Business men shaking hands. | © shutterstock.com

Business men shaking hands. | © shutterstock.com

Increasing corporate market power and merger and acquisition activity represent an important phenomenon in many countries. These activities have far-reaching implications for macroeconomics, competition policy and labor markets for both advanced economies and emerging markets. Although most research and policy discussions focus on the impact of mergers and acquisitions on competition and consumer welfare in product markets, firm consolidations can also be consequential for workers. Understanding the short- and long-term impacts of consolidations on worker outcomes is important for effective regulation of consolidations and the design of labor market, social insurance, and safety net policies.

In our recent study, we examined the consequences of firm takeovers using comprehensive administrative data from the Netherlands. We found that the workers of companies acquired by other firms are more likely to lose their jobs and experience longer-term negative consequences for their earnings in the labor market and overall income . These negative consequences are pervasive across many types of workers, firms, and takeovers and appear to be driven by the restructuring of firms’ labor forces, rather than by changes in the structure of local labor markets or product markets.

Workers at firms targeted by takeovers lose jobs and income

We analyzed the consequences of more than 1,000 takeovers—events where one firm absorbed another—between 2011 and 2015 in the Netherlands, a high-income country with comprehensive employment protection and generous social insurance and transfer programs. We combined information on takeovers with matched employer-employee administrative data on all Dutch firms and workers for the 2006 and 2019 period. To understand the consequences of takeovers on the workers of acquired firms, we matched acquired firms with firms that were not acquired but were otherwise similar on several dimensions, including industry, location, and size and compared the outcomes of workers at acquired firms with the outcomes of workers at these matched controls.

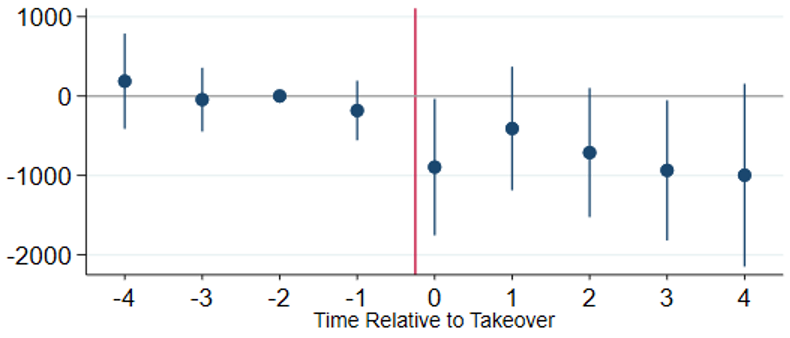

Figure 1: Change in employment following a takeover at acquired vs matched control firms

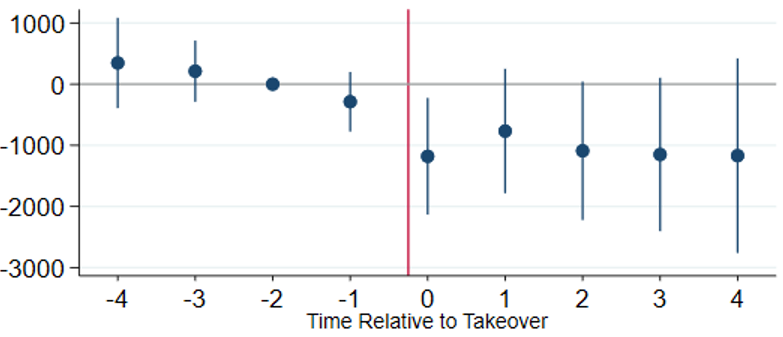

We found that relative to matched controls, the employees of acquired firms where 6 percentage points (8.5 percent) less likely to remain at the consolidated firm (figure 1). While most of the workers who lose their original jobs were able to find work elsewhere and overall employment fell only by 1 percent, both their labor market income and their overall income that includes social safety net payments was persistently lower (figure 2). The loss of labor income, despite finding another job, is driven not by lower wages but by working fewer hours. In the years after a takeover, labor income is on average 1,070 euros lower among affected workers. Accounting for transfers, their income declined by 789 euros on average.

Figure 2: Change in income following a takeover at acquired vs control firms

Labor income only

Total income (including labor market income and social safety net payments)

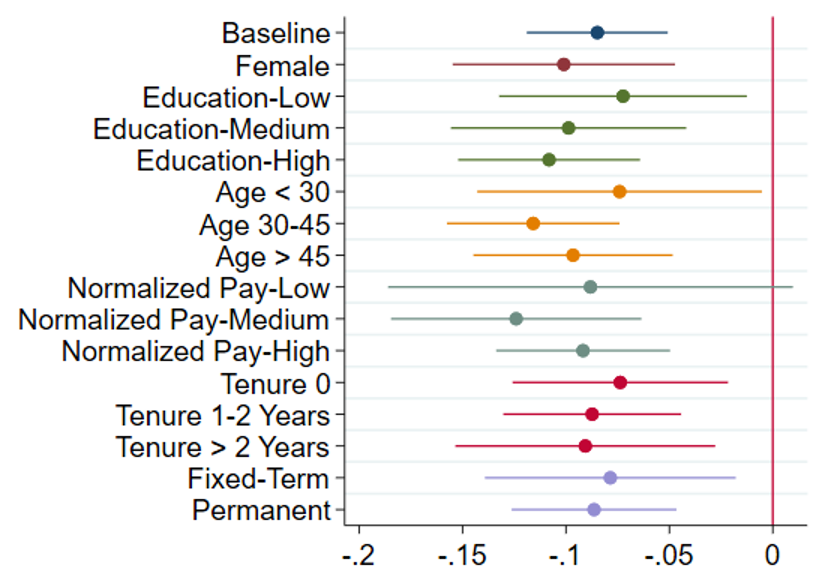

Income and job loss is driven by firm restructuring rather than market concentration

The traditional concern about mergers is that they make product markets less competitive, driving up prices, negatively impacting consumer welfare. More recently, labor market concentration has also become a concern as it can make labor markets less competitive, driving down wages, also negatively impacting worker welfare. It appears that in the takeovers analyzed in our paper, this mechanism was unlikely to be main explanation for the loss of jobs and income because most takeovers had negligible effects on product and labor market competition. Takeovers also had similar impacts across many different types of workers (figure 3).

Figure 3: Impact of takeover on employment by worker characteristics

Instead, it appears that firms restructured and let go of some of their more expensive workers and workers at the acquired firm who were similar to workers at the acquiring firm. We find that workers who earned more at their employer than expected, based on their skills, were more likely to lose their jobs. Similarly, we find that workers who had similar skillsets to workers that the acquiring firm was already employing were also more likely to be let go.

Governments may need to account for the labor market impacts of mergers

Our findings suggest that even consolidations that are typically viewed favorably from a consumer welfare perspective can still have large, long-term welfare impacts for workers. The result that takeovers substantially increase the probability of job loss with long-lasting negative consequences for workers suggests that policy makers may want to take these effects into account when they consider mergers . The negative impact on workers may be important even if it is not driven by market concentration but by potentially efficient firm restructuring. To address these concerns, policy makers can use regulatory guidelines that incorporate impacts on workers as a consideration or design social insurance and transfer policies to better compensate workers for job losses that arise because of mergers.

Join the Conversation