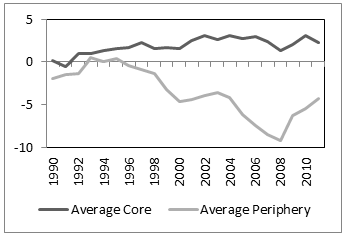

The Eurozone sovereign debt crisis, triggered by the 2008–09 global financial crisis, exposed macroeconomic imbalances in member countries that had accrued gradually following the advent of the euro in 1999. The growing current-account deficits in the Eurozone periphery and surpluses in the core were a main symptom of these imbalances (Figure 1).1 These patterns of intra-Eurozone current-account imbalances led to the accumulation of large external debts in the Eurozone periphery, matched by growing claims held by commercial banks in the core.

Figure 1. External current-account imbalances in the Eurozone core and periphery (% of GDP, 1990–2011)

Source: BPS database.

Two views of external imbalances in the Eurozone

What caused the external imbalances within the Eurozone is still an open question. One view emphasises domestic demand growth, spurred by financial integration, low interest rates, and the stronger potential for economic convergence that came along with the euro (Blanchard and Giavazzi 2002, Lane and Pels 2012). Another diagnosis focuses on the loss of competitiveness in the periphery, as a result of wage growth inconsistent with underlying productivity trends (Trichet 2011, Draghi 2012).

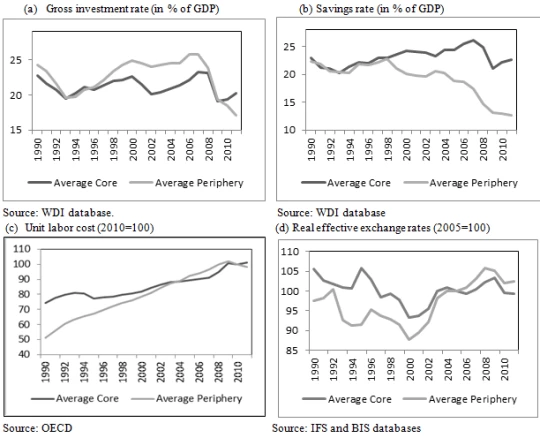

Evidence used to bolster the first interpretation focuses on the broadening gaps between investment and savings rates in the Eurozone periphery (Figures 2a and 2b). The steady growth in unit labour costs and the appreciation of real exchange rates in the periphery are meant to corroborate the second view (Figures 2c and 2d). The divergence of competitiveness within the Eurozone has been an increasingly popular theme in post-crisis policy debates (Sinn and Valentinyi 2013), although the performance of tradable goods sectors in the periphery was far from dismal (Gaulier et al. 2012).

In fact, the stylised facts associated with the Eurozone imbalances do not provide sufficient evidence to disentangle these interpretations. Indeed, one would have expected countries affected by credit booms to experience both external imbalances and worsening competitiveness, as a result of cost increases sparked by strong demand in non-tradable goods sectors. Whether the competing explanations have equal plausibility is an empirical matter that merits investigation.

Figure 2. Savings–investment imbalances and competitiveness gaps in the Eurozone core and periphery (1990–2011)

Methodology to track the drivers of external imbalances in the Eurozone

In a recent paper (Diaz-Sanchez and Varoudakis 2013), we assess the relative contribution of key factors potentially associated with external imbalances – through their impact on savings, investment, and competitiveness – using a panel-data Vector Autoregressive (panel VAR) model. In addition to the current-account balance, the VAR specification includes the real effective exchange rate, the real interest rate on long-term government bonds, the annual real GDP growth rate, and the per capita GDP of each Eurozone country in proportion to the average per capita GDP of the EU to approximate convergence effects. To assess robustness, the unit labour cost is also used as an alternative measure of competitiveness. The panel VAR makes it possible to identify the relative contribution of the factors playing a role in external imbalances. It does this by analysing their interaction as part of a multi-dimensional time series model, in which all the macro variables are endogenous. Accounting for endogeneity is desirable as the current-account balance and the real exchange rate (a key determinant of price competitiveness) are determined jointly.

The panel VAR was estimated for the Eurozone countries as a whole over different time periods, and for the Eurozone periphery and core country groups separately. The assessment relies on generalised impulse responses and generalised variance decompositions (Pesaran and Shin 1998). Unlike the more standard Cholesky decomposition of shocks, with the chosen methodology, the order of the variables in the model is irrelevant for the final variable responses.

Contributions to external imbalances in the Eurozone periphery and core

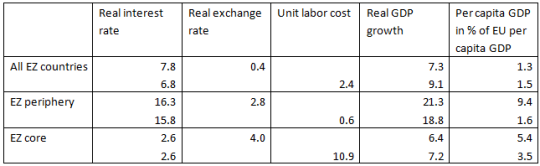

Some key empirical findings of the paper are summarised in Table 1 for the period 1996–2011.

Table 1. Percentage of variation in current account explained by column variable (panel VAR estimated over 1996–2011)

Note: For each country group, two model specifications were estimated, using alternatively the real exchange rate and unit labour cost as competitiveness measures.

