Money bag and government building. Government debt concept.

Money bag and government building. Government debt concept.

The debt burden of governments is among the most widely cited statistics worldwide. Risk analysts, investors, taxpayers and politicians all have a keen interest in knowing the level and composition of a country’s public debt. At the same time, there is growing recognition that debt statistics are plagued by major limitations and incomplete reporting, especially in developing countries (World Bank 2021).

In this blog, we introduce a new, ongoing research project that quantifies the “hidden debt problem” in a systematic way and that puts current challenges into a broader perspective (Horn, Mihalyi and Nickol 2022). Our research is based on a comprehensive new dataset of revisions of external debt stocks and loan commitments for 50 years and more than 140 developing countries.

Our central finding is that underreporting of public debts is a recurring phenomenon. “Hidden debts” are large and most likely to be revealed in bad times, such as during debt crises, resulting in further bad news . We also document recent advances in the debt coverage of the World Bank’s International Debt Statistics and show that a recent wave of “hidden debt” revelations has contributed to today’s record debt levels.

Measuring underreporting and increases in debt coverage by tracking data revisions

Our forthcoming research paper (Horn, Mihalyi and Nickol 2022) provides 50 years of evidence on “hidden debt revelations”, building on the most widely used international debt statistics – the World Bank’s International Debt Statistics and its predecessor publications. The key idea is as follows: When previously undisclosed loans are reported, past debt statistics need to be revised. Tracking these revisions quantifies increases in the coverage of debt statistics and allows to analyze the timing, characteristics, and drivers of “hidden debt” revelations.

To gain a long-run perspective on debt underreporting and disclosure, we digitized past annual editions (“vintages”) of the International Debt Statistics and its predecessor publications, including the World Debt Tables (1979–1996) and the Global Development Finance reports (1997–2013).[1] This novel database allows us to track revisions to debt statistics across almost 50 different vintages of data and over hundreds of crisis episodes.

