The traditional view of international trade is a mercantilist one. That is, exports are good and imports are bad. Exports are considered good because they add to a country’s gold reserves while imports have the opposite effect. As it turns out, the mercantilist view now stands questioned given the number of theoretical and empirical studies showing the many benefits of imports. In fact, as Paul Krugman remarked, one could turn the mercantilist view on its head and argue that exports are the unfortunate necessity or cost of enjoying imports. However, the cost-benefit calculus of imports is quite under-researched and in many areas the imports literature lags behind the voluminous literature on exports – perhaps a hangover from the mercantilist bias towards exports.

One area of imports that is relatively less researched is imports of intermediate inputs. Recent empirical evidence suggests that foreign input use may be important for the growth and development of firms and the economy (Amiti and Konings, 2007; Bernard et al., 2007; Seker, 2012, Vogel and Wagner, 2010). This could be because imported inputs are of higher quality due to embedded foreign technology in inputs, and certain foreign and domestic inputs may be imperfect substitutes (Halpern et al., 2009; Gibson and Graciano, 2011). While this is a useful starting point, a number of exciting research avenues remains to be explored. As such, we provide a few examples here for manufacturing firms surveyed by the World Bank’s Enterprise Surveys in over 80 developing countries.

First, how important are foreign inputs for manufacturing firms in developing countries? Enterprise Surveys data show that imports of inputs are more pervasive among private firms than exports of final goods. On average, 61 percent of the firms use imported inputs. In contrast, only 26.6 percent of the sampled firms export (directly or indirectly) some or all of their final output. Across countries, the average level of imports (as % of firm’s total inputs) equals 37.1 percent while the level of exports as a percentage of firm’s total sales equal only 11.6 percent.

Second, we must resist extending existing patterns for exports to imports. That is, imports of inputs and exports of final goods do not always have the same relationships with respect to other economic variables. For example, the percentage of sales that is exported rises sharply with the income level of the country. However, there is almost no correlation between income level and the proportion of firm’s inputs that is of foreign origin (figure 1). Hence, a separate analysis for imports is required.

Figure 1

Source: Enterprise Surveys.

Note: GDP per capita values on the horizontal axis are PPP adjusted, at constant 2005 International Dollars and for the year prior to the year covered by Enterprise Survey. Data source is World Development Indicators, World Bank.

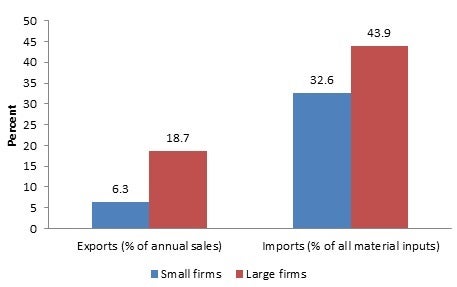

Third, even in cases where exports show similar patterns, they may not do so to the same degree. For example, one of the most robust findings in the literature is that firm-size and exporting activity are positively correlated. That is, larger firms export more. In Bolivia, large firms export 14.6 percent of their output compared with just 1.7 percent exported by small firms. In contrast, the level of foreign inputs as a percentage of all inputs differs much less for large and small firms equaling 51 percent for large firms and 44 percent for small firms. Figure 2 shows that this result holds on average across the 83 countries for which data are available.

Figure 2

Source: Enterprise Surveys.

In short, imports of intermediate inputs are heavily under researched but as the examples above suggest, a number of exciting results await discovery. We hope that this post will encourage the readers to explore this important and exciting avenue for future research.

Join the Conversation