However, continuation of low and stable emerging market and developing economy inflation is by no means guaranteed. If the wave of structural and policy-related factors that have driven declines in inflation loses momentum, elevated inflation could re-emerge.

Furthermore, if the global inflation cycle turns up, emerging market and developing economy policymakers may find that keeping inflation low and stable may become as a great a challenge as getting there in the first place. To insulate economies from the impact of global shocks, options include strengthening institutions, including central bank independence, and establishing complementary fiscal policy frameworks.

Read more on the topic in the January 2019 Global Economic Prospects.

Emerging market and developing economies have achieved a significant decline in inflation since the mid-1970s, with median annual national consumer price inflation down from a peak of 17.3 percent in 1974 to about 3.5 percent in 2018. Declines in inflation over recent decades have been broad-based across regions and country groups.

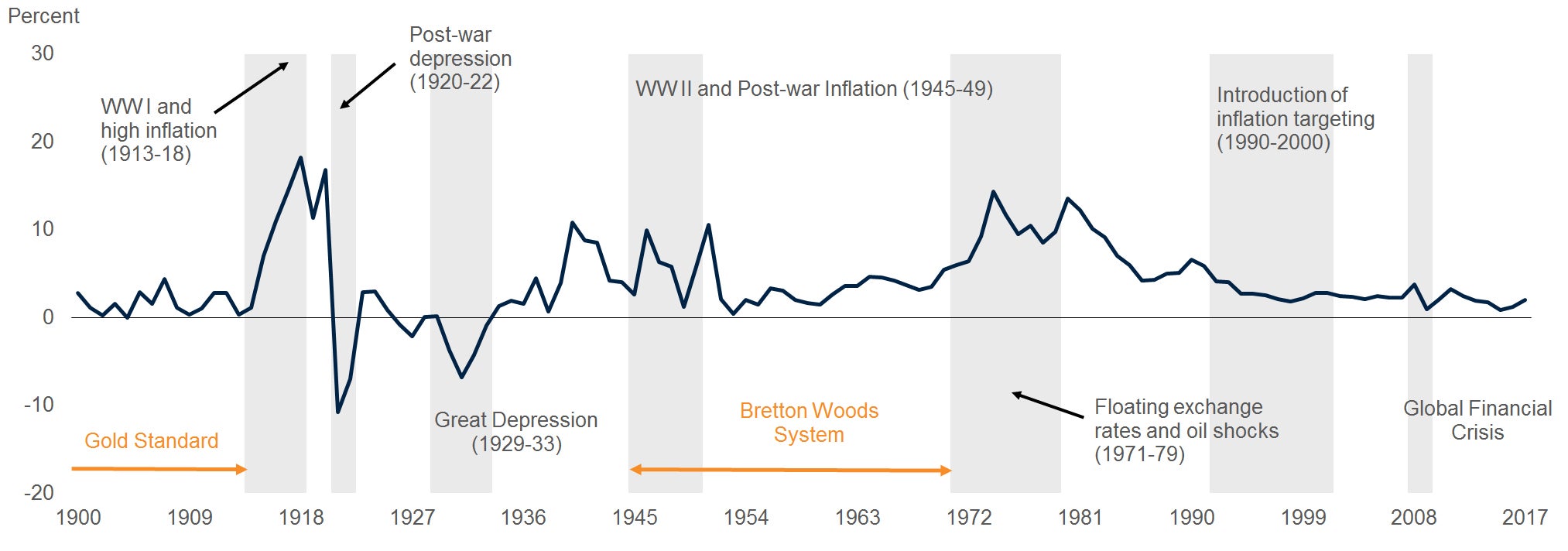

While the global financial crisis played a major role in pushing inflation down over the past decade, the longer-term trend of lower inflation has been supported by a range of structural changes. The most significant of these have been the wide-spread adoption of more effective and more transparent monetary, exchange rate, and fiscal policy frameworks as well as globalization. However, the structural and policy related factors may lose momentum or be rolled back amid mounting populist sentiment. Past episodes of low and stable global inflation (during the Bretton Woods fixed exchange rate system and during the gold standard) were followed by surges of inflation once these systems ended.

Global inflation

Inflation has become increasingly globally synchronized. The contribution of global forces to inflation variation has grown over time: since 2001, it has almost doubled, and now accounts for 22 percent of inflation variation in the median country. This is around double the degree of synchronization of global output growth that reflects the global business cycle. Consequently, emerging market and developing economy inflation could rise if the global inflation cycle turns up. Structural and policy related factors that have helped lower inflation over the past several decades may lose momentum or be rolled back amid mounting populist sentiment.

Contribution of global factor to inflation variation

Emerging market and developing economy policymakers need to recognize the increasing role of the global inflation cycle in driving domestic inflation. Policy options to help insulate economies from the impact of global shocks include strengthening institutions, including ensuring central bank independence, and establishing fiscal frameworks that can both assure long-run debt sustainability and provide room for effective counter-cyclical policies.

Join the Conversation