Quantifying the underreporting problem

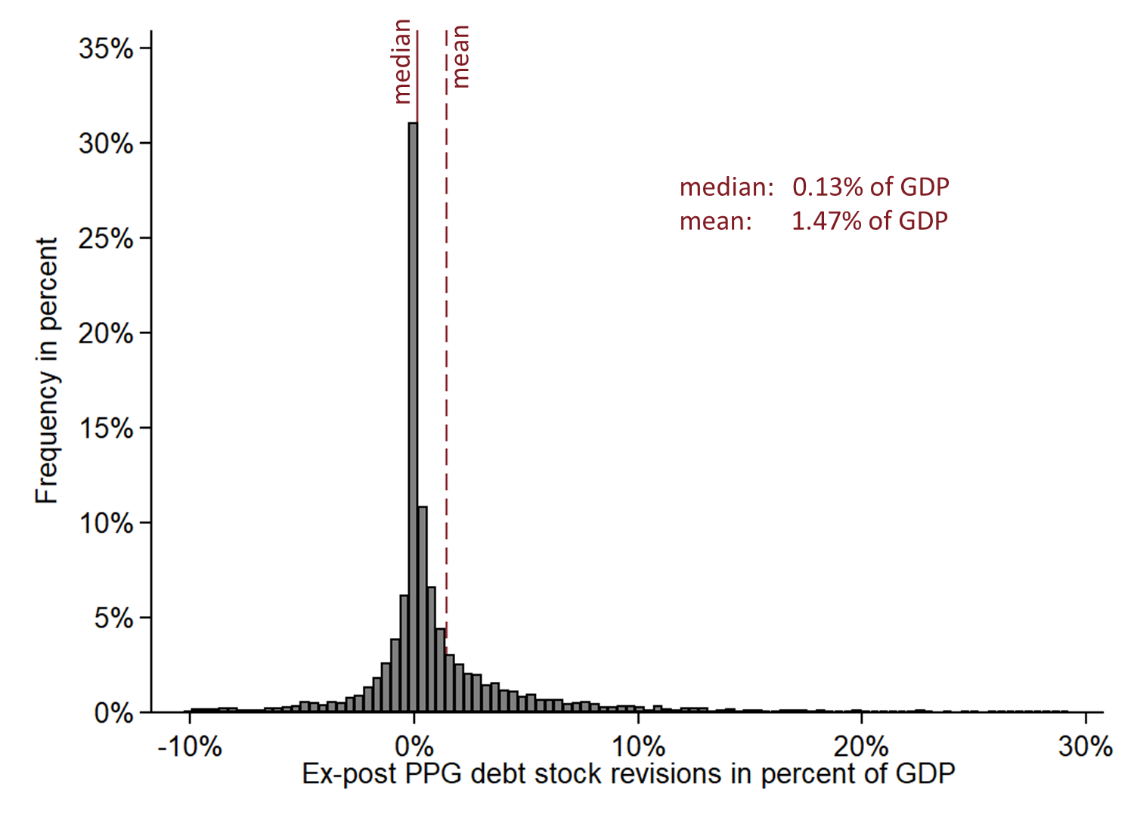

We show that underreporting of debt has been a long-standing issue. Ex-post revisions to debt statistics are frequent, systematically upward biased and can be very large (Figure 1). While the revision data is noisy, ex-post upward revisions of debt and loan data are twice as likely as ex-post downward revisions.[2] And while the median debt stock revision is close to zero (0.13 percent of debtor country GDP), the average revision is 1.47 percent of GDP and statistically highly significant. In other words, 'actual’ debt stock figures increased by an average of 1.47 percent of GDP between the time they were first published and the latest World Bank debt report.

Figure 1. Debt stocks tend to be revised upwards in hindsight

Note: This figure shows the distribution of cumulative ex-post data revisions to the public and publicly guaranteed (PPG) external debt stocks from 1970 to 2020 across different vintages of World Bank debt statistics (1979–2022). The cumulative ex-post revision is the difference between initial reporting and the latest reporting in percent of the debtor country’s GDP. The horizontal axis is truncated for readability. Revisions of commitment and disbursement data show very similar patterns of right skewness.

Our data and approach further allow to identify key characteristics of debt underreporting and revelation. At the debtor side, we find that high-risk, low-income countries with weak capacity are most likely to have their debt upward revised in hindsight. At the creditor side, we show that debts owed to commercial and bilateral creditors are most likely to experience upward revisions, whereas ex-post revisions of debts owed to bondholders or the World Bank and the IMF are very rare. This discrepancy confirms that non-marketable debt instruments from commercial banks and bilateral lenders are more prone to underreporting, since they are not traded in centralized markets and more likely to include confidentiality clauses (World Bank 2021; Gelpern et al. 2021).

Finally, we observe robust cyclical patterns of data revisions and hidden debt revelations (Figure 2). Underreporting of borrowing is most severe during boom years, whereas revisions of the data are more likely to occur during busts, e.g., in the aftermath of financial crises or in connection with IMF programs. This cyclical pattern has a counterpart in the over-optimism bias of growth forecasts that also tends to get more severe during boom years (Frankel 2011; Beaudry and Willems 2022). Underreporting of debt and overly optimistic growth forecasts reinforce each other in the context of debt sustainability analyses. If debt is underreported and future growth over-estimated, there is serious risk that early warning signals of debt distress are overlooked, and that fiscal policy planning is based on erroneous assumptions about the future dynamics of the debt-to-GDP ratio.

Figure 2. Hidden debt builds up in the boom, and tends to be revealed during the bust

Note: This figure shows binned scatter plots for the association between revisions of loan commitment data and real per capita GDP growth. The scatter plots show the average commitment revision for 20 equally sized bins of real per capita GDP growth.

Recent advances in World Bank IDS debt coverage

Debt data revisions in the past five years share many of the characteristics of past cycles. Official debt statistics underestimated the build-up of debt in numerous developing countries during the economic boom years following the 2008-2009 global financial crisis. As in past episodes, underreporting was particularly pronounced in low-income countries with weak governance and for debt owed to commercial banks and bilateral creditors. Increased borrowing through state-owned enterprises and special purpose vehicles, which typically have much more uneven reporting standards, importantly contributed to this accumulation of “hidden” debt (Horn, Reinhart and Trebesch 2021; Malik et al. 2021; Rivetti 2021; World Bank 2021).

The past five years have brought substantial improvements in the coverage of debt statistics and have shed light on large “hidden” debts. Our analysis of data revisions suggests that the past five IDS vintages have identified and added US$587 billion in previously unreported loan commitments. This amounts to more than 15 percent of the total outstanding debt stock of IDS-reporting developing countries in 2020. Newly identified loans were extended in almost equal parts by official creditors (US$271 billion; 46%) and private creditors (US$316 billion; 54%). The latest vintage alone, IDS 2022, added US$199 billion in loans to past statistics. This is the single largest increase in debt coverage in the entire 50-year history of the World Bank’s debt report publications.

