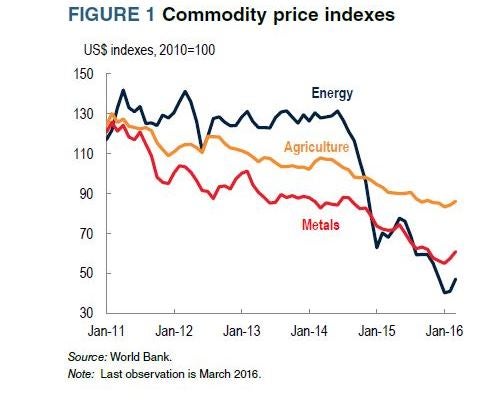

Most commodity price indexes rebounded in February-March from their January lows on improved market sentiment and a weakening dollar. Still, average prices for the first quarter fell compared to the last quarter of 2015, with energy prices down 21 percent and non-energy prices lower by 2 percent according to the April 2016 Commodity Markets Outlook.

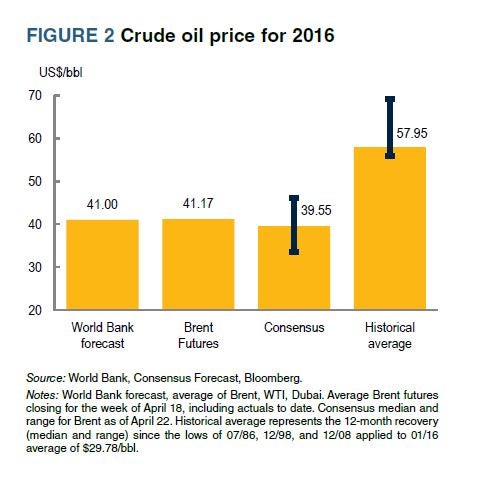

Energy prices fell 21 percent in the first quarter of 2016. Oil prices led the decline by dropping 22 percent owing to resilient non-OPEC oil production, expanding supplies from Iran, and weak seasonal demand. Natural gas and coal prices are down 15 and 3 percent, respectively, due to oversupply. Oil prices rose from $25/bbl in mid-January to more than $40/bbl in mid-April due a number of supply issues, notably outages in Iraq and Nigeria. Oil production in the U.S. fell in December, the first year-on-year drop in several years. A proposal by key OPEC and non-OPEC producers to freeze production at January levels failed to materialize at the recent OPEC meeting held in Doha on April 17.

The outlook

All main commodity price indexes are expected to decline in 2016 due to persistently abundant supplies and, in the case of industrial commodities, weak growth prospects in emerging market and developing economies. Energy prices are expected to fall 19 percent, with average oil prices projected at $41/bbl in 2016 (compared with $37/bbl in our January 2016 Outlook). The rebound in oil prices from the January lows will be weaker than previous recoveries.

Non-energy prices are expected to fall 5 percent in 2016, 1 percentage point lower than the January 2016 Commodity Markets Outlook forecast. Metals prices are projected to decline 8 percent following last year’s 21 percent drop, due to weak demand prospects and new capacity coming on line. Downside price risks include a further slowdown in China, larger-than-expected production, and depreciation of currencies of key suppliers.

Agricultural prices have been revised lower, and are projected to decline 4 percent in 2016 with prices falling in most commodity groups. This agricultural price outlook reflects adequate supplies in anticipation of another favorable crop year for most grain and oilseed commodities. Agricultural commodity markets are also aided by lower energy costs and plateauing demand for biofuels. The largest price drop is for grains, beverages, and oils and meals. Upside risks to agricultural price forecasts include the likely development of La Niña (unusually cold weather in the equatorial Eastern Central Pacific Ocean). Its overall impact on commodity markets—if it indeed materializes—will be less than the impact of El Niño.

For commodity-related information please visit:

http://www.worldbank.org/en/research/commodity-markets

Join the Conversation