Concept of retirement planning.

Concept of retirement planning.

International diversification offers significant advantages, yet some sophisticated investors, including pension funds, do not fully exploit these opportunities. In many cases and to the detriment of returns, large fractions of the portfolios are allocated to domestic securities; the so-called “home-bias.”

If cross-border diversification is as good as advertised, how can we actively encourage it? A key challenge, perhaps surprisingly, is that the longstanding theoretical benchmark to evaluate international portfolios indicates that it is optimal to hold very few domestic assets. According to the Capital Asset Pricing Model (CAPM), the workhorse of modern portfolio theory, the fraction of assets invested domestically should be proportional to the country’s market capitalization relative to global markets. In most developing countries, a domestic investor would then need to allocate close to 100% of its assets internationally. Such allocations are likely unfeasible or impractical, regardless of the country’s pension system. To the extent that estimates of the benefits of international diversification are calculated relative to the CAPM’s prescription, these gains might be either misleading or largely exaggerated.

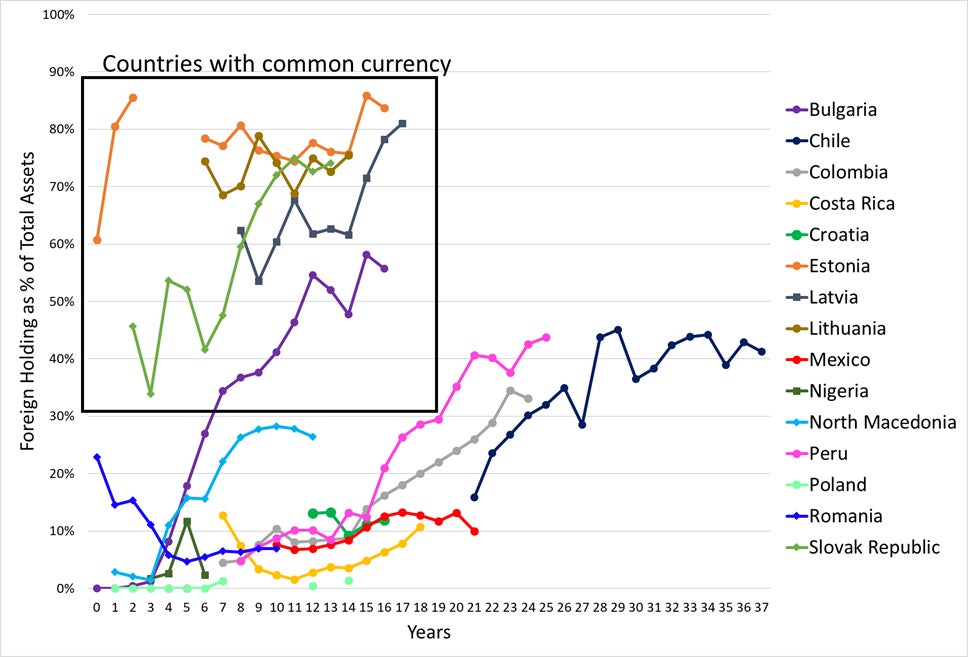

In a recent paper (Afanador et al., 2021), we propose a new methodology to estimate the gains from international diversification where the optimal asset allocation of pension funds is constrained by financial frictions. Using historical data for 77 countries, we estimate an expected -- or benchmark level of foreign exposure for pension funds -- where observable characteristics of the domestic market and the pension industry are considered, such as financial development, integration with international markets, among others. For example, as pension funds mature, they tend to increase their international holdings, but the dynamics are considerably different when pension funds are domiciled in a country with common currency (Figure 1).

Figure 1. Foreign holdings relative to the first year of operations

Source: OECD and FIAP. Authors’ calculations.

Using data on performance of fixed-income and equity securities at the local and international level, we estimate the gains from increasing the current level of foreign holdings to the benchmark level in each country. While there have been significant increases in the aggregate share of foreign holdings during the last two decades (Figure 2), such gains have been uneven. We show that for some developing countries, local pension funds could increase their expected returns by over 150 basis points per year if they reach their benchmark level.

We also use our methodology to evaluate the historical allocation of pension funds, in order to identify when some jurisdictions started to lag in relation to their peers. While in some cases strict limits on asset classes constrain the funds’ ability to gain international exposure, pension funds where access to mutual funds or exchange-traded funds is prohibitive often have little exposure to foreign markets (we document that mutual funds and ETFs are the preferred investment vehicles of pension funds to gain foreign exposure).

Overall, our methodology provides a simple measure to examine the potential gains from increasing the exposure to international securities, compare these gains across countries, and evaluate current limits on foreign securities.

Figure 2. Foreign holdings of pension funds

Join the Conversation