A concept of two businessmen negotiating an international trade deal | © shutterstock.com

A concept of two businessmen negotiating an international trade deal | © shutterstock.com

Corporate income tax is an important source of government revenue, especially in low and middle-income countries. However, effective tax rates are often far below statutory rates due to generous tax incentives provided to attract investments. These incentives include tax credits, income exemptions, and reduced rates. The OECD/G20’s proposal to establish a global 15 percent minimum tax on large multinationals could profoundly impact the effectiveness of tax incentives meant to attract investments and call into question their rationale. Yet, the distribution of effective tax rates and the take-up of tax incentives are not well documented in developing countries.

Firm size is systematically related to effective tax rates

In a recent paper, we constructed firm-level effective tax rates using administrative data and a consistent methodology across 13 countries at various income levels in Africa (Ethiopia, Eswatini, Rwanda, Senegal, and Uganda), Latin America (Costa Rica, Dominican Republic, Ecuador, Guatemala, Honduras, and Mexico), and Eastern Europe (Albania and Montenegro). We observed all corporate tax-registered firms and could accurately measure the tax burden across formal firm-size distribution. The effective tax rate is defined as a firm’s corporate tax liability divided by its net profits (total revenue minus standard deductible costs).

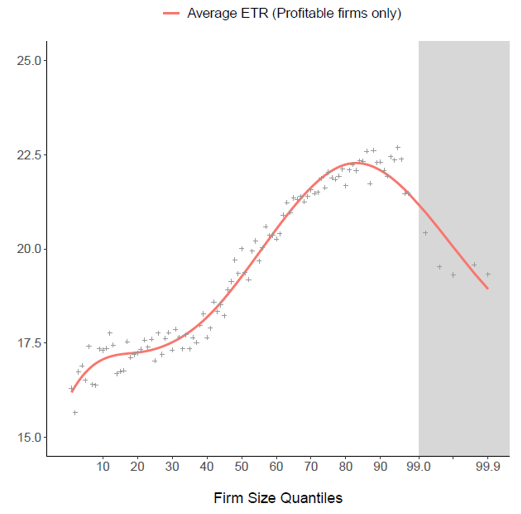

Figure 1: Effective Tax Rates and Firm Size (Cross-Country)

This figure plots the effective tax rate (ETR) by firm size (revenue) quantiles, averaged across the 13 countries in our data. For each quantile, we first average ETRs across firms in each country, and then average across countries to give equal weight to each country. The quantiles correspond to percentiles between the 1st and 89th percentile (white area), and to 0.2 percent bins between the 99th and 100th percentiles (shaded area). The orange fitted line is based on a cubic smoothing spline.

Within sample countries, we found tax burdens unequally shared across firms, following an inverted U-shape. Figure 1 shows effective tax rates (ETRs) as a function of sales percentiles, averaged across countries (country-specific curves are shown in the paper). Smaller firms often benefit from reduced rates and are more likely to declare losses, yielding zero tax liabilities. While effective tax rates initially increase with firm sizes, they flatten at the 90th percentile and decrease at the top: the largest 1 percent of firms faces an ETR that is on average 2.5 percentage points lower than the ETR for other top decile firms. This pattern is consistent across countries: effective tax rates rise in all 13 countries for small and medium firms, and drop in 9 of 13 at the top.

We analyzed the types of tax incentives firms claim to better understand the low tax burden for the top 1 percent. We controlled for whether a firm claims for different types of tax expenditures: exempt income, special deductions, re-timing (loss carryback or carryforward), and tax credits, as well as for characteristics of the firm (sector, location, age). The tax differential for the top 1 percent is mostly due to tax credits claimed by large firms and income exempted from tax. Geography also plays a role, by partially proxying for preferential tax regimes such as special economic zones.

Policy implications: The wide scope of a 15 percent minimum tax

A global corporate minimum tax could have a wide scope and generate significant revenue, since tax incentives substantially decrease tax burdens of large firms, many of which belong to multinational groups. As currently designed, pillar II of the OECD/G20 Inclusive Framework allows headquarter countries of multinationals (MNEs) to claim a top-up tax if profits reported by MNE subsidiaries in other countries are taxed at an effective rate below 15 percent. Few MNEs are headquartered in developing countries, thus these countries are unlikely to directly benefit from claims to under-taxed profits. Yet, a global minimum tax would encourage countries to ensure that large firms pay at least 15 percent of their profits in tax in each country they operate in and limit the rationale for tax incentives, since source countries hosting MNE affiliates could raise their ETRs without changing the overall tax burden for the MNEs and deter investment.

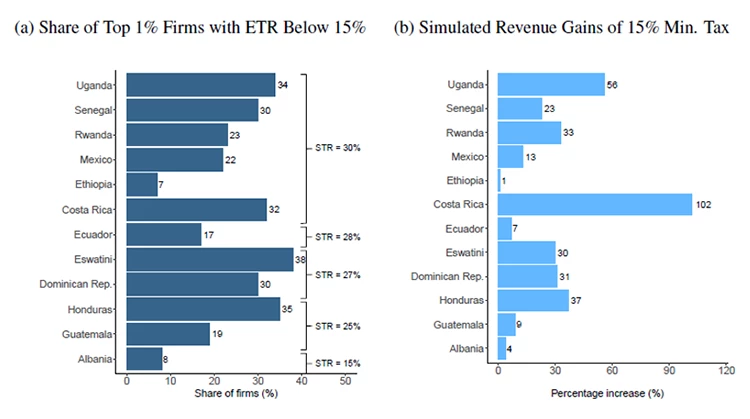

We simulated a minimum tax of 15 percent applied to the 1 percent largest firms in each country, which represents a best-case scenario for tax revenues. This is a simplified scenario, not intended to account for all details of pillar II provisions. In fact, for most countries, our data actually do not allow us to identify MNEs. Figure 2(a) shows that the scope of a minimum tax is wide: a quarter of top firms currently faces an ETR below 15 percent on average across countries, and the variation in this share is limited across countries (from 7 percent in Ethiopia to 38 percent in Eswatini). Figure 2(b) shows that in half of the sample countries, a 15 percent minimum tax would raise corporate tax revenue by at least 27 percent, which corresponds on average to 0.6 percent of GDP.

Figure 2: Scope and Tax Revenue Potential of a 15 percent Minimum Tax

Note: Panel (a) shows the share of firms in the top 1 percent of the size (revenue) distribution that have an ETR below 15 percent in the most recent data cross-section. Panel (b) shows hypothetical revenue gains from requiring all firms in the top 1 percent to pay an ETR of 15 percent at least, compared to the actual sum of Corporate Income Tax liabilities of all firms in the latest cross-section. Montenegro is not part of the calculations since its statutory tax rate is 9 percent.

Changes to the global corporate architecture could present an opportunity for low and middle-income countries to put an end to the competition for lower corporate taxation by reducing tax incentives and increasing revenue. To actually achieve these revenue gains, countries will need to make difficult adjustments to their tax codes. One approach is to restrict the generosity of tax incentives offered to MNEs and eliminate the incentives that do not have clear societal benefits. Another promising path, followed for example by Colombia, is to cap the value of tax incentives as a percentage of firms’ tax liability, ensuring that effective tax rates do not fall too low. A third alternative could be to impose a minimum tax on revenue of MNEs, such as the one Honduras had in place before 2018 (Lobel, Scot, Zuniga. 2022). Countries will face crucial policy decisions in the coming years, highlighting the importance of generating thorough evidence on the design of these various policy options.

Join the Conversation