•In the Eurozone as a whole, growth and real interest rate fluctuations have played a more prominent role than changes in competitiveness (measured by either the real exchange rate or unit labour costs) in current-account balance fluctuations.

•Growth and real interest rates have played a more important role in current-account dynamics in the Eurozone periphery than in the core. These two factors, combined with per capita GDP convergence, explain between 36% and 47% of current-account variation in the periphery, compared to around 14% in the core.

•Changes in competitiveness, measured by real exchange rates or by unit labour costs, have not been strongly associated with external imbalances in the Eurozone periphery, explaining at best 3% of current-account variation. Competitiveness changes, when measured by unit labour costs, account for a more important fraction of current-account variation in the Eurozone core, at par with GDP growth and real interest rates.

Policy implications

The findings corroborate the view that, up until 2008–09, the growing external imbalances in the Eurozone periphery were mainly driven by a domestic demand boom triggered by greater financial integration and the resulting surge in credit and intra-regional capital flows. The deterioration of the periphery’s competitiveness played only a minor role. Subsequently, severe growth contractions and the spike in real interest rates since 2009 have been associated with the periphery’s diminishing external imbalances.

Looking at the Eurozone core, favourable trends in unit labour costs have played a role in the emergence of current-account surpluses, possibly by enabling the core countries to take advantage of strong demand growth in emerging-market economies, especially in China (Chen et al. 2012).

At one level, the findings point to enhanced mutual surveillance of demand management policies – a step already taken by the Eurozone’s new fiscal compact – as a means of preventing imbalances from building up in a context of growing financial integration and easy finance. Tighter regulation of credit markets, including through macroprudential measures, might also be needed to thwart excess leverage and concentration of lending in investments prone to speculative bubbles. Fiscal policy coordination across the Eurozone would facilitate the management of external imbalances without placing an often unjustified burden in the form of fiscal tightening on countries with sound fiscal positions affected by credit booms.

At another level, the evidence suggests that the policies of internal devaluation implemented in the periphery, with the aim of boosting external competitiveness by curtailing labour costs, may have had only limited effectiveness in restoring the external balance to equilibrium. Internal devaluation may have certainly contributed to a contraction of domestic demand and, through this channel, may have helped absorb external imbalances in the Eurozone periphery. However, an unintended consequence of this correction has been a potentially large redistribution of income at the expense of wage earners in the periphery.

To be sure, improvements in external competitiveness matter and can boost real GDP growth, as evidenced by the impulse response functions of the panel VAR model. Structural reforms that improve the business environment and investments that enhance productivity hold the key to external rebalancing and stronger medium-term growth (Gill and Raiser 2012). This broader structural reform agenda, as well as complementary, productivity-enhancing public investments in physical and human capital, should not be lost from sight by the focus on labour cost competitiveness as a remedy to external imbalances in the drive to prevent future crises.

Authors’ note: The views expressed in this column are these of the authors and should not be attributed to the World Bank Group, its Executive Directors, or the Governments they represent.

References

Blanchard, O and F Giavazzi (2002), “Current Account Deficits in the euro Area: The End of the Feldstein-Horioka Puzzle?”, Brookings Papers on Economic Activity, 2: 147–186.

Chen, R, G-M Milesi-Ferretti, and T Tressel (2012), “External Imbalances in the euro Area”, IMF Working Paper 12/236.

Diaz Sanchez, J L and A Varoudakis (2013), “Growth and competitiveness as factors of Eurozone external imbalances: Evidence and policy implications”, Policy Research Working Paper 6732, World Bank.

Draghi, M (2012), “Competitiveness of the Eurozone and within the Eurozone”, Speech at the colloquium “Les défis de la compétitivité”, Paris, 13 March.

Gaulier, G, D Taglioni, and V Vicard (2012), “Tradable sectors in Eurozone periphery countries did not underperform in the 2000s”, VoxEU.org, 19 July.

Gill, I S and M Raiser (2012), “Golden Growth: Restoring the lustre of the European economic model”, World Bank, Washington DC.

Lane, P R and B Pels (2012), “Current Account Imbalances in Europe”, IIIS Discussion Paper 397, Trinity College, Dublin.

Pesaran, H and Y Shin (1998), “Generalized Impulse Response Analysis in Linear Multivariate Models”, Economics Letters, 58(1): 17–29.

Sinn, H W and A Valentinyi (2013), “European imbalances”, VoxEU.org, 9 March.

Trichet, J-C (2011), “Competitiveness and the smooth functioning of EMU”, Lecture at the University of Liège, 23 February.

--------------------------------------------------------------------------------

1 The ‘Eurozone periphery’ is defined to include the countries of the monetary union most affected by the sovereign debt crisis: Greece, Ireland, Italy, Portugal, and Spain. These are the largest net debtor countries in the Eurozone, although in some countries – particularly in Italy – the current-account deficits have not been excessive. The ‘Eurozone core’ countries are defined to include: Austria, Belgium, Denmark, Finland, France, Germany, the Netherlands, and Slovenia.

The above post first appeared in voxeu.org.

Join the Conversation