Photo: World Bank

Photo: World Bank

“Trade policy can make an important contribution to ensuring an effective exit from the crisis. That’s why we should work together … and avoid tensions and obstacles to world trade.”

- German Federal Minister for Economic Affairs and Energy Peter Altmaier, March 31, 2020

“Common sense measures like deferring tariff payments and fully funding loan programs for retailers — now largely closed — are just two of the tools all governments should be implementing.”

- American Apparel and Footwear Association President and Chief Executive Officer Stephen Lamar, April 22, 2020

As of May 11, COVID-19 has infected more than 4 million people and caused almost 300,000 deaths. To slow down the pandemic, many countries implemented lockdowns and border closures with significant disruptions to production, trade flows and other economic activities. Global demand and supply are suffering unprecedented negative shocks. Many governments launched drastic policy responses, ranging from massive stimulus packages to monetary interventions. Yet, it is not clear when the global economy will start to recover.

While many countries are implementing trade restrictions, especially on exports of critical medical equipment, food and basic supplies, several trade liberalization responses could in fact mitigate negative shocks from COVID-19. Governments should consider incorporating tariff reductions and non-tariff trade measure (NTM) simplification in their policy interventions, at least until economies recover, for three reasons.

First, COVID-19 induced chaos and disruptions have significantly increased trade costs and impeded firms to reach their customers and suppliers in a timely manner. Second, social distancing requirements and lockdowns have reduced governments’ abilities to enforce trade restrictions and process the necessary paperwork. Goods are piling up at ports and customs awaiting inspection and clearance. Finally, in a world dominated by global value chains (GVCs), which are more sensitive to trade costs and delays, tariff reductions and NTM simplification could provide the flexibility and speed for a GVC-led trade recovery. Tariff reductions and NTM simplification are not likely to impose high costs on high and upper-middle income countries, which account for over 90 percent of world trade. Lost revenues would be small relative to the budgets and stimulus packages of these countries. The time to act is now.

Tariff Reductions

Many countries are experiencing shortages of goods as governments are ordering factories to close and workers to stay home. Increasing imports of such products would relieve the markets; this could be facilitated by lowering tariffs. A valuable channel is the expansion of country and product coverages of the existing World Trade Organization (WTO) Agreement on Trade in Pharmaceutical Products (or the zero-for-zero initiative on pharmaceuticals) so medicines or medical products could be imported with zero tariffs.

In 2018, total tariff revenues were $277 billion (Table 1), corresponding to 0.69 percent of the value of world trade and 0.37 percent of world GDP. Across-the-board removal of tariffs might not be feasible since tariff revenues are important contributors to government budgets in many low-income countries (Figure 1). An alternative would be for countries with a tariff-revenue-to-GDP ratio below the world median (0.78 percent) to eliminate their tariffs, while allowing the remaining countries – mostly least developed countries – to maintain them at the current levels. These reductions would cover 90 percent of world trade and GDP, while protecting the fiscal balances of the most dependent countries. A third option would be to have only high-income and upper-middle income countries remove their tariffs. The reduction would amount to $209 billion, covering 94 percent of world trade and 93 percent of world GDP.

These tariff reductions for upper-middle-income and higher-income countries, however large they might seem, are relatively small compared to their stimulus packages. For many G20 countries, the preliminary packages account over 5 percent of their GDP and are increasing by the day (Figure 2). Even for many non-Organisation of Economic Co-operation and Development (OECD) countries, the announced packages are large; for example accounting for 9% of GDP for Thailand, 2.5% of GDP for Bangladesh, 1.2% of GDP for Argentina. (Just the decline in economic activity due to the Global Financial Crisis of 2008-2009 resulted in a decline of tax revenues corresponding to 1.3 percent of GDP.)

Table 1. Costs of eliminating tariffs

|

|

Lost tariff revenue

|

Lost tariff revenue as share of world trade |

Lost tariff revenue as share of world GDP |

Share of world trade accounted for |

Share of world GDP accounted for |

| Scenario 1: Global tariff-free trade |

277 billion USD |

0.69% |

0.37% |

100.00% |

100.00% |

| Scenario 2: Partial tariff-free trade (only countries relying less on tariff revenue) |

178 billion USD |

0.45% |

0.24% |

90.00% |

90.05% |

| Scenario 3: Partial tariff-free trade high-income and upper-middle income countries |

209 billion USD |

0.52% |

0.28% |

93.65% |

93.15% |

Source: Authors’ calculations based on data from International Monetary Fund, Government Finance Statistics Yearbook, World Customs Organization, and World Development Indicators.

Notes: table shows values based on data averaged for 2013-2018 for 141 countries. For European Union member countries for which neither International Monetary Fund, Government Finance Statistics Yearbook nor World Customs Organization provide information on tariff revenues (since they are collected in a centralized manner), the average for the available European Union countries is imputed.

Figure 1. Tariff revenue as a share of tax revenue by income group

Notes: figure shows GDP-weighted averages for each income group based on data for 2013-2018 covering 141 countries. For European Union member countries for which neither International Monetary Fund, Government Finance Statistics Yearbook nor World Customs Organization provide information on tariff revenues (since they are collected in a centralized manner), the average for the available European Union countries is imputed.

Figure 2. Size of COVID-19 stimulus packages as share of GDP (%)

Source: IMF (2020), Policy Responses to COVID-19.

