Collage made of words about fiscal policy. | © shutterstock.com

Collage made of words about fiscal policy. | © shutterstock.com

In response to the COVID-19 pandemic, policy makers across the globe unleashed unprecedented amounts of fiscal stimulus to counter the sharpest decline in global growth. As economies reopened, coupled with the Russian Federation’s invasion of Ukraine, consumer inflation shot up to rates not seen in four decades in advanced economies and since the 1990s in emerging market and developing economies (EMDEs). In response to rising inflation, monetary policy makers quickly ratcheted up interest rates surprising financial markets multiple times. The U.S. Federal Reserve, for example, implemented multiple consecutive 75 basis point hikes, a pace of increase not seen since the 1980s. Prior to this rapid adjustment, real interest rates in the United States (U.S.) reached a nadir not seen in almost 80 years. EMDEs saw equally rapid increases in policy rates. Against this backdrop, the path forward for policy makers has become more uncertain and so have the expectations of policy moves.

In a recent paper, we estimate measures of fiscal and monetary policy uncertainty as well as their impact on output and prices for 54 economies — 32 advanced economies and 22 EMDEs.

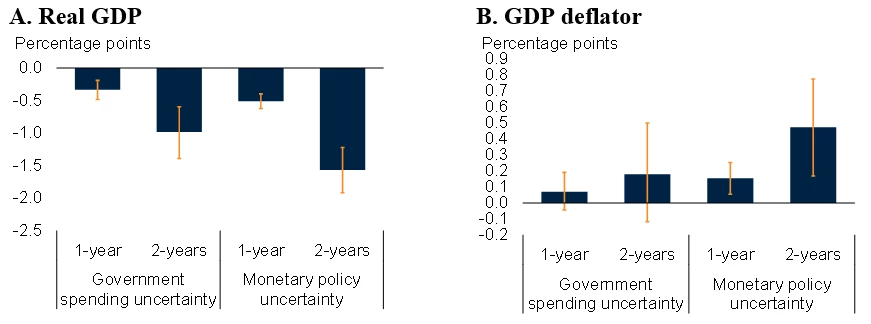

We find that shocks related to policy uncertainty have a material impact on activity and prices, and act like negative supply shocks: raising prices while lowering output, investment, and consumption (figure 1). An increase in fiscal policy uncertainty from government spending is associated with a statistically significant drop in real GDP, private consumption, and fixed investment as well as a marginal increase in prices. Monetary policy uncertainty follows a similar dynamic, being associated with a decrease in real GDP and an increase in prices.

Figure 1: Cumulative impact of a one standard deviation increase in policy uncertainty

Source: Mumtaz and Ruch (2023).

Note: Results based on a structural panel vector autoregressive model with stochastic volatility for 54 economies including 32 advanced economies and 22 emerging market and developing economies. Orange whiskers reflect the 16-84th percentile.

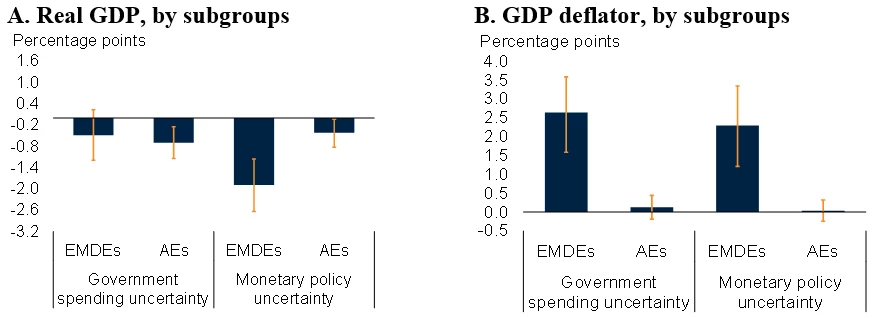

There are also differences in how advanced economies and EMDEs respond to policy uncertainty shocks (figure 2). Monetary policy uncertainty is more detrimental in EMDEs and is associated with lower output and higher inflation whereas fiscal policy uncertainties are more harmful in advanced economies and is associated with a greater fall in output.

The impact of monetary policy uncertainty in EMDEs may be greater because firms may raise prices due to lack of confidence that the central bank will maintain its inflation target. These economies may also be more sensitive to changes in real interest rates because of the role external debt plays in smoothing consumption. In advanced economies, government spending is generally more efficient and its impact on growth for each additional dollar of spending is greater (that is, a larger fiscal multiplier), suggesting a higher cost to firms and households from rising fiscal policy uncertainty (See Ilzetzki, Mendoza, and Vegh (2013); Schwartz et al. (2020); and Devadas and Pennings (2018).

Figure 2: Cumulative impact of a one standard deviation increase in policy uncertainty

Source: Mumtaz and Ruch (2023).

Note: Results based on separate structural panel vector autoregressive model with stochastic volatility for 22 EMDEs and 32 advanced economies. Figures reflect cumulative impact after 2 years. Orange whiskers reflect the 16-84th percentile.

Given the current environment of high inflation and rising global recession risks, policy makers must make every effort to minimize the uncertainty about their future decisions (See the June 2023 Global Economic Prospects report for the current global economic outlook and how to address policy challenges including policy uncertainty).

Monetary and financial authorities in EMDEs will need to continue to calibrate domestic monetary conditions considering the effects of both domestic tightening and cross-border spillovers from higher policy rates in advanced economies. Critically, communicating monetary policy decisions clearly, leveraging credible monetary frameworks, and safeguarding central bank independence will help EMDEs anchor inflation expectations and avoid disruptive capital outflows. This would help limit the adverse economic impact of tightening cycles.

Also, EMDEs can adopt fiscal rules or medium-term expenditure frameworks to set debt on a more sustainable path and create a predictable policy environment. This includes coordinating across monetary and fiscal policy such that fiscal policy does not add to inflationary pressures and prompt additional monetary policy tightening.

Join the Conversation