Figure 3. Ex-post upward revisions of past commitment data have grown since IDS 2018

Note: This figure shows cumulative upward revisions of private and official loan commitments by IDS vintage. Example: IDS 2022 identified and added US$199 billion in loan commitments to statistics published in IDS 2021.

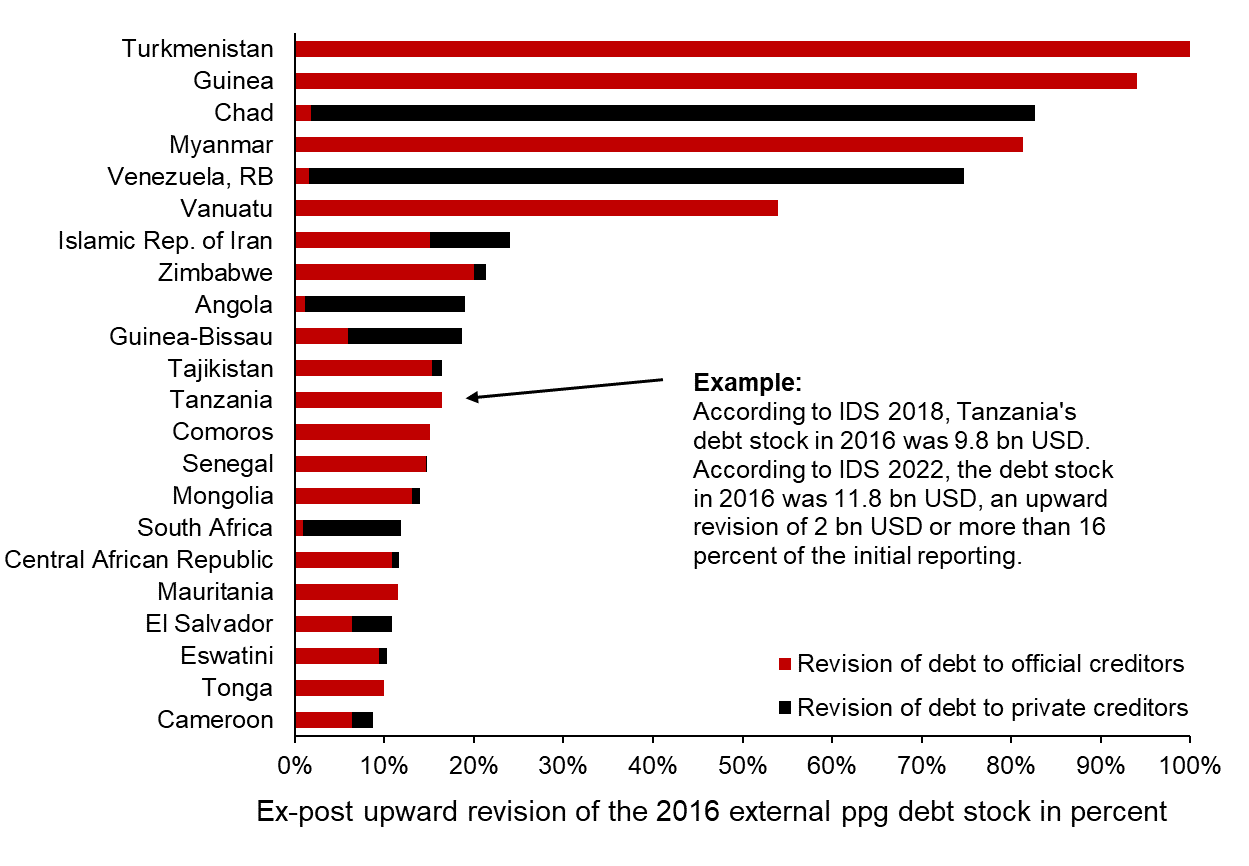

Coverage increases have occurred in a large number of developing and emerging market countries. Over the past five vintages, upward revisions of debt statistics occurred in more than 60 IDS reporting countries from all income brackets and regions.[3] On average, the public and publicly guaranteed external debt stock was revised upward by 5.3 percent over the past five IDS vintages. While in many countries these revisions were modest in size, in 20 countries, the upward revision was more than 10 percent of the initially reported debt stock (Figure 4). As in earlier episodes of underreporting, this group is dominated by low-income countries and countries with weak capacity.

