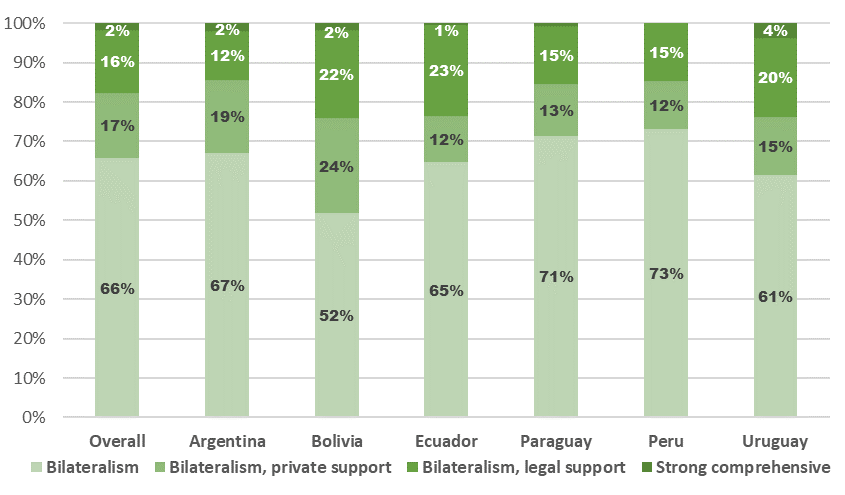

Figure 2: Cross-country Variation of the Mix of Governance Structures for Supplier-Relations

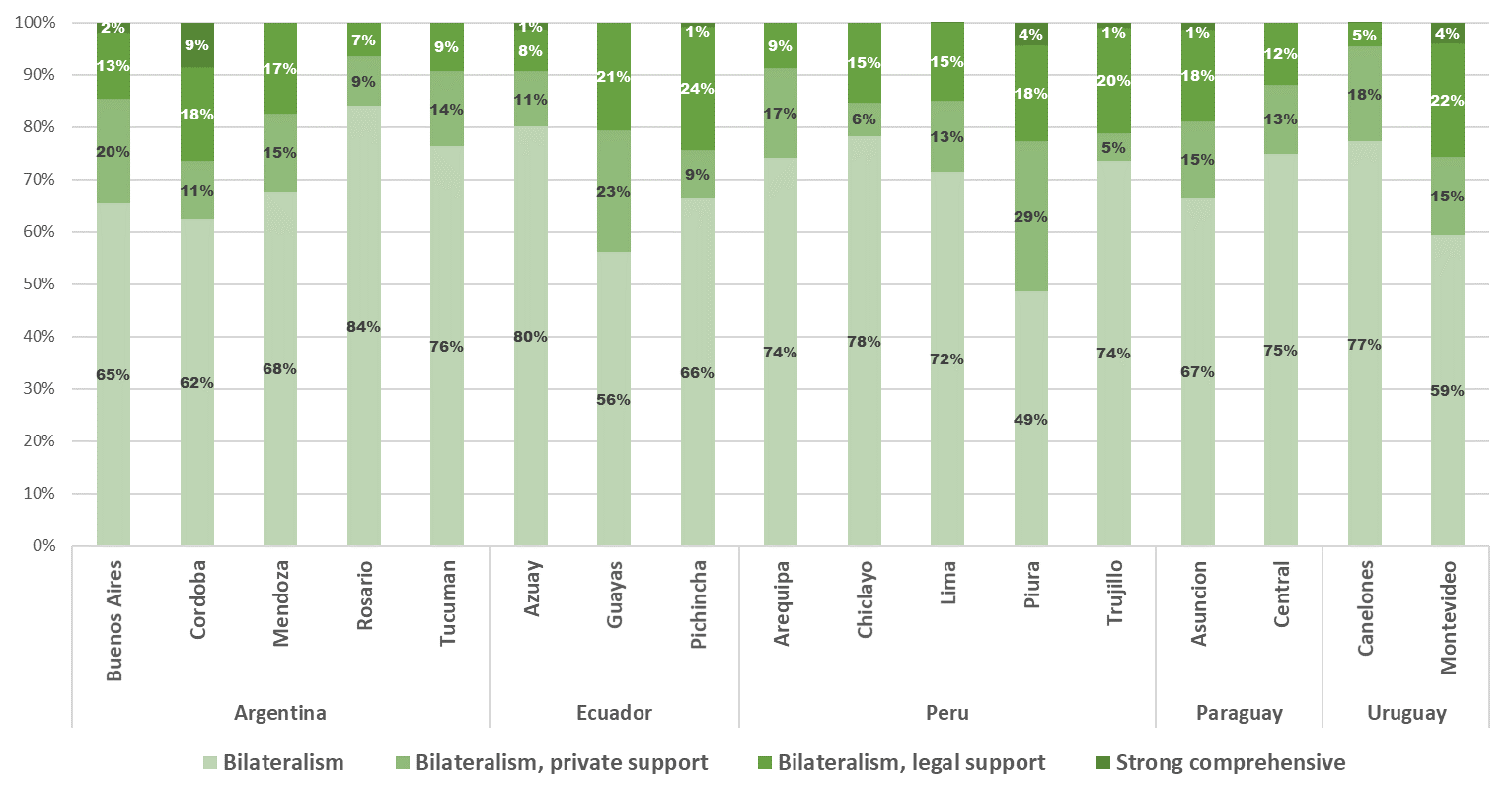

Figure 3: Within-country Variation of Governance Structures for Supplier-Relations

How do firms manage their relationships with other firms? More specifically, how do they ensure fulfillment of their agreements to buy and sell goods and services? To what extent do they rely on mechanisms such as trust, law, or third-parties? How do they combine such mechanisms to form transactional governance (as defined by Williamson 1979)? This blog introduces the first study that provides a systematic, cross-country, economy-wide analysis of these questions. The gap in the literature that this study fills is rather surprising given the longstanding consensus that economic development is associated with the effectiveness of arrangements for supporting business agreements (Williamson 1985; North 1990; Moran and Ghoshal 1999, Greif 2001). Furthermore, one of the key findings of the World Development Report 2020 is that firms participating in Global Value Chains are distinctly relational. In this blog, I summarize the aforementioned study, which focuses on firm-to-firm relationships in South America, and was co-authored by Peter Murrell, David C. Francis and myself (available here).

