With a lifting of sanctions in 2016, Iran could play a key role in energy markets but boosting capacity will require foreign investment, according to the World Bank’s latest edition of

Commodity Markets Outlook.

On July 14, 2015, the five permanent UN Security Council Members plus Germany reached a comprehensive nuclear agreement with Iran. Sanctions will be suspended upon verification by the International Atomic Energy Agency that Iran has implemented required measures. This is expected in the first half of 2016.

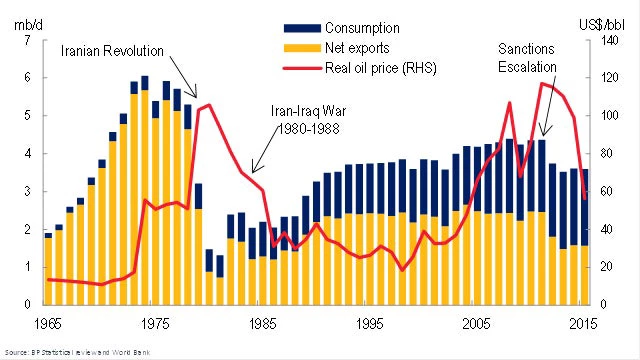

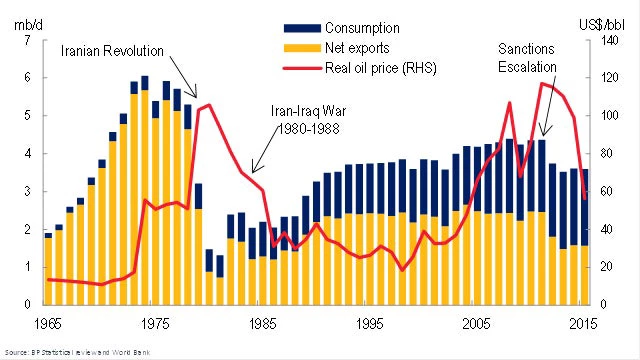

Upon lifting of sanctions, the country could immediately begin exporting the 40 billion barrels it has in floating storage. Within a few months, Iran could raise crude oil production by 0.5-0.7 million barrels per day (mb/d), potentially reaching a 2011 pre-sanctions output level of 3.6 mb/d or about 4 percent of global oil consumption. It could take longer to register a sizeable increase in production, however, given that some oil fields could require rehabilitation.

Iran is expected to quickly seek to regain its earlier market share, particularly in Europe, where it lost 0.7 mb/d in sales with the imposition of sanctions. However, increasing Iran’s exports comes amidst ample global supplies and as OPEC peers and Russia vie for market share, especially in Asia. Anticipation of Iran’s exports has already contributed to lower prices in recent months.

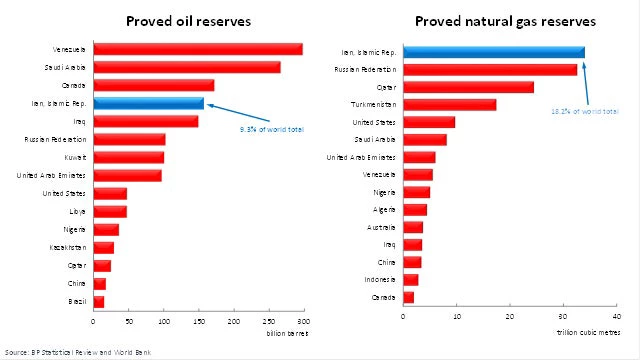

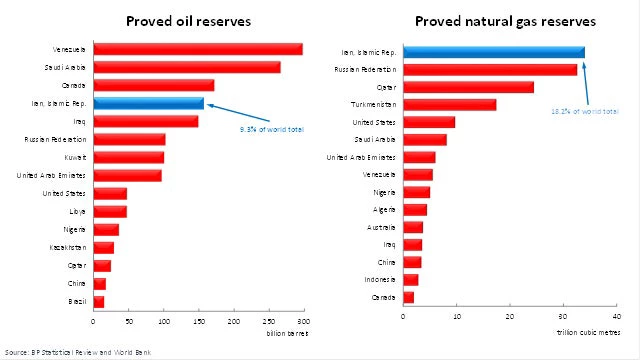

While Iran has substantial reserves – 9.3 percent of the world total – raising capacity will be costly and will require foreign investment and technology.

