Ramnicu Valcea, Romania - July 2020: People on the street during the covid-19 pandemic on a sunny noon

Ramnicu Valcea, Romania - July 2020: People on the street during the covid-19 pandemic on a sunny noon

Everyone wants a quick recovery from the COVID-19 economic crisis. This crisis has hit the transition economies of emerging Europe and central Asia (henceforth ECA transition EMDEs) particularly hard. This group of countries comprises all of the Former Soviet Union, the Former Yugoslavia and the formerly centrally planned economies of eastern and central Europe, with the exception of those which are now classified as high-income countries. Their median real GDP contraction in 2020 was 4.3 percent, approximately double the average of EMDEs globally and double the median they experienced (1.8 percent) in 2009 following the global financial crisis (GFC).

The severity of the recession in ECA and in other parts of the world has raised fears of scarring or hysteresis, in which the recession itself depresses long-term potential output. Policymakers around the world face a fine balancing act. How should they address the concern over scarring effects while limiting the risk that a policy response that is too large or too prolonged could trigger overheating or exacerbate economic imbalances, including fiscal risks?

What is hysteresis? Hysteresis is the notion that a deep recession can leaves scars on the supply side of the economy which depress long term potential output. Such scarring could occur because the recession reduces capital investment or because unemployment depletes human capital and possibly discourages labour force participation. The notion of hysteresis has important implications for the costs and benefits of macroeconomic stabilization policy in deep recessions, such as the current COVID-19 recession. Several empirical studies have found evidence of hysteresis following recessions, especially the great recession, although most of the studies have focussed on high income countries.

What was the experience during the great recession in 2009?

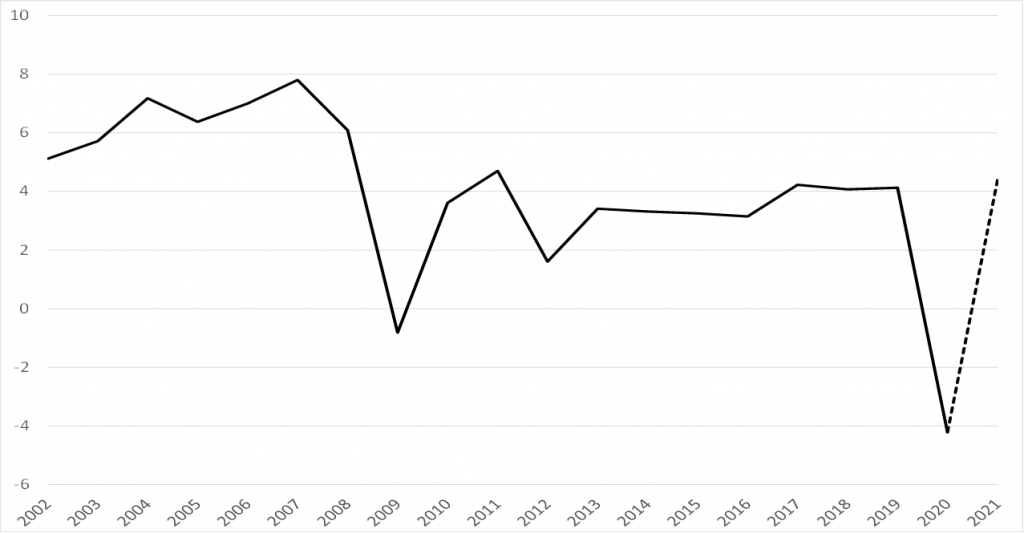

Our recent research explores the impact of the great recession in 2009 on the subsequent medium-term trajectory of real output. Figures 1 and 2 illustrate what happened to the median level of real GDP and growth respectively, in the ECA transition EMDEs after the great recession of the GFC. Compared to the 2008 forecast, median GDP in 2013 was lower by 18 percent. Median growth rates in the five years after 2009 were on average 3.3 percentage points lower than in the five years preceding 2009 (median growth was 6.6 percent during 2004 to 2008 compared to 3.3 percent during 2010 to 2014.

The question we ask in our research is whether the 2009 recession itself was a causal factor in the subsequent fall in the trajectory of real output over the medium term, compared to what had been forecast before the recession (i.e. can the great recession help to explain the gap between the dashed and solid lines in figure 1). There are several other possible causes for this gap. For example, real growth before the 2009 recession might have been unsustainable, because it was based on an unsustainable credit boom party financed by external capital inflows, as was the case in several ECA transition EMDEs. It is likely that the growth slowdown after the GFC in many EMDEs was the result of multiple causes.

