Even though “The golden age of finance has now ended,” (Barry Eichengreen in reference to the Great Recession), the golden age of industrialization in the developing world has just begun.

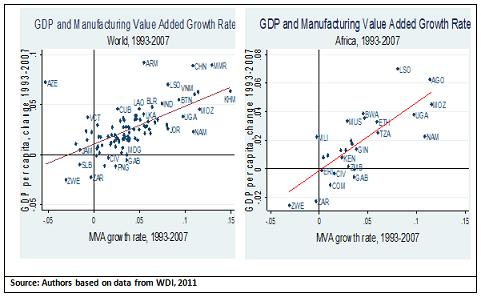

In a recent paper,'Leading Dragons phenomenon: new opportunities for catch-up in low-income countries,' Vandana Chandra, Yan Wang and I have presented evidence on how modern economic development is accompanied by structural transformation from an agrarian to an industrial economy and occurs through a process of continuous industrial and technological upgrading. Since the 18th century, all countries that industrialized successfully in Europe, North America and East Asia had two features in common: one, they exploited their comparative advantage; and two, they leveraged the late-comer advantage to emulate the industrial upgrading patterns of countries richer than them. Except for a few oil exporting countries, no country has achieved a high-income status without industrializing. In general, a change in GDP per capita is strongly and positively correlated with growth in value added in the manufacturing sector (figure 1). If a natural resource- or land-rich country has achieved a middle income status without a large manufacturing sector, it has rarely succeeded in sustaining growth.

Figure 1: Industrialization as an Engine of Growth: Manufacturing and Income Growth,1993–2007

The large dynamic emerging market countries such as China, India and Brazil are also engaged in industrial upgrading but with a critical difference. Because of its sheer size, China has absorbed nearly all labor-intensive jobs and has become the world’s largest exporter of labor-intensive products. The current view is that China’s dominance hinders poor countries from developing similar industries. In this paper, we argue that industrial upgrading has led to rising wages and is pushing China to move up the ladder from labor-intensive to more capital- and technology-intensive industries. These industries will shed labor and create a huge opportunity for lower wage countries to start a phase of labor-intensive industrialization. This process, called the Leading Dragon Phenomenon, offers an unprecedented opportunity to low-income Sub-Saharan Africa.

Building on the theme of 'From Flying Geese to Leading Dragons: New Opportunities and Strategies for Structural Transformation in Developing Countries,' we show that because of the similarity in the comparative advantage of low-income countries and the dynamic emerging market economies, when the latter upgrade their industrial sectors, they will create a huge space for low-income countries. The latter can use the opportunity to tap the potential latecomer advantage to start industrialization and achieve dynamic growth.

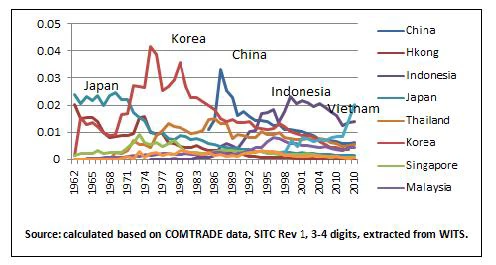

In this paper, we discuss how industries shifted from one country to another historically and how they continue to do so even today, although in a more nuanced way. During the industrial revolution, manufacturing industries jumped from the UK to continental Europe and the United States; in the pre-war period from Germany to Japan; and in the post-war period from the United States to Japan. At each stage, the pace increased. Hence the jumps from Japan to East Asian NIEs, and then to ASEAN4, and most recently to China and Vietnam have occurred faster than in the “flying geese pattern” described in Akamatsu (1962) and Gerschenkron (1962). Historical experiences of the industrial revolution offer several insights.

• For example, some European countries could catch up with Britain relatively quickly because their stage of development was quite close to Britain’s. The per capita incomes of Germany, France, and the United States were about 60 to 75 percent of Britain in 1870 (Maddison). During the Meiji restoration, Japan targeted Germany’s industries and its per capita income was about 40 percent of Germany’s. Thus it was realistic for Japan to target Germany rather than Great Britain. Even though many nation states tried to catch up, Japan succeeded because of the right choice of targeting countries.

• Nearly all countries that industrialized successfully, followed their comparative advantage or comparative advantage following (CAF) strategies to tap the late-comer advantage in a flying geese pattern.

• Not only did industries “jump” across borders, but the industries that “jumped ” also upgraded from low-value added labor intensive products to higher value added sectors. In the late 1970s and 1980s, the lead geese were the East Asian Tigers, and Chinese firms learned from and followed the leading Tiger enterprises that relocated to China. Today, as Korea continues to upgrade, the industries that are relocating to China are also moving into higher-end products, e.g., from garments to computers, from home appliances to electronics. In a fraction of the time it took Japan and the East Asian Tigers, China has been able to replace simple labor intensive products with more sophisticated ones. This is enabled by a government that fosters CAF strategies.

