Photo: Gennadiy Kolodkin / World Bank

Photo: Gennadiy Kolodkin / World Bank

The outbreak of the coronavirus (COVID-19) pandemic triggered a record one-month decline in oil prices in March, as wide-ranging measures to stem the pandemic precipitated a collapse in oil demand and a surge in oil inventories. Low oil prices are unlikely to temper the global recession as current restrictions on a broad swath of economic activity disrupt travel and transport, which account for roughly two-thirds of oil demand.

The pandemic has dealt a dual blow to oil-exporting emerging market and developing economies (EMDEs) as they grapple with the public health crisis alongside the plunge in oil prices and associated decline in fiscal revenues , which comes at a time when fiscal positions were already strained. However, as we say in our latest analysis, the current environment of low oil prices, however, provides an opportunity to review energy-pricing policies and implement changes that yield efficiency and fiscal gains over the medium term.

Price collapse

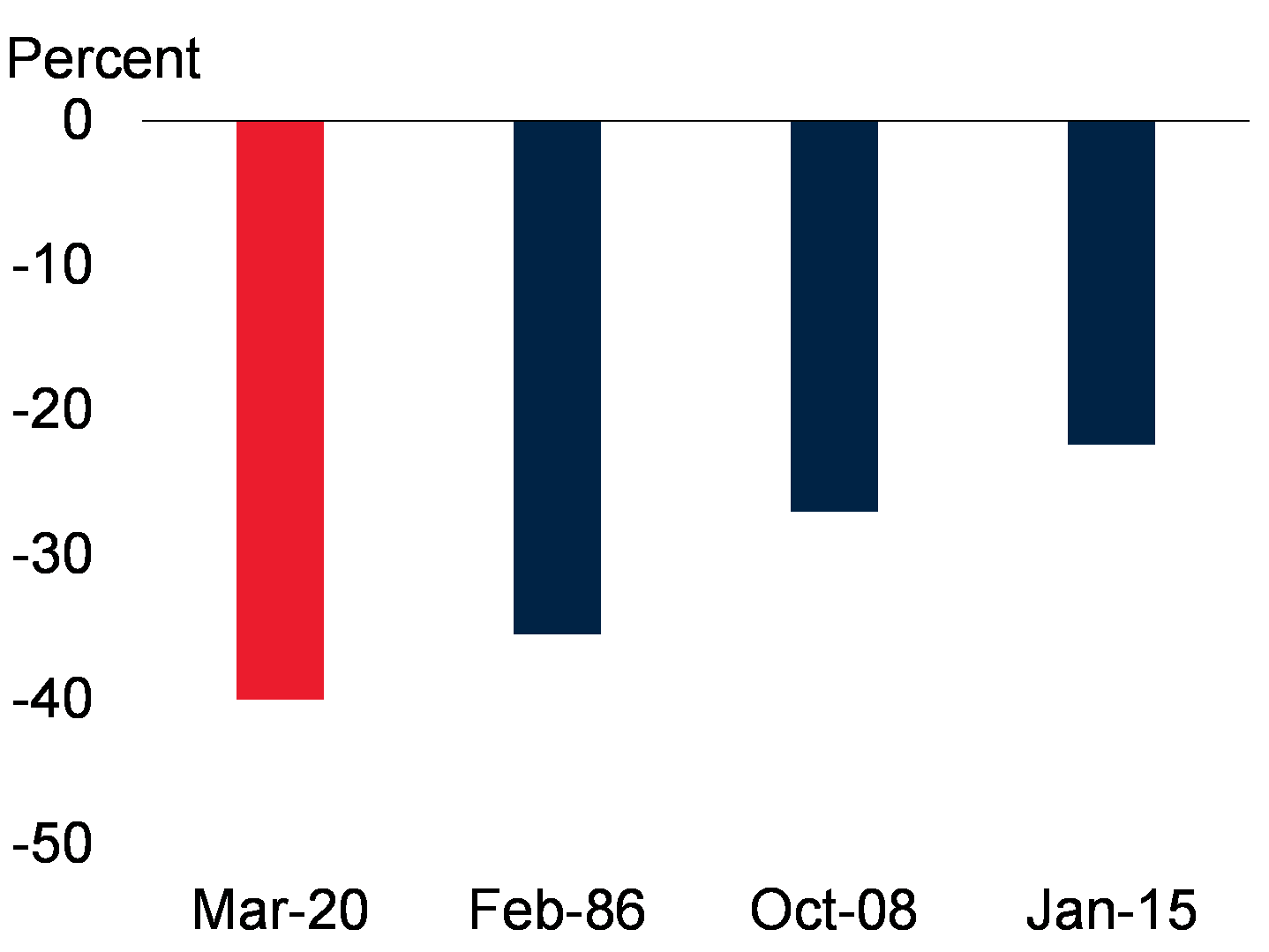

As the pandemic gripped the global economy, oil prices collapsed in the first quarter of 2020, with March registering the single largest one-month drop on record.

Largest one-month declines in oil prices since 1970

Source: Bloomberg; World Bank.

Note: Figure shows the largest declines in Brent oil prices since 1970.

Demand dive

The fall in global oil demand has been unprecedented as travel and transport, which account for about two-thirds of oil demand, plummeted and the global recession took hold.

Global oil demand growth

Source: International Energy Agency; World Bank.

Note: Shaded area shows IEA estimates for year-on-year demand growth in 2020Q2.

Although supply factors have also played a role, the oil price plunge is predominantly demand-driven, due to the pandemic and the associated restrictions to slow its spread. The downward pressure on prices has been further exacerbated by rising oil inventories.

