This blog is the eighth in a series of ten blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook. Earlier blogs are here.

The World Bank’s Metals and Minerals Price Index is forecast to remain broadly unchanged in 2019, following a projected 5 percent increase in 2018. However, volatility is anticipated to remain elevated due to China’s environmental policies, tariff negotiations between the United States and China, and Chinese policy responses aimed at stimulating the economy and cushioning the impact of trade tensions.

Despite supply disruptions and falling inventories, metals prices retreated in the third quarter on softening global demand and U.S.-China trade tensions. The Index declined by about10 percent in Q3 (q/q), partially offsetting its bullish ride over the past couple of years.

Metals and minerals price index

Copper

Copper prices are often considered a global economic barometer due to the importance of the metal in infrastructure and manufacturing. Fiscal stimulus from the Chinese government to spur infrastructure projects could provide a boost to copper demand, and a moderate recovery of copper prices is expected in 2019.

Prices fell 11 percent in 2018 Q3 (q/q), reflecting gloomy market sentiment as trade tensions escalated. In addition, fears of supply disruptions due to labor strikes in the world’s largest copper mine, Escondida in Chile, did not materialize. Although production remains robust and mine expansions are expected in the Democratic Republic of Congo and Zambia (in part driven by electric vehicle demand), markets remain relatively tight.

World copper stock-to-consumption ratio and LME copper price

Aluminum

Aluminum prices are anticipated to recover in 2019, with consumption outstripping production outside of China and rising alumina prices.

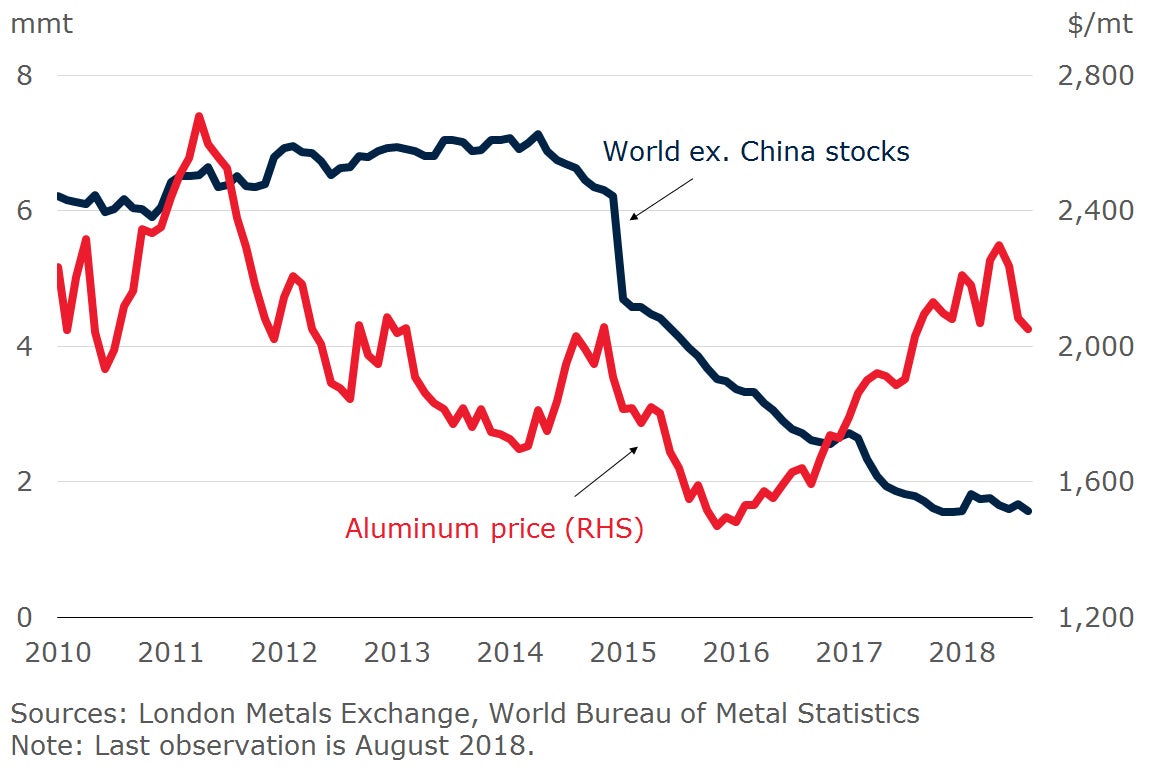

Aluminum prices have been volatile throughout the year on persistent concerns about alumina supply (alumina is extracted from bauxite and is then used to produce primary aluminum). The world’s largest alumina refinery, Alunorte in Brazil, has been operating at half capacity since March due to an environmental dispute. Sanctions on Russian aluminum producer Rusal in April and labor strikes at Alcoa in Western Australia that lasted more than six weeks starting in August led to price spikes. Meanwhile, U.S. tariffs on aluminum imports have resulted in a divergence between the United States price and the London Metals Exchange benchmark. However, trade tensions in the second half of 2018 have outweighed supply disruptions and tight inventories, with aluminum prices declining by 9 percent in 2018 Q3 (q/q).

World ex. China aluminum stocks and LME aluminum price

Nickel

Nickel prices are foreseen to increase in 2019.