Figure 2: Shares of Textile exports in total merchandise exports: Five generations: Japan, Korea, China, Indonesia and Vietnam

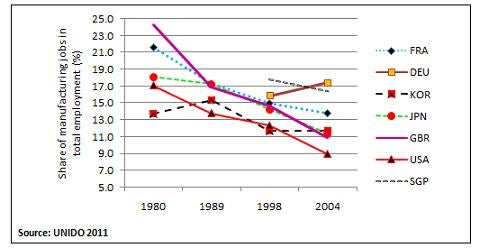

Today, China is at a stage where the Western countries and Japan were in the 1970s, and Korea, Taiwan (China), Hong Kong (SAR, China), and Singapore were in the 1980s. As their labor intensive industries matured, wages increased and firms moved into more technologically sophisticated industries that were consistent with their underlying endowment structure. In the Western countries and the Asian Tigers, the overall contraction in manufacturing jobs is an outcome of two factors: the services sector has become sophisticated and expanded; and an increase in the capital intensity of production in manufacturing has led to a contraction in manufacturing jobs. (Figure 3).

Figure 3: As labor intensive industries matured, wages rose and low skill manufacturing jobs relocated to other lower wage countries

As the structure of its industries, exports and employment is upgrading, China’s labor cost is rising rapidly. Recent data indicates that wages in China’s manufacturing sector grew rapidly, rising from just over 150 dollars per month in 2005 to around 350 dollars in 2010 (about US$4,200 per year). China’s 12th Five-Year Plan proposes that real wages will grow as fast as GDP, implying that real monthly wages will double from around $350 per month to $700 per month over the next decade. When combined with continued currency appreciation, China’s real wages could approach $1,000 per month within a decade or the level of some of the higher middle-income countries (Turkey, Brazil), and $2,000 per month by 2030 or the level of Korea, and Taiwan, China today.

Evidently, rising wages in labor intensive industries have already triggered relocation of low wage jobs overseas. Many lower wage countries in China’s neighborhood such as Vietnam, Laos, Cambodia, and even Bangladesh are emerging as the new growth nodes of the garment, footwear and other labor intensive industries. How many jobs each country can attract depends on the incentives package it offers to investors.

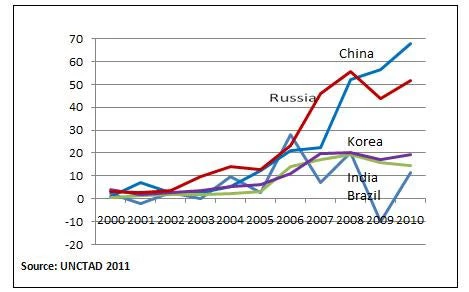

Sub-Saharan Africa is unable to benefit from the relocation of labor intensive industries from China as some of the basic factors for developing a manufacturing base are missing: financial capital, entrepreneurial skills, links with global buyers and markets. For these countries, FDI is a panacea. For industrialization, the scarcity of local entrepreneurial skills and investment capital are invariably the top two constraints for low income countries. In this aspect, the availability of FDI can enable SSA to overcome these constraints, take advantage of the Leading Dragon phenomenon and finally participate in the global production of labor-intensive products. Outward FDI from developing and transition economies reached US$388 billion in 2010 with China at the helm (US$68 billion) and Brazil, Russia, India and Korea (BRICK) the other key sources of FDI (Figure 4). About 22 percent of China’s OFDI is presently concentrated in the manufacturing sectors, second only to 29% in mining. India, which has a long tradition of investing overseas since the 1950s, currently invests over 40% of its OFDI in manufacturing.

Figure 4. Outward FDI (OFDI) from BRICK Countries,2000-2010 (in USD billions)

The Leading Dragon Phenomenon:

China has an estimated 85-100 million workers in manufacturing, with most of them in labor intensive industries or labor-intensive segments of capital-intensive industries. As these industries shed labor, they will create a huge opportunity for lower wage countries to start labor intensive manufacturing products. This process will offer millions of labor intensive job opportunities to many developing countries. We argue that the Leading Dragon Phenomenon provides an extraordinary opportunity for many lower wage countries to embark on a labor- intensive industrialization phase. If India, Brazil, Indonesia and other large MICs maintain their current pace of growth, a similar pattern and employment space will arise. The Leading Dragon Phenomenon alone is almost sufficient to double the total manufacturing employment of 10 million workers in Sub-Saharan Africa when only 10 percent of Chinese jobs relocate to the Continent. If Brazil and India follow suit, the total jobs relocation will be sufficient for Africa and other low wage countries.

Low-income countries must compete to gain access to capital, technology and capacity development opportunities. If they have the right policy framework, the industrial upgrading in large emerging market economies, especially China, would provide them a golden opportunity for a dynamic manufacturing sector-led growth in the years to come.

Join the Conversation