Mother and child bending beside a clay plot with a mobile phone in the mothers hand | © shutterstock.com

Mother and child bending beside a clay plot with a mobile phone in the mothers hand | © shutterstock.com

The promise of universal primary and secondary education is one of the Sustainable Development Goals. Yet in 2020, about 64 million children were out of primary school, including 34 million girls. Over 195 million children globally were out of secondary school.

Sub-Saharan Africa has the highest rates of education exclusion of the six developing world regions. Over one-fifth of primary-age children are out of school, and almost 60 percent of youth between the ages of 15 and 17 are not in school. There are many barriers to education for low-income households. One of them is school fees, which unfortunately remain widespread in schools across Sub-Saharan Africa, causing financial stress to families. Digital financial services are one way to help families manage school fee payments so they can keep their children in school.

New Global Findex data finds that over half (54 percent) of adults in Sub-Saharan Africa are very worried about paying school fees, and 29 percent name school fees as their biggest financial worry (above medical expenses, paying for old age, and monthly bills). In a dozen Sub-Saharan African countries, including Kenya and Nigeria, school fees are the most commonly reported financial worry.

Across Africa, 21 percent of enrolled students attend a private school, and that share is much higher in certain economies. Even in countries like Uganda, which offers free primary education, parents still have ancillary school expenses for uniforms, exam fees, school upkeep, books, or hiring an extra teacher. The cost of sending a child to school in Uganda varies from US$168 for government schools to US$420-680 for private schools. At the same time, more than 60 percent of adults in Uganda are very worried about school fees; for 40 percent of adults, school fees are the biggest source of financial worry. This is not surprising, as about 42 percent of Ugandans live below the poverty line of US$2.15 per day (about $785 per year).

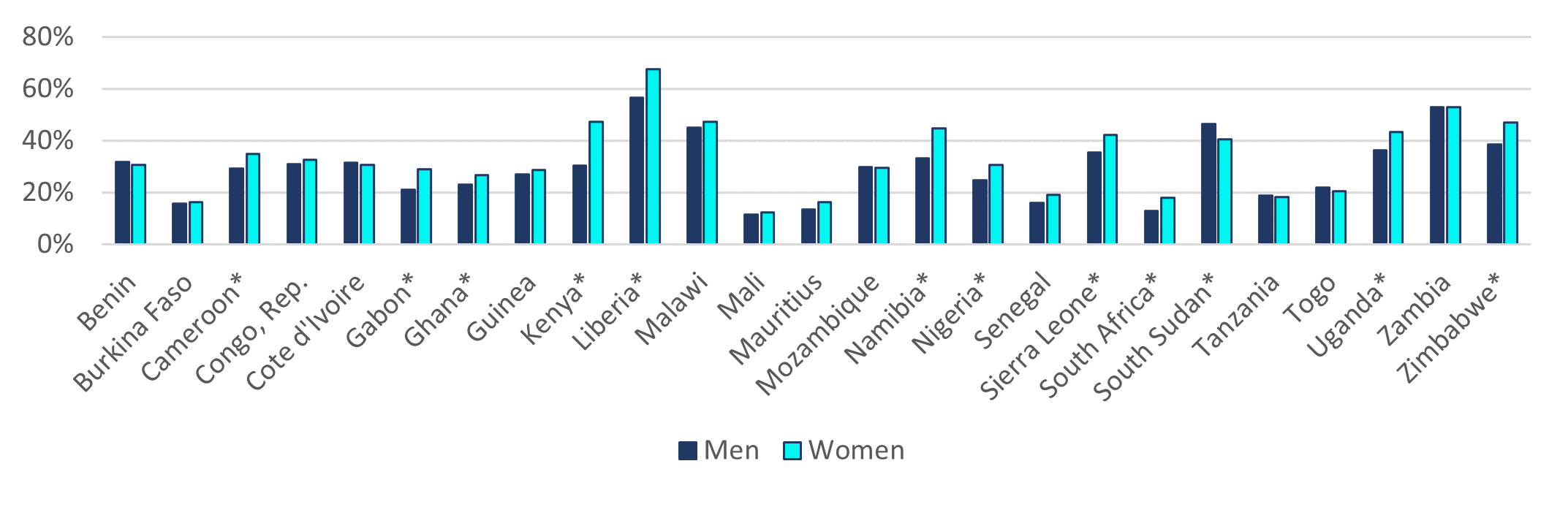

Figure 1: Share of adults most financially worried about school fees (%, age 15+)

Note: Asterisk indicates that women are significantly more likely than men to cite school fees as their biggest financial worry. Source: Global Findex database, 2021.

Women are significantly more likely than men to cite school fees as their most significant financial worry, at 31 percent, compared with 26 percent of men (Figure 1). There are many reasons why women might report greater financial stress about school fees than men. For instance, women might be responsible for making school fee payments or might worry less than men about other expenses, such as monthly bills. Recent research on intrahousehold bargaining also suggests that women might bear a greater burden of the stress of school fees because they have less control than men over household spending decisions for education.

Given the importance of education and the challenges that low-income households face affording it, what financial solutions exist to help? Global Findex data suggests three opportunities:

- Digitalizing school fee payments: School fees are typically due in full at the beginning of a school term, which can be challenging if a family’s income is low at that time since poor families often have spikes and dips in income. More than 60 percent of adults are smallholder farmers with variable cash flows, for example, and a survey has found that families find school fees easier to afford when they fall due shortly after harvest.

If fees are digitalized, it becomes easier for parents to make and schools to accept incremental payments. For example, schools and parents can determine a fee schedule that matches the household’s seasonal income flows.

The transition may be easier for adults with experience making digital payments: Among the 29 percent of adults in Sub-Saharan Africa who named school fees as their biggest financial worry, about half also made or received a digital payment using a card or phone, including 34 percent who have a mobile money account.

- Promoting formal savings: Fifty-seven percent of adults who name school fees as their biggest worry also saved—although only 13 percent saved formally with a bank or mobile money account. Formal savings accounts that include features to incentivize savings show promise as a tool to increase education access. This was demonstrated in Kenya, where researchers evaluated the impact of a commitment savings account for education that included an interest rate bonus on funds saved until a goal date. Parents who saved were 18-24 percentage points more likely to enroll their children in high school. The results using a more conventional mobile savings account without the commitment bonus were nearly the same, suggesting that having an easy way to save, not the bonus, was enough to affect parental behavior.

- Promoting formal credit: Borrowing is also high among adults who worry about school fees: 58 percent borrowed from any source, including family and friends, but only 9 percent borrowed from a formal financial institution. Providing borrowing options for education could help drive enrolment, as shown in Uganda, where a large home solar system provider (which offered financing options for its solar solutions) introduced a school fees loan product, underwritten using customer data on the solar loan product. The education loans were associated with a 50 percent reduction in the share of children out of school, and borrowers increased their education spending by 36 percent.

The long-term consequences of low enrollment or gaps in schooling should not be underestimated. Digital financial services cannot address all the barriers keeping children out of school. However, there is potential to alleviate some of the problems families face by equipping them with tools to save and make payments.

Join the Conversation