The cotton picking cotton planting base. Credit: Humphery/Shutterstock.com

The cotton picking cotton planting base. Credit: Humphery/Shutterstock.com

This blog is the sixth in a series of nine blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook.

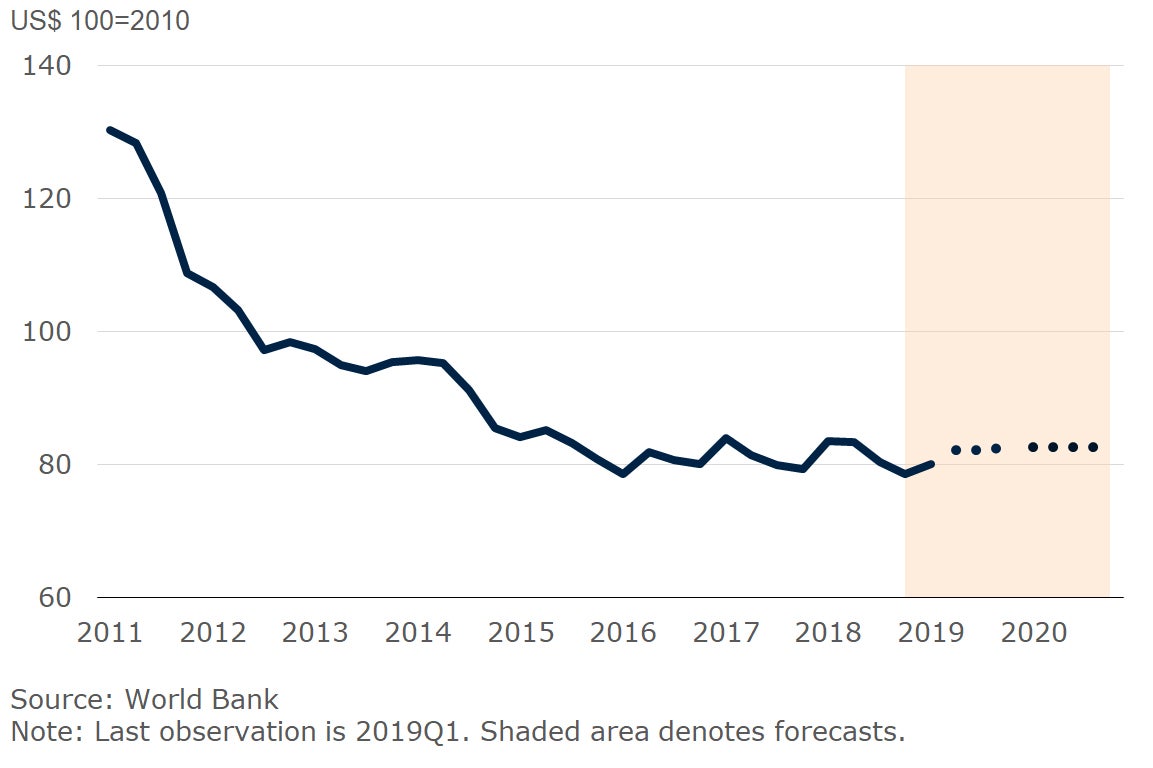

The World Bank’s Raw Materials Price Index gained 2 percent in the first quarter of 2019 (q/q) in response to a large increase in rubber prices but stood almost 4 percent lower than 2018 Q1. The index is expected to stabilize in 2019 and gain marginally in 2020, according to the latest Commodity Markets Outlook.

Raw material price index

Cotton

Cotton prices declined 5 percent in the first quarter and stand almost 9 percent lower than a year ago. The price weakness, which intensified recently, reflects news on very favorable supply conditions—production is expected to outpace consumption next season (2019-20) for the first time since 2015-16. Global cotton production is expected to reach 27.6 million metric tonnes (mmt) in 2019-20, with increases in most major producing countries, including the China, India, Pakistan, United States, and several West African countries. Consumption, on the other hand, is estimated at 27.3 mmt, suggesting global stocks will increase by almost 2 mmt. Following a projected decline of almost 7 percent in 2019, cotton prices are expected to experience a marginal increase in 2020.

Cotton prices

Cotton stocks

Natural Rubber

Natural rubber prices surged in the first quarter, after plunging to a 30-month low in the fourth quarter of 2018. The price strength, which continued into April and May, reflects a slowdown in global natural rubber production in early 2019 due to adverse weather conditions and slower tapping. Lower production materialized in most East Asian producers, especially, Indonesia, Malaysia, and Thailand, which together account for nearly 70 percent of global supplies. On the demand side, consumption of natural rubber for vehicle tires (two-thirds of its market) is expected to fall as vehicle sales slow in China, North America, Europe, and elsewhere. However, fiscal stimulus in China, along with the reversal of interest rate hikes in many advanced economies, is expected to stimulate demand. Natural rubber prices are expected to gain 9 percent in 2019 and 3 percent in 2020.

Natural rubber prices

Natural rubber production

Join the Conversation