Non-Tariff Measure Simplification

Beyond tariffs, many goods that go through customs face myriad inspections and certifications to confirm they satisfy various safety requirements, health standards and technical regulations. These requirements are collectively known as non-tariff measures (NTMs). Complying with NTMs is costly and time-consuming for both importing and exporting firms. While many NTMs are in place for legitimate health and safety reasons, some can be considered protectionist and excessive.

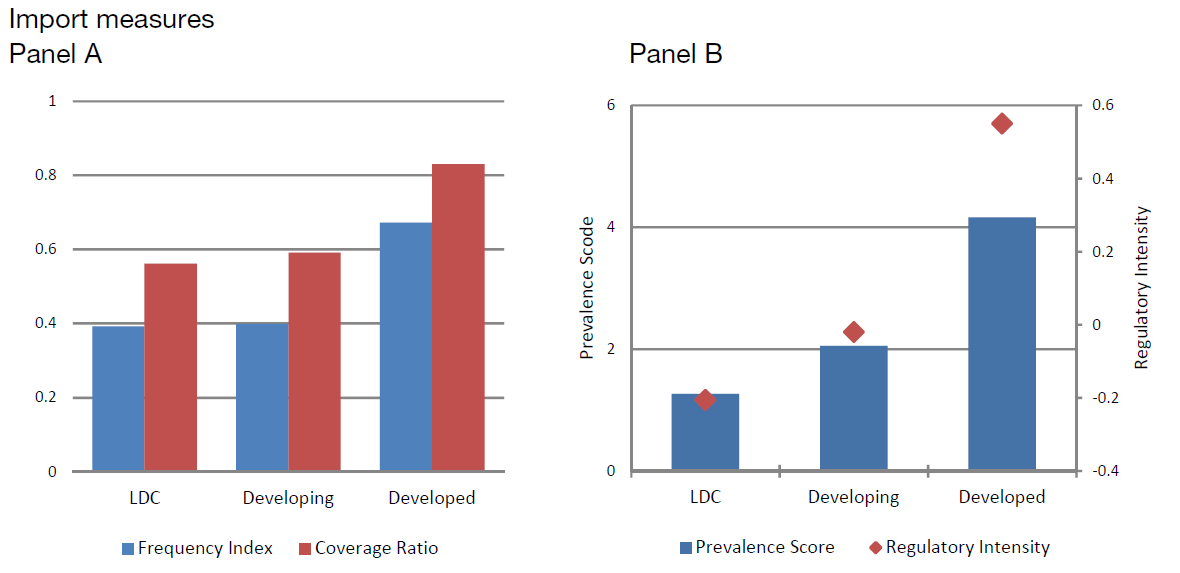

NTM coverage varies widely across countries and products. Developed countries tend to impose more NTMs, particularly on agricultural products from the developing countries (Figures 3-4). The ease of satisfying NTMs increases with GDP per capita (Figure 5). Developing countries have more difficulty meeting NTMs due to limited administrative capabilities and other constraints.

Figure 4. Imposition of NTMs by Product Groups

In times of crisis, the costs of meeting NTMs increase. Due to COVID-19 lockdowns, many governments no longer have the manpower necessary to check and approve NTM requirements and issue certificates, causing logjams at major seaports. At the time of this note, some countries, including those in the European Union, Canada, Ukraine, Brazil, Chile, Russia, Costa Rica, and South Africa have notified the WTO of temporary easing and simplifications of some of their NTMs in the form of accepting electronic signatures, documents and certifications, or waiving sanitary standard requirements. On April 6 2020, the governments of India and Nepal announced temporary suspension of the requirement of certificate of origin (COO) in trade between the two countries. Malaysia’s government granted special exemptions to clear non-essential goods at affected ports, so that imported essential goods would not be impacted.

Figure 5. Ad Valorem Equivalent of NTMs vs. GDP per Capita of Exporting Countries

Let’s Make Trade Lead the Post COVID-19 Recovery through Global Value Chains

On April 17, 2020, the foreign ministers of 13 countries -- Brazil, Canada, France, Germany, Indonesia, Italy, Mexico, Morocco, Peru, Singapore, South Korea, Turkey and the United Kingdom -- committed to maintaining essential global links to minimize the disruption from the COVID-19 pandemic and to facilitate economic recovery. The countries pledged to promote and protect free trade and agreed that emergency measures must be targeted, proportionate, transparent and temporary, and they should not create unnecessary barriers to trade or disruption to GVCs.

GVCs account for nearly half of global trade today. GVCs exist when production takes place in multiple countries, with different stages of the production process being completed in different countries. Since GVC trade is associated with intermediate inputs crossing borders multiple times, trade costs in the form of tariffs, NTMs, and other administrative barriers are incurred multiple times, magnifying their effects.

Reductions in tariffs and simplifications of NTMs would decrease costs at each stage of the production chain, which would greatly amplify the overall gains from trade. Lower tariffs, NTMs, improvements in customs would have benefits for GVC-trade (World Bank, 2019), and would support the global economic recovery by giving a boost to GVC-led trade. Heeding the 13-country pledge, now is the time to expand global trade linkages through tariff reductions and NTM simplification as part of a global effort to mitigate the negative effects of the COVID-19 pandemic.

References:

Kee, H. L., and Nicita, A. (2020). “"Trade Fraud, Trade Elasticities and Non-Tariff Barriers," work in progress.

IMF (2020). Policy Responses to COVID-19, https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19.

UNCTAD-WB (2018). The Unseen Impact of Non-Tariff Measures: Insights from a New Database.

World Bank (2019). Trading for Development in the Age of Global Value Chains, World Development Report 2020. Washington, DC: The World Bank.

Join the Conversation