As emergency meetings of Heads of State to address the Euro zone crisis have seemingly become recurrent events, the crisis in the Euro zone lingers on stubbornly and might possibly become more serious with borrowing costs for Italy and Spain, reaching unsustainably high levels. As ever bolder proposals proliferate to put an end to the crisis, it is important to look back at the history of the crisis and try to identify its root causes. A working paper by Justin Lin and myself addresses this question and, in particular, the extent to which it was driven by the global financial crisis and by factors internal to Europe, notably the adoption of the common currency.

The crisis in Europe reflects primarily the reaction of financial markets to over-borrowing by private households, the financial sector and governments in periphery countries of the Euro Zone. In many analysts’ views, the European debt crisis—which led to economic adjustment programs sponsored by the EU and the IMF in Greece, Ireland and Portugal—was caused by fiscal profligacy on the part of noncore countries driven primarily by the expansion of a welfare state model and rising public sector wages. Proponents of this view argue that if countries had balanced their budgets and avoided the temptation to create a welfare state, excessive private spending would not have occurred and investors and banks would have been more aware of the risks involved. Consequently, noncore countries must adopt a realistic position regarding their fiscal policy stance and renounce their welfare objectives. The generalized commitment to fiscal discipline will allow Europe’s currency to regain strength, without further need for fiscal stimulus. Among European countries, Germany is a particularly strong proponent of the view that fiscal austerity is crucial to addressing the crisis, and under its influence, the G-20 Toronto summit in June 2010 established fiscal consolidation as the new policy priority.

However, our paper finds that, in the peculiar policy and regulatory environment of the Euro-zone, the adoption of the euro itself was a major factor in creating the conditions for the crisis and illuminates the mechanisms through which the common currency contributed to the crisis.

While the process of financial integration in the Euro- zone had been ongoing since 1957 and had gained impetus with the adoption of the Financial Services Action plan (FSAP) in 1999, it was the adoption of the Euro that led to a fully integrated financial market. Financial integration and the reduced risk of lending in non-core countries resulted in a sharp increase in cross-border capital flows with claims by core countries on non-core countries’ banking systems dominating the increase (Figure 1). Lending by German and French banks to non-core countries’ banks was by far the most important factor in this increase.

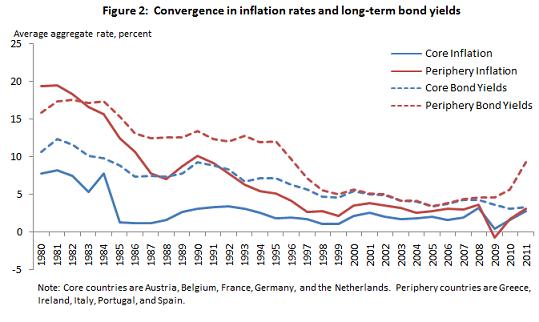

The elimination of the currency risk and the easier access to international capital markets that followed EMU membership led to convergence of interest rates in periphery countries to the level of core countries. The resulting fall in lending rates on commercial bank loans as well as on the cost of sovereign debt in periphery countries was perhaps the single most important effect of the adoption of the euro and had profound implications for the financial system in Europe and the structure of European economies (Figure 2). The sharp fall in interest rates led to a very significant increase in consumer lending; and in Ireland and Spain, and to an extent in Greece, much of it was channeled into real estate, leading to a real estate bubble. The increase in lending was also catalyzed by a parallel fall in interest rates in core countries reflecting the impact of financial deregulation.

The freedom of financial flows which moved throughout Europe and abroad, low borrowing costs, easy access to liquidity via leveraging as a result of growing lending from core banks to noncore banks, and no exchange rate risk provided a false sense of prosperity in a low-risk environment. The sense of prosperity was false because it was not matched by improvements in productivity or the business environment that would have laid the foundation for sustained long-term growth. In fact, the sudden abundance of financial flows in non-core countries resulting from the adoption of the euro exacerbated weak competitiveness that had already adversely affected these countries before the adoption of the common currency.

One of the factors contributing to this loss of competitiveness was the sharp rise in wages in non-core countries. Between 2001 and 2011 per unit labor costs in Greece rose by 33 percent, 31 percent in Italy, 27 percent in Spain and 20 percent in Ireland, while they grew by only 11 percent in the United States and by only 0.9 percent in Germany. Wage increases and growth in government spending in non-core countries led to large increases in aggregate demand and to an appreciation of the real exchange rate. The ensuing loss of external competitiveness led to a shift away from manufacturing sectors towards service and non-tradable sectors—a Dutch disease-type phenomenon.

At the heart of the euro debt crisis is an intra-area balance of payments crisis caused by seriously unbalanced intra-area competitiveness positions and the—largely private—accompanying cross-border debt flows. The common currency was central to this outcome with its impact on interest rates (both for sovereigns and for credit to the private sector), financial integration and the encouragement of export-led growth in core countries and consumption-led growth in non-core countries.

The investment and consumption booms were not without (temporary) benefits and led to a significant pick-up in growth in many periphery countries. In the aftermath of the global financial crisis, however, most European countries entered a recession and the bubble in the real estate market burst, leading to sharp increases in non-performing loans and subsequent government-financed bail-outs for the financial sectors. The increase in public debt resulting from these bail-outs was further compounded by the ballooning of government deficits resulting from the sharp fall in revenue as a result of the drop in output. Sharply deteriorated debt sustainability indicators and increased budget deficits led to a crisis of confidence in the financial markets and prompted the current sovereign debt crisis.

Further Readings:

Paradigm lost: The Euro in Crisis by Uri Dadush

The Euro Debt Crisis and Germany’s Euro Trilemma by Jörg Bibow

The unexpected global financial crisis : researching its root cause by Justin Lin and Volker Treichel

Join the Conversation