activities have higher productivity and are more capable of making technological advances than firms that do not. So, where do Latin American firms stand on R & D investment?

In a special report by the World Bank Group’s Enterprise Surveys team on innovation by firms in Latin America and the Caribbean (LAC), an attempt was made to estimate R & D investment by manufacturing firms around the period 2009-2010. Uncovering a firm’s R & D spending is no easy task. Firms in the region typically do not report R & D expenditures, and when estimated they are susceptible to over-reporting. To counter this, minimum thresholds of R&D spending were used: Annual cost of one researcher for small firms, one researcher and a technician for medium firms, two researchers and two technicians for large firms. These thresholds had to be met for R&D estimates to be considered valid.

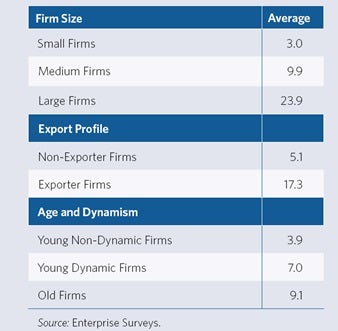

What do the data indicate? On one hand, eight percent of Latin American and Caribbean firms have invested in R&D. On the other hand, the actual estimates of R & D spending are quite low, about 0.5 percent of annual sales. Furthermore, the R&D investments are rather skewed. Among the 8 percent of firms in LAC that report spending on R&D, only one in four spent more than $150,000 in 2009. Older, larger, and exporting firms are more likely to be involved in R & D spending than smaller, younger, and non-exporting firms (see table 1). One word of caution - given the minimum R & D spending thresholds used, it may be possible that R&D figures for small firms are underestimated.

Table 1: Share of Latin American and Caribbean Firms Spending on R&D by Size, Exporter Status, and Age

What about across industries? For a smaller sample of large Latin American economies with enough observations to be able to analyze the data at the industry level - Argentina, Chile, Colombia, Mexico, and Peru- the chemicals and plastics had the highest share of firms involved in R & D (31 percent) in contrast to textiles (7 percent).

Table 2: Share of Latin American Firms Spending on R&D in Large Economies by Industry

The core message from the data is that private sector R&D spending is pretty low. While Latin American countries such as Chile and Mexico may be taking the right steps by allocating more government budget to innovation, there needs to be more discussion on providing the right incentives to increase R&D spending for firms. Even though identifying the specific policies that enable greater private sector R&D is no cakewalk, addressing potential institutional and other factors detrimental to the business environment would be a step in the right direction.

Latin American and Caribbean countries included in report:

Small Caribbean countries: Antigua and Barbuda, The Bahamas, Barbados, Belize, Dominica, Grenada, Guyana, Suriname, St. Kitts and Nevis, St. Lucia, and St.Vincent and the Grenadines

Medium-size countries: Bolivia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Jamaica, Nicaragua, Panama, Paraguay, Uruguay, and Trinidad and Tobago

Large countries: Argentina, Brazil, Chile, Colombia, Mexico, Peru, and República Bolivariana de Venezuela.

Join the Conversation