Warm data background. | © Flickr Creative Commons

Warm data background. | © Flickr Creative Commons

Small businesses in India have long struggled to gain access to formal credit. Even before the COVID-19 pandemic, a staggering 92 percent of them lacked such access. India’s micro, small, and medium enterprises (MSMEs) sector faces a significant credit gap — between $250 billion and $300 billion. This is because credit access is skewed towards larger firms and those with tangible assets. That leaves MSMEs and individuals without collateral struggling to obtain loans. Even if they find a lender, the loan terms and conditions are often harsh or fail to meet their specific needs.

India’s introduction of a new architecture called Account Aggregator (AA) could revolutionize the national credit landscape , making it easier for businesses and individuals with limited financial backgrounds or asset-backed collaterals to access formal financial institutions.

To comprehend the significance of AA, it is essential to understand the India stack — a Digital Public Infrastructure (DPI) established through a public-private partnership. DPIs are interoperable digital building blocks with open standards and specifications that institutions and organizations can use to offer different services. The India stack consists of three interconnected layers that provide a digital identity to every Indian while facilitating easy, cost-free, mobile-first digital transactions. These layers are the foundation on which the AA architecture has been built. The stack uses the ecosystem created by each layer to operate an architecture that is projected to supercharge India’s credit environment.

Figure 1: India Stack

Source: Forbes Digital Assets

First Layer: Identity

|

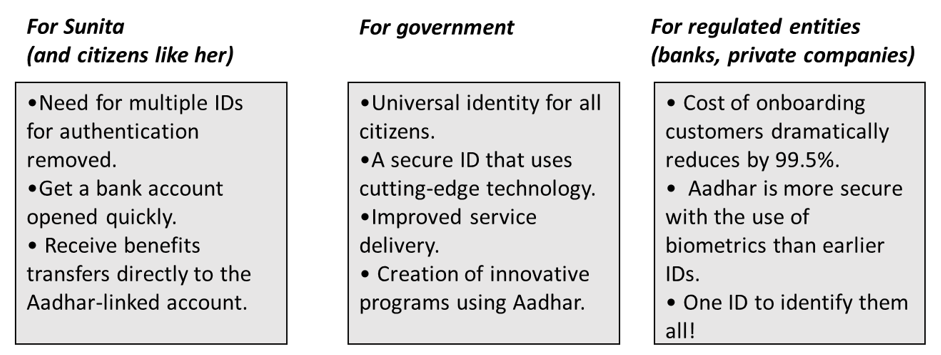

Until 2010, the vast majority of the Indian population lacked any form of reliable formal identification. This posed a significant challenge for the government and the private sector in delivering essential services to the people, especially in rural areas. In 2010, the Indian government introduced the Aadhaar number, a unique identification number issued by the Unique Identification Authority of India (UIDAI). This marked a turning point in the country's digital transformation journey.

Aadhaar, which means "foundation,” is a 12-digit number that serves as an individual's biometric identity. It comprises an individual's biometric (fingerprints and iris scan) and demographic information, including their name, age, gender, and residential address. Aadhaar is the first layer of the India stack. It has enabled the government and private sector to improve efficiencies and innovate new products and services using Aadhaar.

Before Aadhaar, only one in 25 people had any form of formal identification, and just one in four had bank accounts. Aadhaar has transformed the authentication ecosystem in India and replaced multiple government IDs, such as passports, PAN cards, ration cards, and voter IDs, for authentication. Today, Aadhaar is ubiquitous: it provides easy and quick authentication to millions of Indians, helping to empower citizens.

The Indian government has been pushing for zero-balance bank accounts under the Pradhan Mantri Jan Dhan Yojana (PMJDY), opening over 450 million accounts by 2022. Aadhaar has been instrumental in achieving this goal, as it has facilitated the KYC process, reducing the cost of conducting e-KYC from $12 to 6 cents. This has helped extend banking to millions of Indians, improving financial inclusion and reducing corruption in government services access for the poor.

