الصورة حوض بناء السفن عند شروق الشمس. © Travel mania/Shutterstock

الصورة حوض بناء السفن عند شروق الشمس. © Travel mania/Shutterstock

Global GDP growth in 2019 has been downgraded to 2.6 percent, 0.3 percentage point below previous forecasts, reflecting weaker-than-expected trade and investment at the start of the year. Global trade growth has also been substantially revised down, to 2.6 percent, the weakest pace since the global financial crisis. Heightened policy uncertainty, including a recent re-escalation of trade tensions between major economies, has been accompanied by a deceleration in global investment and a decline in confidence.

Global GDP growth is expected to gradually firm to 2.8 percent by 2021, predicated on continued benign global financing conditions, as well as a modest recovery in emerging market and developing economies (EMDEs) previously affected by financial market pressure.

Risks remain firmly on the downside, in part reflecting the possibility of destabilizing policy developments, including a further rise in trade barriers between major economies; renewed financial turmoil; and sharper-than-expected slowdowns in major economies. Weakening activity and heightened downside risks highlight the need for policymakers to reinforce policy buffers to shore up longer-term growth prospects.

Global growth has weakened in tandem with slowing trade and manufacturing activity.

Global economic activity has continued to soften, with trade and manufacturing showing signs of marked weakness. Goods trade growth and new export orders fell to levels comparable to those prevailing at the start of 2016, when concerns about the global economy were elevated. The deceleration in manufacturing has been broad-based—the share of countries with industrial production in technical recession has tripled since the start of 2018, reaching nearly 25 percent in early 2019. As a result, global GDP growth in 2019 has been downgraded to 2.6 percent—0.3 percentage point below previous projections. Additionally, global trade growth in 2019 has been revised down a full percentage point, to 2.6 percent—slightly below the pace observed during the 2015-16 trade slowdown, and the weakest since the global financial crisis.

Global GDP and trade growth

Dampening trade prospects in emerging market and developing economies.

EMDE activity, particularly trade, has been markedly weaker than expected, with a substantial softening in external demand, heightened global policy uncertainty, and subdued investment only partially offset by recent improvements in external financing conditions. As demand from major economies continues to moderate, export growth is expected to decelerate across EMDE regions in 2019. Overall, export growth in 2019 is expected to be below historical averages in more than 80 percent of EMDEs. Trade in Asia—which contains major, tightly interconnected, global manufacturing hubs—has been particularly affected.

Export volume growth, by EMDE region

Near-term growth prospects will be insufficient to tackle global poverty, despite a projected recovery in global growth.

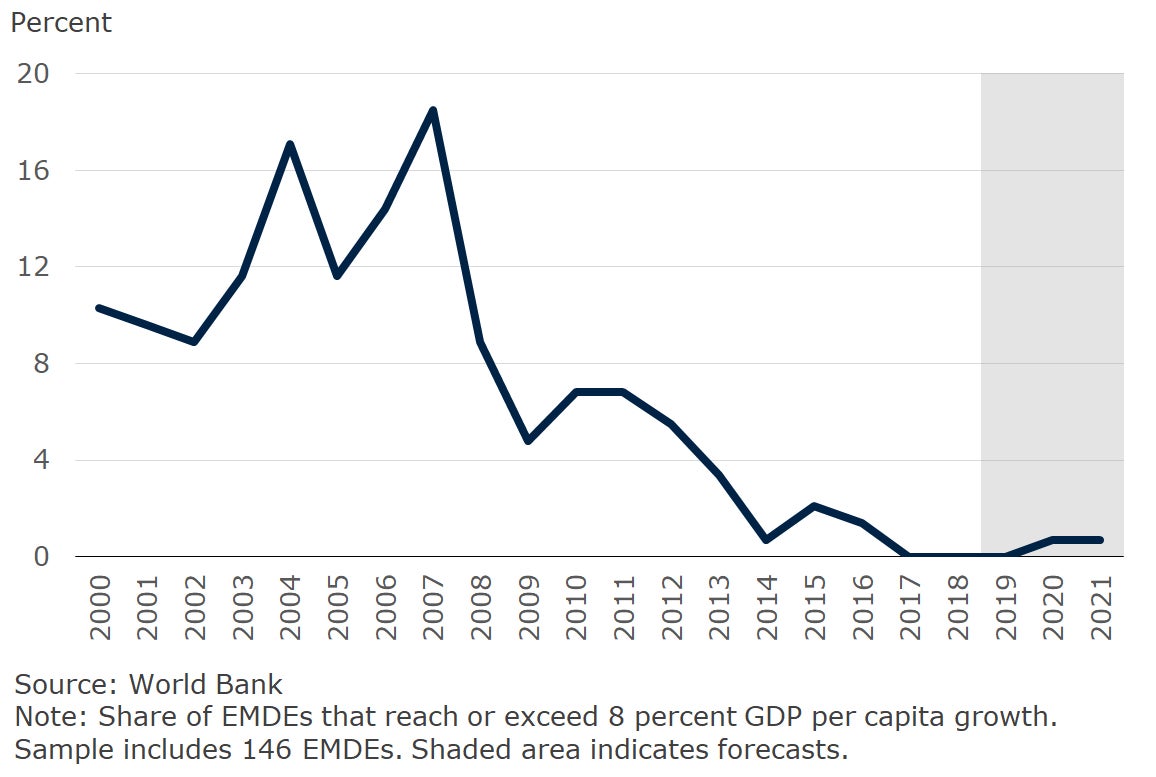

Growth is projected to gradually firm to 2.8 percent by 2021, as slowing activity in China and advanced economies is offset by a modest cyclical recovery in major commodity exporters and in EMDEs previously affected by financial market pressure. However, per capita growth in EMDEs will remain insufficient to narrow income gaps with advanced economies. Per capita income in most EMDEs is projected to grow less than the 8 percent per annum needed to reduce global extreme poverty to 3 percent by 2030, with growth less than half this rate in countries with the largest number of poor.