Figure 1: Median Real GDP in ECA Transition EMDEs, 2002 = 100, outcomes and 2008 forecast (dashed line): 2002-2013

The lines represent the median values of the real GDP index in each year, across all of the ECA EMDEs

Source: World Economic Outlook databases

Figure 2: Median Real GDP Growth Rates; ECA Transition EMDEs: 2002-2020 and 2021 forecast (percent)

Source: World Economic Outlook Database

To determine whether hysteresis was a causal factor in the reduction of real output after the great recession in 2009, we estimated cross country regressions using a sample of 65 non fuel exporting middle income countries (which included all of the non-fuel exporting ECA transition EMDEs). The dependent variable was the gap between actual real output in 2013 and that which had been forecast in 2008. The explanatory variables include real growth 2009 alongside proxies for other possible causes, such as unsustainable growth before the great recession, changes in the external trading environment and changes in structural or policy factors which affect the competitiveness of the economy, as well as regional dummy variables. We find that there was a significant and fairly large hysteresis parameter (the estimated coefficient on real growth on 2009) which adversely affected the performance of real GDP in MICs in the years following the 2009 recession. The larger was the fall in real GDP in 2009, the larger was the gap between actual GDP four years later and the level at which it had been forecast immediately before the recession.

What are the implications for the fiscal response to the COVID-19 recession?

The COVID-19 recession, which is much steeper than the 2009 recession, may also impart significant scarring and hysteresis effects on the future path of real output, especially on those economies most badly affected. This has important implications for stabilization policy and, in particular, the use of counter cyclical fiscal policy. First, in conventional macroeconomic theory, the benefits of a successful stabilization policy, which dampens and/or shortens a recession, are confined to the short-term impact on welfare of a smaller or shorter recession. But hysteresis implies that successful stabilization policy will have a second set of benefits, potentially much greater than the first, which arise because a smaller or shorter recession means less damage to the medium- term level of potential output.

The second implication of hysteresis for fiscal policy pertains to the sustainability of public finances. One of the drawbacks with implementing a fiscal expansion to counter a recession is that it will widen the fiscal deficit and thus raise public debt. Public debt to GDP ratios has already risen sharply in many ECA transition EMDEs in 2020 because of the combination of the recession and discretionary fiscal policies: the median increase in public debt to GDP ratios in these countries in 2020 was eight percentage points of GDP. However, if the hysteresis effects of recession are significant and the fiscal multiplier is positive, a temporary fiscal stimulus can improve public debt ratios over the long term, compared to what would happen without the stimulus. This is because a successful fiscal stimulus will mitigate the hysteresis effects and thus raise the long-term level of real output, which in turn will raise the public revenue base. The long-term impact on the budget of the fiscal stimulus will depend on the relative magnitudes of the annual increase in public revenue and the increased interest costs arising from the impact of the fiscal stimulus on public debt. If the former is larger than the latter, the net effect on the budget will be positive, allowing public debt to be reduced over time, ceteris paribus. The larger is the hysteresis parameter, the larger the fiscal multiplier and the smaller the marginal interest rate on public debt, the more likely it will be that a temporary fiscal stimulus has a net positive effect on the budget in the long run.

Policy implications

To conclude, we argue that the likelihood of hysteresis or scarring from the deep COVID-19 recession in many of the ECA transition EMDEs strengthens the case for a well-designed countercyclical fiscal policy package to boost demand and restore growth, as this will have benefits not just in the short term but will reduce long term damage to potential output. Most of the ECA EMDEs are implementing fiscal stimulus measures to support their economies and the incomes of the population. The fiscal stimulus should be temporary if it is not to undermine fiscal sustainability, but it will be important to avoid a premature withdrawal of stimulus measures while the economy is still in recession. Fiscal stimulus measures need to be well designed, both to avoid creating permanent expenditure liabilities and to maximise their multiplier affects, especially because of the peculiarities of this recession, with supply side restrictions affecting some sectors of the economy because of social distancing, travel restrictions and other measures put in place to protect public health. If fiscal stimulus measures are well designed, so that they are both temporary and maximize the multiplier effects during the recession, they will help to mitigate risks to long-term fiscal sustainability.

Join the Conversation