Aadhaar has facilitated the transfer of over $310 billion to more than 6 billion beneficiaries under direct benefit transfers by the government. This has been a significant achievement for India — it has enabled the government to deliver various social welfare schemes directly to the beneficiary’s bank accounts, cutting leakages and ensuring that the benefits reach the intended recipients.

Figure 2: The value proposition of Aadhar

Second Layer: Payments

|

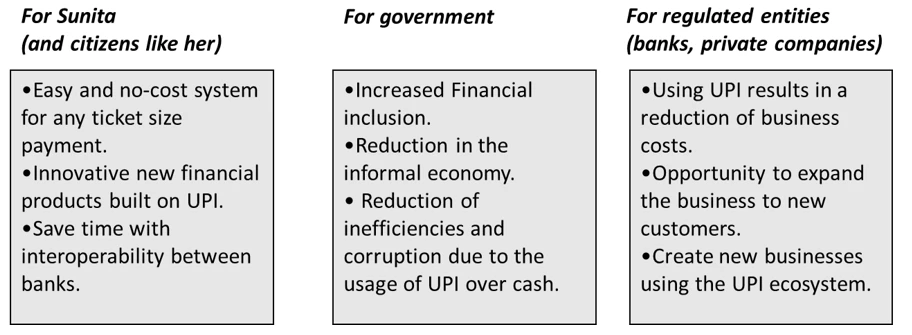

The Unified Payments Interface (UPI), an instant-payment system introduced in 2016, created the second layer of the India stack, which provided the DPI for payments in the country. The National Payments Corporation of India (NPCI), a not-for-profit organization governed through a public-private partnership, created UPI as a consortium of the Reserve Bank of India (RBI), public and private banks, and the government of India. Previous payment methods in India — including Rupay, NEFT, RTGS, NACH, VISA, and Mastercard — were utilized mainly by the wealthy, leaving less privileged citizens unable to take advantage of digital payment technologies.

UPI was developed to incorporate the best features of all previous payment systems and standardized payment methods. It utilized the Immediate Payment Service (IMPS) to provide a 24/7 channel-independent payment system that is accessible through mobile phones, the internet, ATM, and Unstructured Supplementary Service Data (USSD) on basic phones with low-speed mobile internet access. UPI's mobile-first implementation also provided an open Application Programing Interface (API) with instant channel-independent service.

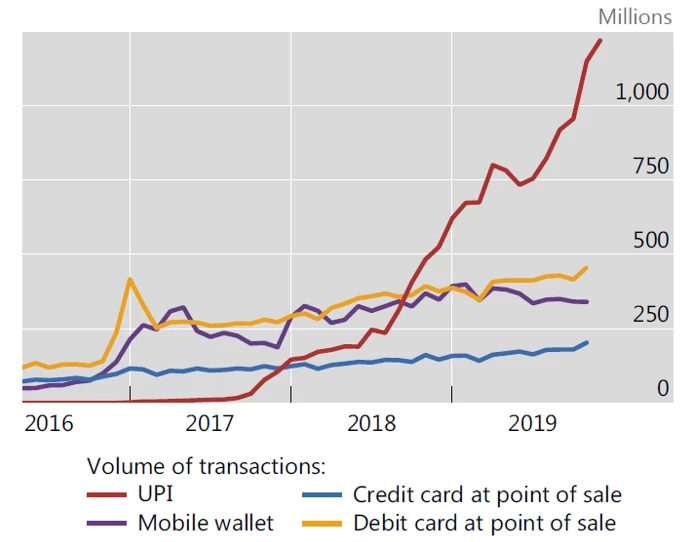

In contrast to the closed payment system in China — which is dominated by private fintech companies such as Alipay and WeChat Pay — UPI was developed with regulatory oversight from the RBI, the country's central bank. Its success was enhanced by the expansion of smartphone usage in India, currently with 750 million users, and the disruption of the mobile internet market by Jio in 2016, which reduced the cost of mobile data by 96%. This led to a significant increase in mobile data usage, from 140 MB/month in 2015 to 14.04 GB/month in 2021. The Indian government's demonetization in November 2016 — which made ₹500 and ₹1000 notes not legal tender and created a currency shortage — further pushed people to use digital payments instead of cash.