Share of EMDEs with per capita growth at or above 8 percent per annum

Global growth outlook continues to be subject to considerable downside risk, particularly from rising trade barriers and elevated policy uncertainty.

The risk to the global growth outlook remains tilted to the downside, as destabilizing policy developments could erode confidence and dent investment. Rising trade policy uncertainty—triggered, for instance, by a substantial rise in new trade barriers between major economies—could result in cascading trade costs and a lack of clarity about future trading rules. Renewed financial turmoil in EMDEs or sharper-than-expected slowdowns in major economies could also dampen growth and increase the probability of a marked global downturn. These risks are compounded in some regions by the possibility of intensifying conflict and by the increased frequency of extreme weather events. In all, the probability of global growth being a full 1 percentage point below forecast in 2020 is close to 20 percent.

Probability of global growth being 1 percentage point below baseline

Subdued growth prospects and heightened downside risks highlight the need to reinforce policy buffers and build resilience to negative shocks.

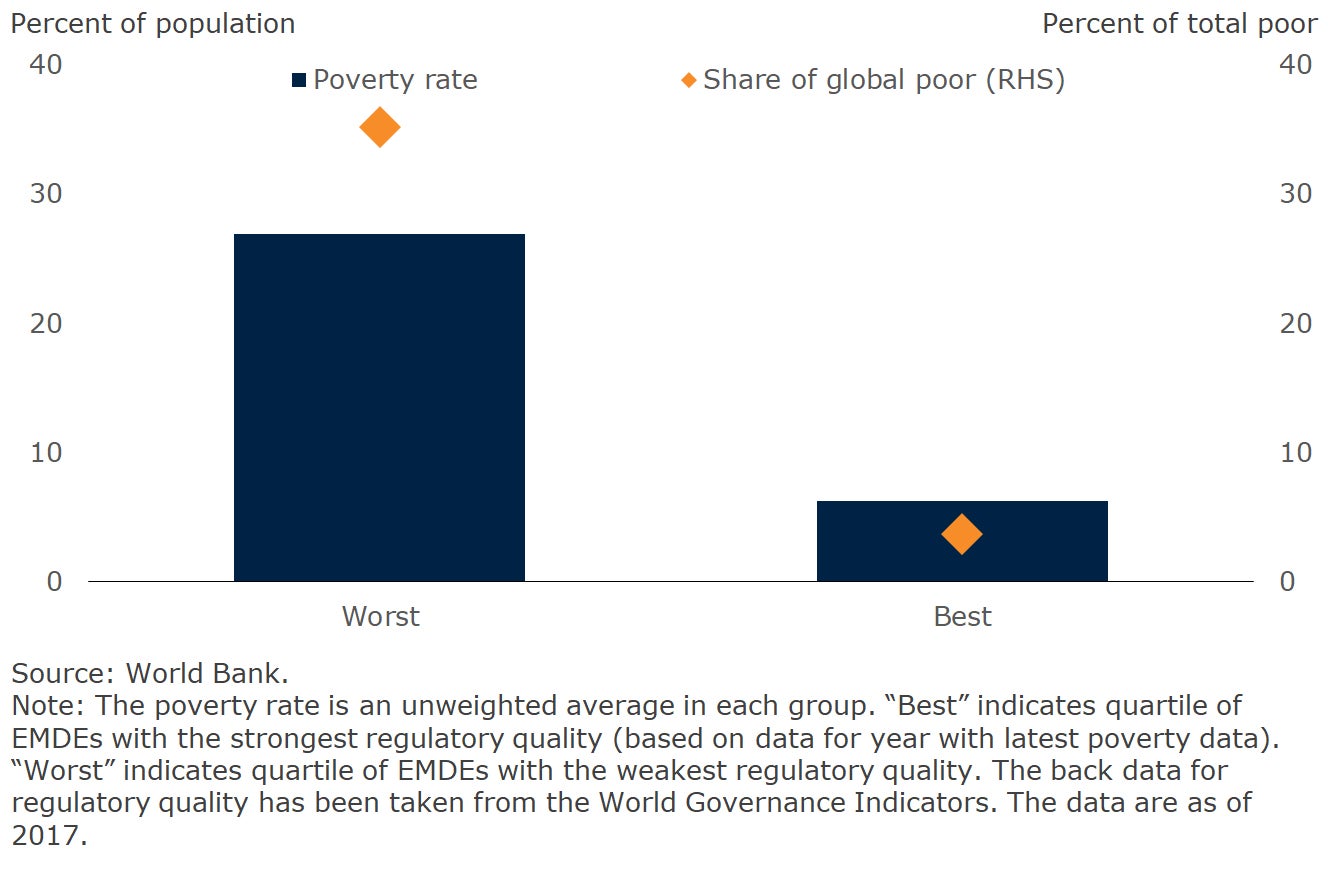

Given limited fiscal space and large investment needs to meet critical development goals, policymakers need to ensure that public spending is both cost effective and growth enhancing. At the same time, policy environments should be conducive to private-sector-led solutions. Structural reforms aimed at bolstering the business climate could also shore up longer-term growth and contribute to poverty alleviation. Improving access to reliable and affordable infrastructure, leveraging productivity-enhancing technologies, and buttressing institutional quality can help remove key bottlenecks to activity. Building resilience to extreme weather events, and boosting agricultural productivity is also a key priority in countries with large and poor rural populations.

Poverty, by regulatory quality

Join the Conversation