Last week I spoke at the World Bank’s Productivity Bootcamp, organized by Ana Cusalito, Bill Maloney, and Jan De Loecker. A psychologist might say that the professor in me could not let go of teaching. But the Bootcamp was about more than “productivity.” It covered firm profitability, competition, and market power – topics that lie at the heart of the raging debate on market concentration and firm profits, the declining labor share in the U.S., and rising inequality.

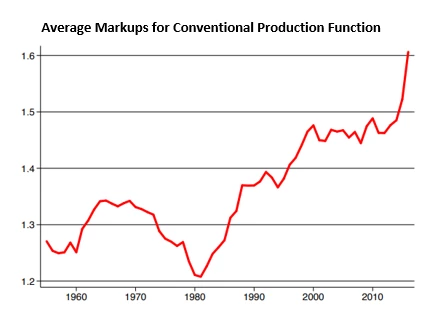

The origins of the debate can be traced to a graph in a recent paper by Eeckhout, De Loecker and Unger that shows a sharp rise in firm variable profits (or markups in the economics jargon) in the U.S. starting in the early 1980s:

Another recent paper by Autor and coauthors reinforces this message of rising profits by documenting the rise of highly profitable “superstar” firms that employ a low share of labor and dominate specific industries. Along the same lines, work by Caroline Freund and coauthors at the World Bank has emphasized the dominance of “superstar” firms in international trade.

While there is agreement on the fact of rising profits and industry concentration, the explanations for this phenomenon vary. Are the rising profits the result of anti-competitive behavior and lax antitrust? Or do they reflect the dynamism of a small number of highly efficient firms? What role has technology and globalization played in the emergence of the “superstar” phenomenon?

Before we go on, why should we, at the World Bank, care? For two reasons.

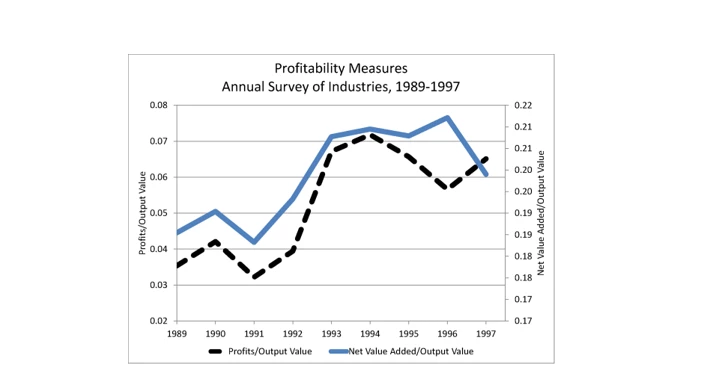

First, the phenomenon is not confined to the U.S. In a recent paper on the Indian trade reforms, my coauthors and I documented a similar rise in the profits of Indian firms:

Second, we argue that globalization and, in particular the integration of low-wage developing countries in global value chains, has played an important role in increasing firm profits.

A firm’s variable profit is – by definition – the gap between the price the firm charges for a product and the per unit variable cost of production, such as the cost for materials and labor. So when profit goes up, it is either because the price went up or because the cost went down (or a combination of both). One would be hard-pressed to argue that prices facing consumers have gone up in the last three decades. On the other hand, there is substantial evidence that costs have been going down.

The literature seeking to identify the mechanisms behind shrinking variable costs deserves a blog post of its own. There is excellent work showing contributions from both technology (e.g., the work by Acemoglu and Restrepo on automation or Ganapati on distribution centers) and globalization (e.g., our aforementioned paper or Amiti and Konings on the role of cheaper imported inputs in India and Indonesia respectively). Both mechanisms reduce the costs of production without necessarily increasing the price to consumers. Highly efficient, low cost firms make profits. And as a result, they may end up dominating the industry.

This is why it is misleading to use market shares or concentration indices as a measure of market power or competitiveness. It is the classic chicken and egg problem. Are profitable firms making profits because they use unfair methods to eliminate the competition? Or does the competition get eliminated because it cannot compete with the more efficient firms? These questions are at the heart of the recent debate on the origins of firm “superstars”. By the way, if you want an excellent, in-depth coverage of the topic, see Steve Berry's Keynote Address at the FTC on market structure and competition.

No matter where one stands in this debate, one thing is certain. We cannot make progress unless we have methods that deliver credible estimates of firm costs and profits. This is harder than it sounds. Which is why the Bootcamp last week was so valuable!

Join the Conversation