UPI's open API architecture has spurred private entities to leverage it for innovation and new service offerings. Ease of usage, an improved enabling environment, innovation by FinTechs, and other features of UPI led to the explosion of UPI transactions.

Figure 3: UPI monthly transactions have grown rapidly

Source: The Bank for International Settlements

UPI usage remained strong even after the shocks of demonetization and the COVID-19 lockdown wore off. Some of the key elements that have made UPI successful:

- Money can be transferred quickly and seamlessly between banks with the involvement of various stakeholders, such as banks, merchants, and telecom service providers.

- Payments are made instantly using fiat currency within the financial system.

- Users enjoy zero transaction costs.

- All parties involved need to strictly comply with financial regulations, granting regulators complete oversight of the ecosystem from the very start.

- Easily make payments at physical stores by scanning QR codes, which also promotes the use of UPI among individuals who may struggle with reading and writing.

- Usability on mobile devices can be guaranteed even without internet access by using the USSD service.

In 2021, the UPI platform facilitated over 38 billion transactions worth about $900 billion through mobile apps such as PhonePe, Google Pay, and WhatsApp. In 2022, this number increased to a staggering 74 billion transactions, amounting to $1.5 trillion. These transactions were processed through a shared and interoperable digital public payment infrastructure. UPI not only led to an increase in the efficiency of transactions, but it also improved financial inclusion and reduced informality in the economy.

Figure 4: UPI’s value proposition to different stakeholders

Third layer: Data governance

|

Today, every online activity and digital payment leaves a digital footprint. Governments are prioritizing regulations to ensure the protection of this sensitive data. However, the approach varies. The United States has adopted a market-oriented approach, leaving large corporations with control over their customers' data. In contrast, the European Union prioritizes harm prevention, as evident in the General Data Protection Regulation (GDPR). The United Kingdom has embraced open banking as its framework for regulating data protection.

India's approach is different. It aims to empower individuals by giving them control over the data collected from multiple sources. This is where the third layer of the stack — Data Empowerment and Protection Architecture (DEPA) — plays a crucial role. DEPA has three pillars:

- A personal data-protection bill, which will be discussed in the parliament soon.

- An electronic consent artifact that captures user consent for sharing personal data with third parties.

- A newly regulated entity known as consent managers, called Account Aggregators (AAs) in the financial sector. These AAs are NBFCs (non-bank financial companies) that RBI regulates.

What are Account Aggregators?

India’s data protection bill introduces the concept of consent managers (“Account Aggregators”) that will manage data-sharing across different institutions using the DEPA electronic artifact. AA was introduced and made live in September 2021 by the RBI.

India currently has a data-fiduciary-centric model. Individuals or small businesses must go to the original keeper of data to access their data. This inhibits the use of data for the financial empowerment of individuals. The current method of storing financial data across institutions and companies is also inefficient, resulting in the use of notarized hard copies, PDFs, screen scraping, password sharing, etc., all of which pose a threat to individual privacy. Accessing and sharing information can be difficult because of the varied formats. This forces individuals and institutions to rely on patchwork solutions.

With AAs, individuals will have complete control over their data through a set of standards and APIs that ensure the electronic transfer of data in a standardized format, making it easier to transfer information across institutions . AAs can be thought of as traffic police between Financial Information Users (FIUs) and Financial Information Providers (FIPs), with users having complete control over the flow of information. The introduction of AA architecture could revolutionize how financial data is shared, similar to the impact UPI has had on money transfers.