Contribution to largest oil price declines since 1970

Source: Bloomberg; Energy Information Administration; International Energy Agency; OPEC; World Bank.

Note: Chart shows the contribution to explained six-month log changes in oil prices, based on structural vector autoregression estimation. For each of the seven episodes, only the month with the deepest six-month oil price plunge is shown.

Limited promise for global growth

Past demand-driven oil price plunges did not boost growth in the near- or medium-term. There have been six previous oil price plunges of more than 30 percent prior to the current episode: 1985-86 (supply-driven), 1990-91 (demand-driven), 1998 (demand-driven), 2001 (demand-driven), 2008-09 (demand-driven), and 2014-16 (supply-driven). These events were not associated with higher EMDE growth, and the current episode of low oil prices holds even less promise amid widespread restrictions and more limited room for fiscal support in energy-exporting EMDEs.

Cumulative impulse response of EMDE output, by type of oil price plunge

Source: Bloomberg; Energy Information Administration; International Energy Agency; OPEC; World Bank.

Note: Cumulative impulse responses of real output in EMDEs in response to an oil price plunge, based on a local projections.

Fortify fiscal space

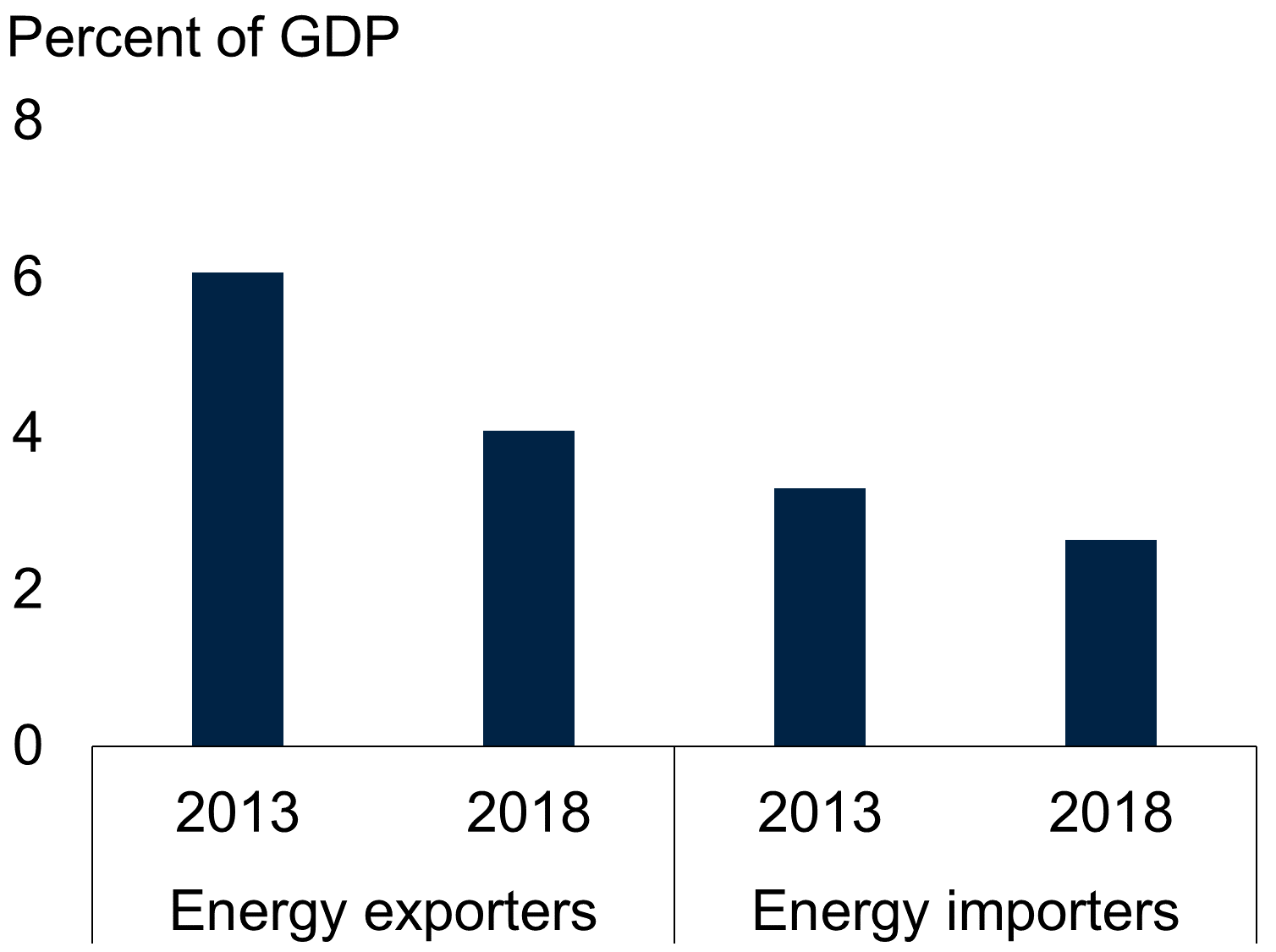

With the current low oil prices, the time is ripe to implement reforms that bolster medium-term fiscal space. Low oil prices are an opportunity for EMDEs to review energy-pricing policies that would help remove inefficiencies and carve out fiscal space for higher priority spending to boost health infrastructure and capacity and protect employment and social safety nets.

Energy subsidies in EMDEs

Source: International Energy Agency; World Bank.

Note: Sample includes 25 energy-exporting EMDEs and 14 energy-importing EMDEs.

Join the Conversation