The World Bank’s conference on “The State of Economics, the State of the World” was an opportunity to take stock of the emergence of new paradigms for understanding economic development. Following Ken Arrow’s talk on the history of the neoclassical model and Shanta Devarajan’s comments on this model’s centrality in the Bank’s work, I had the opportunity to discuss two paradigms of how individuals make decisions that have recently emerged in economics, drawing on psychology, sociology, and anthropology.

The neoclassical model, which remains the standard theory of economics, studies the social determination of prices. The theory assumes that individuals are rational actors with stable and autonomous preferences. The theory thus assumes that there are no social influences on preferences. But this assumption has become contested. Psychologists have shown that individuals see things not as they are, but distorted by frames that make some features salient and others not. Moreover, individuals fill in missing features by using information from associations that might or might not be relevant.

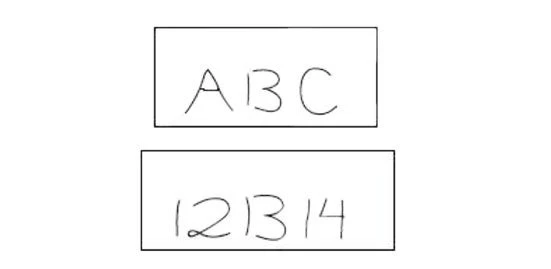

For example, look at the picture below. Each box has three figures. Framing effects lead you to see the second figure in each of the two boxes differently and to neglect its ambiguity.

Thinking fast & neglect of ambiguity

The cognitive system can be thought of as a structure-seeking device. The mental models (the categories, prototypes, concepts, identities, and stories) that individuals have absorbed from experience and exposure have framing effects. In psychology, processes of perception and cognition that were once thought to be universal across humans are now recognized to vary systematically across cultural groups. One reason that these processes are variable is that individuals use prototypes—patterns of attributes—to classify objects into particular types of things. Different cultural groups of individuals, by virtue of their different experiences and exposure, will have learned different prototypes. When individuals learn new prototypes, their perceptions and desires may change.

Even exposure to fiction can be a source of new prototypes and thus of social change. Today about one-fourth of the population in Brazil watches the primetime soap opera at 9:15 each weeknight. Globo, the main producer of soap operas in Brazil, deliberately crafted them with characters who had few or no children. This has been in sharp contrast to prevailing fertility rates in Brazil over the same time period. Causal identification of the impact of the Globo soap operas on fertility rates in Brazil is based on the arguably random timing when different municipalities obtained access to the Globo emissions. A study by Eliana La Ferrara and colleagues in 2012 shows that a fertility decline in a municipality began after the first year that the municipality gained access to the Globo soap operas. The decline was greatest for women close in age to a leading female character in a current soap opera, which is consistent with a role model effect. For women of age 35–44, the decrease was 11% of mean fertility.

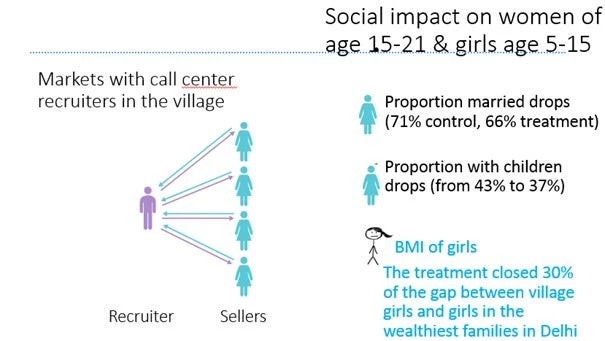

Next let’s consider the effect on cognition and behavior of the emergence of a new prototype in markets, not soap operas. There is good evidence from an experiment by Robert Jensen that the proportion of young women in an Indian village who have jobs influences marriage patterns and the education, fertility rates, and aspirations of others in the village. Rob hired 8 call center recruiters and sent them to recruit women in 80 randomly chosen villages (from a set of 160 villages), all about 100 km from Delhi (too remote for profitable visits from recruiters). His experiment created a surge in demand within those 80 villages for women in call centers and other business process outsourcing (BPO) jobs. Before the experiment, there were no members of any household in these villages with BPO jobs. As a result of the experiment, there were 11 job matches on average per village over 3 years. The proportion of young women with BPO jobs increased from 0 to 5.6 points in the average village to which Rob sent the recruiters. The evidence suggests that the surge in demand changed how women defined their lives and how parents perceived and cared for their daughters, as the figure below shows. The market didn’t just change choice sets; it appears to have had an impact on the way girls and young women perceived themselves and were perceived by their parents.

Just as social experience and structures that create new prototypes and other mental models may expand individuals’ sense of who they are and raise their aspirations, social experiences can also make a society rigid. A social pattern that entails only low education of girls can create stereotypes of “immoral” educated women who threaten the social order. The stereotypes may sustain low demand for educating daughters and hence low placement of women in jobs, sustaining the patterns and stereotypes in a “cycle of mutual constitution.” This idea has become central in the work of the psychologists Hazel Markus and Shinobu Kitayama.

Let’s sum up. With limited cognitive capacity, humans must use mental models to process information. In our recent paper, Joe Stiglitz and I argue that perceptions of objective opportunities, rather than the objective opportunities themselves, are sometimes a useful variable in economic theory. Taking account of distorted perceptions and the histories that shape them can explain many more outcomes as equilibria than the standard neoclassical model does.

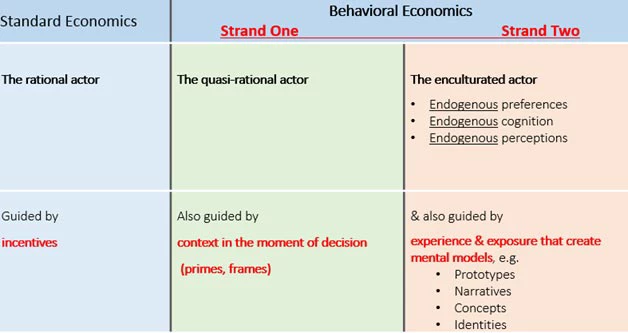

We summarize the three paradigms of the decision-maker in economics. In the standard neoclassical model, the decision-maker is the rational actor with stable and autonomous preferences. Whether the constraints that he or she faces are tightened or loosened, the person’s preferences, perception, and ability to seize whatever opportunities exist do not change.

Behavioral economics departs from that view of the decision-maker. Joe and I distinguish two broad strands of that work. In the first strand, the decision-maker is the quasi-rational actor. Context in the moment of decision provides frames and primes that affect perception, attention, and behavior. Richard Thaler and Cass Sunstein in their book in 2008 show that this means that policy (“choice architecture”) can “nudge” individuals to make better choices without changing their actual incentives or information. Cass presented a rich set of mechanisms and examples in his talk at the conference last week.

The second strand of behavioral economics brings culture (that is, mental models) into economics. In this strand of work, the decision-maker is the enculturated actor. There is social determination not only of prices, but also of “who individuals are.” The enculturated actor is a new model in economics of how individuals make decisions. Policy for economic development is just beginning to explore it.

Join the Conversation