The AA ecosystem is cross-sectoral, with customers at the center. AAs provide a secure interface that allows users to consent to share private and sensitive data. This democratizes data use and sharing, enabling FIUs to request users' financial information. As the system matures, it can potentially transform other industries like health, insurance, personal financial management, and advisory services. Access will not be limited to financial data but also to social media, credit card points, ride share data, health data, and other digital data. The opportunities are unlimited. Private participation will further encourage innovation.

How might AAs transform lending?

Historically, several challenges have inhibited MSMEs from borrowing in the formal financial sector:

- Lack of collateral

A common hindrance for MSMEs seeking credit from formal financial institutions is the absence of physical collateral. This often forces small-business owners and individuals without tangible assets to resort to informal sources of credit at unreasonably high-interest rates.

- Non-standard loan requirements

Many small businesses require frequent small working-capital loans. Sunita, who needs to purchase vegetables and raw materials for pickles, may require only a couple of thousand rupees daily or weekly, which she plans to repay within a short period. However, offering such high-frequency small loans is not practical for many lenders. The cost of underwriting them exceeds the profit from interest.

- High cost of acquiring and verifying financial documents

MSME customers often face significant challenges when it comes to the extensive documentation and verifications required by financial institutions. The lack of a standardized information-sharing system between institutions increases the risk of fraudulent activity. At present, lenders must invest around ₹100 to review customers' financial data to underwrite a loan. Thus, lenders shy away from small amounts of unorthodox loan packages.

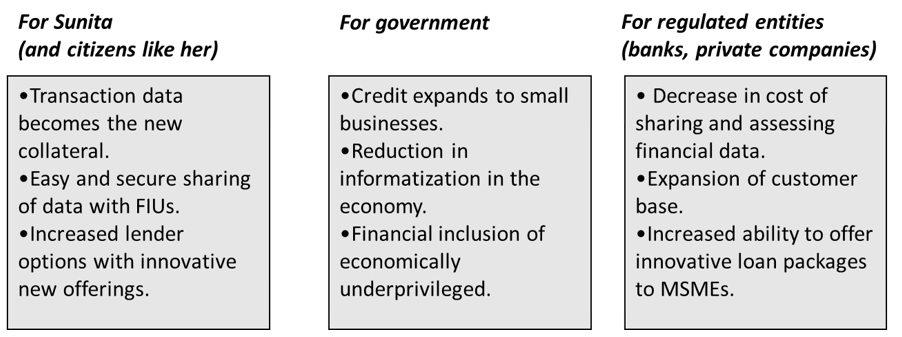

The AA architecture has the potential to alleviate these challenges. In doing so, it could transform the lending landscape for the 92% of small businesses in India that lack access to formal credit:

- AA promotes data as collateral

Aadhar and UPI have enabled millions of people — including shop owners, farmers, traders, and MSME entrepreneurs — to generate a record of digital transactions. This transaction history can be used to build trust with financial institutions and access credit through innovative lending. With AA, accessing and utilizing this data is affordable, secure, and convenient, fostering an environment for innovation in extending credit to the informal economy.

- AA standardizes, secure, instantaneous, and easy data sharing

This shift from physical collateral to information collateral is significant. Lenders can use past cash flow and revenue generation to offer small working capital loans and assess the business's repayment capacity. With AA, document sharing also becomes safe and secure as the FIU directly obtains the documents from the financial institution or the bank.

- AA could cut the cost of sharing and analyzing data

AA could reduce the cost of accessing and analyzing financial data to below ₹10 per customer. The time required to access and analyze data would also decrease substantially. That enables financial institutions to tailor innovative loan packages to different segments of society.