Attracting foreign capital in a saturated market may require Iran to offer incentives. The government is expected to present a new oil contract model to international investors – which will not include U.S. oil companies, which are still prohibited from doing business with Iran as some U.S. sanctions remain in effect. Non-U.S. firms are expected to take advantage of the opportunity, however.

At its peak in the early 1970s, Iran exported 5.7 million barrels per day, but it is not expected to return to that level in the foreseeable future. Even so, one estimate holds that if Iran were to increase exports by 1 million barrels per day to its pre-sanctions level, it would reduce international oil prices by 13 percent.

Over the long term, Iran has the potential to produce and export significant volumes of natural gas as well. With 18.2 percent of the world’s known reserves, Iran is ahead of Russia and Qatar.

Iran could develop gas export capacity through pipelines to neighboring countries and to Europe through Turkey, and through liquefied natural gas to Europe and Asia. The country could also use gas reserves to promote domestic industries, boost oil production, and to export electricity and petrochemicals.

The impact of Iran’s exports on regional gas prices will depend on global gas demand and the ability of markets to absorb the gas.

Apart from the impact on global energy markets, the removal of sanctions and larger oil revenues are expected to provide a major boost to the Iranian economy, Iran’s international trade, foreign direct investment into the country.

Read the Commodity Markets Outlook here: http://pubdocs.worldbank.org/pubdocs/publicdoc/2015/10/22401445260948491/CMO-October-2015-Full-Report.pdf

On July 14, 2015, the five permanent UN Security Council Members plus Germany reached a comprehensive nuclear agreement with Iran. Sanctions will be suspended upon verification by the International Atomic Energy Agency that Iran has implemented required measures. This is expected in the first half of 2016.

Upon lifting of sanctions, the country could immediately begin exporting the 40 billion barrels it has in floating storage. Within a few months, Iran could raise crude oil production by 0.5-0.7 million barrels per day (mb/d), potentially reaching a 2011 pre-sanctions output level of 3.6 mb/d or about 4 percent of global oil consumption. It could take longer to register a sizeable increase in production, however, given that some oil fields could require rehabilitation.

Iran is expected to quickly seek to regain its earlier market share, particularly in Europe, where it lost 0.7 mb/d in sales with the imposition of sanctions. However, increasing Iran’s exports comes amidst ample global supplies and as OPEC peers and Russia vie for market share, especially in Asia. Anticipation of Iran’s exports has already contributed to lower prices in recent months.

While Iran has substantial reserves – 9.3 percent of the world total – raising capacity will be costly and will require foreign investment and technology.

Attracting foreign capital in a saturated market may require Iran to offer incentives. The government is expected to present a new oil contract model to international investors – which will not include U.S. oil companies, which are still prohibited from doing business with Iran as some U.S. sanctions remain in effect. Non-U.S. firms are expected to take advantage of the opportunity, however.

At its peak in the early 1970s, Iran exported 5.7 million barrels per day, but it is not expected to return to that level in the foreseeable future. Even so, one estimate holds that if Iran were to increase exports by 1 million barrels per day to its pre-sanctions level, it would reduce international oil prices by 13 percent.

Over the long term, Iran has the potential to produce and export significant volumes of natural gas as well. With 18.2 percent of the world’s known reserves, Iran is ahead of Russia and Qatar.

Iran could develop gas export capacity through pipelines to neighboring countries and to Europe through Turkey, and through liquefied natural gas to Europe and Asia. The country could also use gas reserves to promote domestic industries, boost oil production, and to export electricity and petrochemicals.

The impact of Iran’s exports on regional gas prices will depend on global gas demand and the ability of markets to absorb the gas.

Apart from the impact on global energy markets, the removal of sanctions and larger oil revenues are expected to provide a major boost to the Iranian economy, Iran’s international trade, foreign direct investment into the country.

Read the Commodity Markets Outlook here: http://pubdocs.worldbank.org/pubdocs/publicdoc/2015/10/22401445260948491/CMO-October-2015-Full-Report.pdf

Join the Conversation