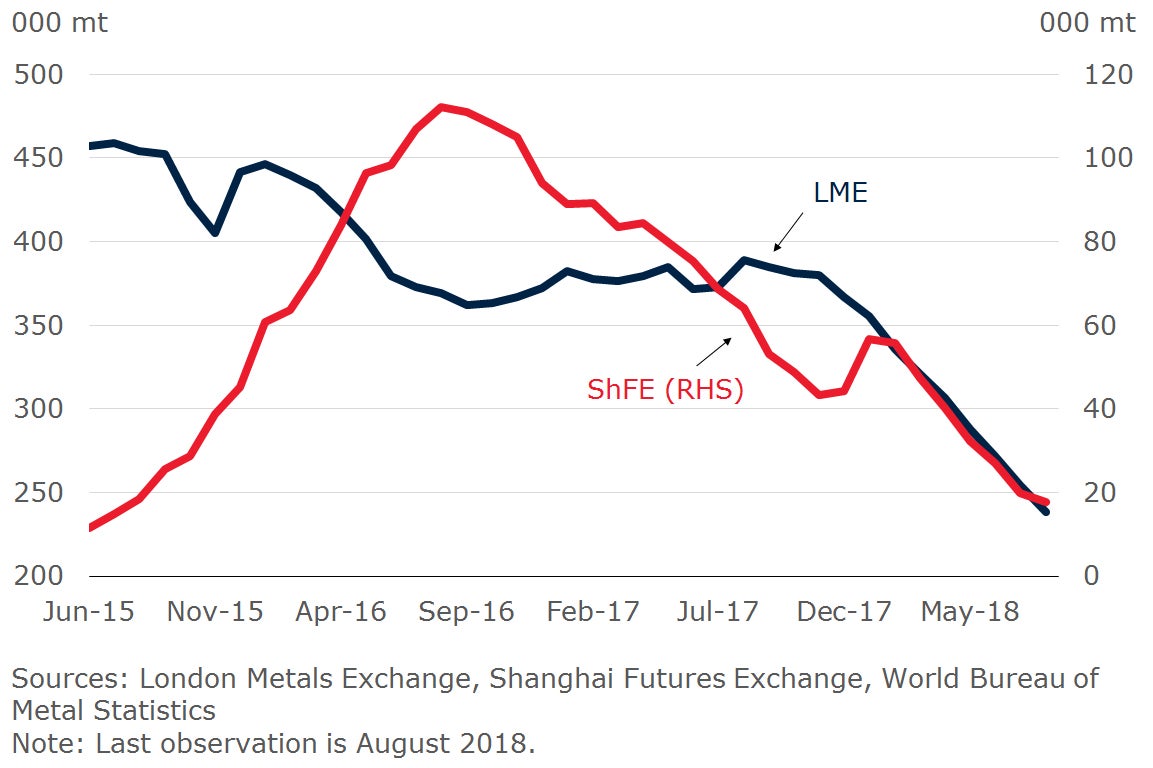

Prices fell by about 9 percent in 2018 Q3 (q/q) but were still 26 percent higher than 2017 Q3. Strong demand for stainless steel and electric vehicle batteries have supported prices, along with a lack of nickel pig iron (NPI) supply in China. Nickel inventories at exchanges, particularly in Shanghai, have been falling precipitously. New supply from Indonesia should support stockpiling as there is long-term electric vehicle demand for nickel.

Nickel stocks at exchanges

Zinc, lead, and tin

On balance, lead and zinc prices are forecast to be slightly lower on average in 2019 than 2018, while prospects for tin look positive.

Despite critically low stocks, the “sister metals” zinc and lead saw the sharpest fall in prices in 2018Q3, by 19 and 12 percent respectively, as trade tensions weighed heavily on market expectations for future demand. With the electric vehicle revolution, lead, inextricably linked to batteries in internal combustion engines, emerged as a casualty (the main electric vehicle batteries are lithium-ion based, with nickel, cobalt, and manganese used for the cathode and a graphite anode). In addition, an expected supply surge in refined zinc has kept prices low. However, market tightness points to a gradual recovery in prices from their current low levels in the near term.

As the “glue” for all things in the form of solder, tin is expected to be an important component in the technology supercycle. Over the past few years, refined tin consumption has been outpacing production. Stocks are falling, exacerbated by supply disruptions in Indonesia and Myanmar. Tin prices are projected to increase modestly in 2019.

LME zinc, lead, and tin stocks

Iron ore

A well-supplied seaborne market, supply additions from Brazil, and a rising share of scrap-based steel production point to lower iron ore prices in 2019.

Unlike base metals, iron ore prices have been spared most of the negative impacts of trade tensions, increasing by 2 percent in 2018Q3 (q/q). This may be because the prices of bulk commodities, such as iron ore and alumina, primarily reflect actual physical demand while base metals prices are indicative of market sentiment. However, such divergence is not expected to persist as the fundamental drivers—especially demand—of both bulk and base metals prices are similar. Steel production in China remains constrained by strict environmental policies and iron ore imports have declined. Prices began to fall in November.

Longer-term trends in metals demand

Over the past 20 years China's demand for metals has grown dramatically, and it now accounts for around 50 percent of global demand for most metals. This increase in the share of demand has come largely at the expense of advanced economies such as the United States and the European Union.

Join the Conversation