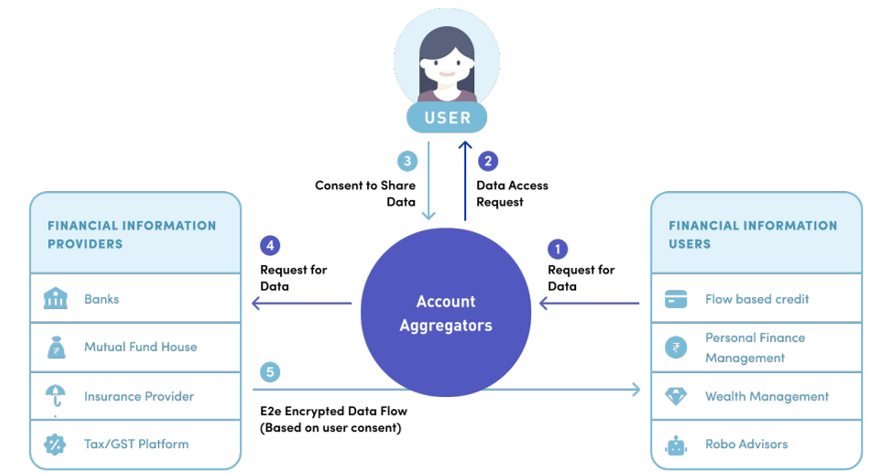

Figure 5: Architecture of Account Aggregator

The chart below illustrates how data will flow from the FIPs to the FIUs. AAs interface with the user through an app.

- As a user, you can register with any of the seven functional AAs. After registration, you can easily connect your financial information to AA apps, such as bank accounts, mutual fund details, and GSTN information.

- If you approach an FIU for a loan, it will need access to your financial information. The FIU can request the AA to share your data. The AA then passes on the data access to you.

- Based on the data request, you can provide your consent. You decide what data you want to share, how it will be used, and how long it will be shared. Once you consent, the AA will send it to the FIP.

- The FIP then sends to the FIU only the encrypted data that you have consented to.

Source: NITI Aayog, Data Empowerment and Protection Architecture

Financial institutions are generally reluctant to share customers' data with competitors. However, under the AA framework, they must also provide their data to access new customers' data in a digitally signed, low-cost format. Thus, banks and other financial institutions can become FIUs only if they also become FIPs. Since they only need to share their customer data but can access data from other sources to serve a more extensive customer base, it makes sense for institutions to share their data through official channels with their competitors. Here are the salient features of AA architecture:

- AAs function solely as conduits for the transfer of encrypted data based on the user's consent. They do not store the data themselves.

- Data transfer requires user consent and is limited to the purpose for which permission was given.

- Once the user consents, FIU is strictly limited to storing and utilizing their data for the specified duration.

- The user can revoke the consent at any time.

When it launched, eight banks were in the AA ecosystem. Today, about 200 financial institutions are active, including all the public sector banks, all the major private banks, and a few insurance companies. In FY2023, about $750 million had been disbursed using the AA framework, and about 50% of the lending has been to the MSME sector. The AA ecosystem has seen explosive growth, with 9.43 million accounts linked as of June 2023 — up from zero accounts when the system came into being in 2021. Almost a million accounts have been linked each month to AAs in the last 10 months alone.

Figure 6: AA’s value proposition for different stakeholders

Turbocharging the digital transformation.

The MSME sector is crucial to the Indian economy. It constitutes about 30 percent of India’s GDP and over 40 percent of its exports. It creates significant job opportunities — about 110 million, according to the National Sample Surveys (NSS) conducted during 2015-16. It empowers rural and urban citizens with little capital to start a business. The development of MSMEs, therefore, is closely linked to India's economic growth.

India’s digital transformation could turbocharge that process. Aadhar, e-KYC, and UPI have already significantly aided India's financial-inclusion progress. AA could become the game-changer the country needs. If it delivers on its promise, AA will bring large numbers of small businesses and individuals into the fold of the formal economy. MSMEs struggling to access credit from formal sources will benefit greatly. By creating a more equitable system for MSMEs and underserved populations, AA would allow them to obtain credit from financial institutions on par with big corporations and higher-income individuals .

Join the Conversation