Figure 4. Country ranking: the largest upward debt revisions since IDS 2018

Note: This figure shows the cumulative ex-post upward revision of external public and publicly guaranteed debt for the countries with the largest revisions over the past five IDS vintages. The debt stock in 2016 serves as the comparison year since it is the latest year available in all five vintages. The upward revision for Turkmenistan is 3200 percent of the initial debt stock and curtailed for readability.

Lessons from our research

The increase in IDS coverage reflects efforts by the World Bank to identify and close existing reporting gaps. These efforts include the use of external data to validate and complement debtor reporting, e.g., through creditor annual reports, market sources and the work by academic researchers, such as AidData, that are filling the void for creditors who do not report. Debt management offices in developing countries should also be given credit for advances in debt reporting. As research by Rivetti (2022) and the WB heatmap reveal, there is still a long way to go with regards to nationally published debt statistics. But more granular public debt data, such as the one Zambia’s authorities have published will allow to more closely track if any loans are missing.

Debt reporting needs to keep up with an increasingly complex borrowing landscape. The revisions we observe are in part driven by the addition of new debt instruments and expanding coverage of borrower entities. One such recent addition are central bank liabilities from swap lines or deposits that have become an important financing source in some developing countries (World Bank 2020). Despite the significant progress made in the coverage of debt stocks and flows, important knowledge gaps remain (Pazabarsioglu and Reinhart 2022). These include undisclosed lending terms such as collateralization (Mihalyi et al. 2022) and the “hidden default” problem, i.e., the lack of systematic data on credit events with non-bond external creditors (Horn, Reinhart and Trebesch 2022).

References

Beaudry, Paul, and Tim Willems. 2022. On the Macroeconomic Consequences of Over-Optimism. American Economic Journal: Macroeconomics, 14(1), 38-59.

Frankel, Jeffrey. 2011. Over-optimism in Forecasts by Official Budget Agencies and Its Implications. Oxford Review of Economic Policy, 27(4), 536-562.

Gelpern, Anna, Sebastian Horn, Scott Morris, Bradley Parks, and Christoph Trebesch. 2021. How China Lends: A Rare Look into 100 Debt Contracts with Foreign Governments. Peterson Institute for International Economics, Kiel Institute for the World Economy, Center for Global Development, and AidData at William & Mary.

Horn, Sebastian, Carmen M. Reinhart, and Christoph Trebesch. 2021. China’s Overseas Lending. Journal of International Economics, 133, 103539.

Horn, Sebastian, Carmen M. Reinhart, and Christoph Trebesch. 2022. Hidden Defaults. World Bank Policy Research Paper 9925.

Horn, Sebastian, David Mihalyi, and Philipp Nickol. 2022. Hidden debt revelations. Mimeo.

Malik, Ammar, Bradley Parks, Brooke Russell, Joyce Lin, Katherine Walsh, Kyra Solomon, Sheng Zhang, Thai-Binh Elston, and Seth Goodman. 2021. Banking on the Belt and Road: Insights from a new global dataset of 13,427 Chinese development projects. Williamsburg, VA: AidData at William & Mary.

Mihalyi, David, Jyhjong Hwang, Diego Rivetti and James Cust. 2022. Resource-backed loans in Sub-Saharan Africa. World Bank Policy Research Working Paper 9923.

Pazarbasioglu, Ceyla, and Carmen M. Reinhart. 2022. Shining a Light on Debt. IMF Finance & Development, March 2022.

Rivetti, Diego. 2022. Public Debt Reporting in Developing Countries. World Bank Policy Research Paper 9920.

World Bank. 2020. International Debt Statistics 2021. World Bank Group.

World Bank. 2021. Debt Transparency in Developing Economies. World Bank Group.

[1] All these reports rely on the World Bank’s Debtor Reporting System (DRS) which was established in 1951. Borrowing or guaranteeing member countries of the IBRD or the IDA need to agree to report detailed data on their long-term public and publicly guaranteed debt through the DRS.

[2] Ex-post downward revisions may result from underreporting of repayments or overestimation of disbursements. There are no valuation changes, as debt is recorded at its nominal value.

[3] This number is derived by counting all countries, in which the debt stock was upward revised by more than one percent of initial reporting. In an additional 18 countries, the debt stock was upward revised but by less than one percent of initial reporting. As for Figure 4, the debt stock in 2016 serves as the comparison years since it is the latest year which is available in all five vintages since IDS 2018. Results are similar if different base years are analyzed.

Join the Conversation