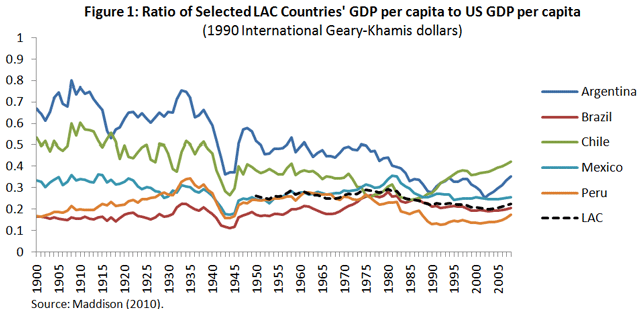

Latin America’s economic performance has been improving steadily over the past decade. Driven by high commodity prices and capital inflows, growth rose above that in the G7 and also helped for the first time to reduce poverty and high income inequality. More than 70 million Latin Americans were lifted out of moderate poverty between 2003 and 2012 and at least 12 countries in the region experienced non-trivial declines in their income Gini coefficients. In parallel, the middle classes expanded and, as a result, income inequality fell throughout the region. The effectiveness of Latin America's economic reforms since 2000 was evidenced by the resilience of its economies during the recent crisis. In fact, the region's recession was relatively short-lived, and with the exception of Mexico, remarkably mild, partly as a result of effective counter-cyclical monetary, fiscal and credit policies made possible as a result of the sustained macroeconomic stabilization since 2000. Yet, Latin America remains trapped in a middle income status and has made little progress in converging to the per capita incomes of advanced countries (Figure 1).

A recent Working Paper by Justin Lin and myself discusses how Latin America could exit the Middle-Income trap. We emphasize that the middle-income trap is not a destiny, as demonstrated by the experience of the newly industrialized East Asian economies and Ireland, which had a growth performance similar to Chile up to the mid-1960s (Figure 2).

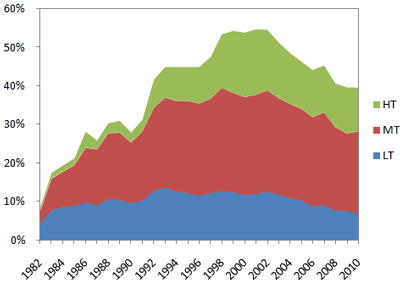

We argue that Latin American countries’ middle-income trap is a result of their inability to continue the process of moving from low value-added to high value-added industries. East Asia has been increasing the share of high-tech and manufacturing commodities in its exports and in its economy. Latin America to the contrary has experienced a declining share of high-tech and manufacturing exports. This lack of diversification and upgrading undermines the sustainability of growth and heightens the exposure and vulnerability to global economic developments (Figure 3).

Should LAC countries not be able to achieve dynamic industrial diversification and upgrading, their economies could further regress and increase their dependency on natural resources, thus remaining trapped in middle-income status, causing unemployment and other social and political issues.

Figure 4: Manufacturing exports of Latin America

and the Caribbean by technology level1

Note: Technology classification from Lall (2002). HT = High tech (electronics, scientific equipment, aircraft); MT = Medium tech (automobiles, processed chemicals and metals, and machinery); LT = Low tech (textiles, basic metal manufactures); PPRB = Primary products and resource based goods.

Source: Authors’ calculation and WITS Comtrade SITC Revision 2.

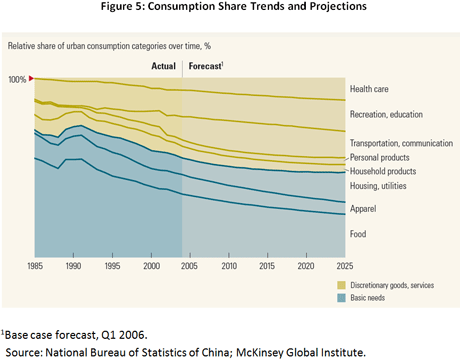

This structural transformation has become even more imperative because of the growing competition from China to traditional manufacturing products from the region. As a result, the region lost market share in certain sectors, such as industrial and electrical machinery, electronics, furniture, textiles and transport equipment. But there are also opportunities from China’s rise. The strengthening of China’s middle-class will imply a shift towards consumption-driven growth, with the structure of consumption expected to move away from food consumption towards transportation, communication, recreation, and healthcare.

To effectively counter the challenges from the new world economy and take advantage of its opportunities, Latin America needs to upgrade its industrial structure. In this endeavor, Latin America could learn from Korea which has successfully upgraded its industrial structure: In the 1960s, the Park Chung Hee government implemented three interrelated sets of economic policies that came to define the Korean model of development. It instituted a set of macroeconomic reforms designed to stabilize the economy, ensuring that Korea’s state-led development model would be market-based. But government intervention played an important role. First, the government adopted drastic measures to share the investment risks of the private sector, providing, in particular, explicit repayment guarantees for foreign loans extended to private sector firms. Second, Park himself spearheaded the effort to boost exports, offering various incentives based on market performance. Korea also greatly expanded technical and vocational training and set up labs to conduct R&D.

Latin America’s experience in implementing industrial policy has been mixed, as state-led development paradigms often led to inefficient economic structures and high fiscal costs. But, Latin America’s lesson from this historical experience should not be to abandon industrial policy, but to implement it in the right way.

The key to successful industrial policy is to identify sectors in which a country has a latent comparative advantage. The Growth Identification and Facilitation Framework, based on New Structural Economics, proposes a six-step process to identify sectors and promote their faster growth. This approach supports firms in the targeted sectors that are viable because they are in line with the country’s latent comparative advantage. Consequently, government’s incentives for investments do not address the firms’ viability problem, but compensate first movers for the externalities they create. A limited tax holiday or discrete subsidy would be sufficient. In addition, the government’s interventions should aim at overcoming coordination failures to facilitate competitiveness of the targeted industries.

One of the central aspects of the GIFF is the need to use the advantage of backwardness for industrial upgrading and diversification to achieve a dynamic change in industrial structure. While this may be obvious for a developing country, how can a middle-income country have an advantage of backwardness? A middle-income country may still suffer from some of the symptoms of “backwardness”— sectors or industries that are within the global frontiers. Technologies in those sectors still trail the high-income countries. In addition, the typical middle-income country possesses sectors or industries that may be highly developed—and may even be at the global technological frontier. For a country to upgrade or diversify to new industries that locate within the global technological frontier, the GIF framework is useful for selecting the industries and identifying the required government interventions. For industries that are already on the global technological frontier, if the country intends to stay in those industries, firms in the industries need to create continuously new processes, new products, and new technologies—thus advancing the frontier. Governments can facilitate such industrial upgrading by providing support for Research and Development—with a view to creating the required innovative activities through granting patents to new technologies, supporting basic research, government’s procurements and mandating the use of new products, as are commonly practiced in advanced countries.

Industrial upgrading and diversification would be essential to avoid further deindustrialization arising from the competitive pressures of the rise of China, broaden the base for economic growth and create the basis for further sustained reduction in unemployment and poverty and improvements in income inequality.

___________________________

1The evolution of the share of manufacturing exports may be affected by the substantive increase in commodity prices over the past decade.

Join the Conversation