We designed new survey questions and added them to the Enterprise Surveys (ES) in Argentina, Bolivia, Ecuador, Paraguay, Peru, and Uruguay. A total of 3,430 business owners and top managers of nationally representative samples of firms were interviewed. (Full details of the survey methodology can be found at http://www.enterprisesurveys.org/methodology.) The questions, which are aimed at eliciting a comprehensive overview of the individual mechanisms of transactional governance, are as follows:

When making agreements with [suppliers][customers], please indicate to what degree each of the following is effective in resolving or preventing problems.

Respondents chose one point on the following Likert scale:

| Not at All | Slightly | Moderately | Very Much | Extremely |

We analyzed the resulting data using Latent Class Analysis (LCA), an exploratory statistical technique. LCA – without imposing any a priori presumptions – uncovered four classes or subgroups of firms, based on the combination of firms’ responses across the six individual mechanisms. The four estimated classes capture different strategies of managing firm-to-firm relationships, or more formally – transactional governance structures. As LCA does not impose any assumptions on the content of classes, the resulting structures could have had any shape, including even bizarre, unintuitive combinations of mechanisms. Instead, LCA gave us four governance structures that are meaningful and recognizable in the context of the existing literature, validating our survey questions as well as the statistical approach used.

In what follows, I first describe the four governance structures that were uncovered, focusing on relationships with suppliers, that is, B2B relations, highlighting how the features of these structures resonate with ideas in the literature. Next, I describe the variation in the use of governance structures across and within countries.

Uncovered Governance Structures

The nature of the four governance structures uncovered by LCA were recognizable enough to admit intuitive names. Namely:

Figure 1 depicts the properties of each class, showing why these names are appropriate.

Figure 1: Governance Structures for Supplier-Relations

| |

|

| Pure bilateralism |

Bilateralism with private support |

| Bilateralism with legal support |

Strong comprehensive governance |

A first observation is that all governance structures use bilateral enforcement mechanisms: no firm relies solely on a combination of third-parties and formal institutions. This raises questions about some claims made in the economics and business literatures that development is a process of escaping personalized interaction and moving to a rule-based, impersonalized set of interactions. We find no evidence of the existence of purely rule-based, impersonalized transactions. Put simply, all B2B interactions are at least partially relational.

Second, bilateralism and the legal system should not be viewed as substitutes. We do not find a case where a move from one class to another would involve a significant decrease in bilateralism simultaneously with a large increase in the use of the legal system. Notably, paid private dispute resolution and the legal system are sometimes substitutes and sometimes complements.

Third, the role of government officials in supporting transactional governance is at least as prominent as the role of non-paid private third-parties, which include networks. This calls for a re-evaluation of the amount of attention devoted to these governance mechanisms, since the former is almost entirely ignored while the latter receives much attention.

Governance Structures Across and Within Countries

Figures 2 and 3 illustrate variations in the use of governance structures across and within countries. This is a simple exploration of patterns in the data, without attempting to isolate causal effects of single variables. Darker shades of green denote governance structures that are more complex, that is, use more mechanisms more effectively. The first column of Figure 2 shows that pure bilateralism dominates, accounting for nearly two-thirds of governance structures in B2B interactions. This figure also illustrates the notable variation in the use of governance structures across countries, variation that is statistically significant.

To show the power of our methodology to generate new insights, consider Bolivia. Governance structures including more than just bilateralism are more effective in Bolivia than in all other countries. This is surprising. Bolivia is the least developed of the six countries and scores lowest on standard measures of the quality of the legal system. The greater estimated importance of legal institutions in the governance of agreements in Bolivia than in, say, Uruguay, is inconsistent with the latter country's much higher ratings on standard indexes of the quality of legal institutions. This is a puzzle, and one that could only be raised in an exercise like ours, which produced comparable cross-country data on all types of firms.

Figure 3 shows within-country variation in governance structures for those countries in which we find statistically significant regional variation. The prevalence of bilateralism varies enormously within countries. For example, firms in Rosario (in Argentina) are on average 22 percentage points more likely to use pure bilateralism in their relations with suppliers than firms in the neighboring region of Cordoba. Regions can even appear very different from their countries: Piura (in Peru) has the lowest level of pure bilateralism amongs any of the 17 regions in Figure 3, even though Peru has the highest level of pure bilateralism of the six countries in Figure 2.

Examining Figures 2 and 3, the conclusion is inescapable that within-country variation is even more important than cross-country variation. For example, the standard deviation of the percentage of bilateralism in Figure 3 is greater within the regions of each of Argentina, Ecuador, Peru, and Uruguay than it is across the countries in Figure 2. Even though legal systems are country-level institutions in the six nations we study, regions, rather than countries, might be the best unit of analysis for understanding governance.

Figure 2: Cross-country Variation of the Mix of Governance Structures for Supplier-Relations

Figure 3: Within-country Variation of Governance Structures for Supplier-Relations

In addition to cross-country and within-country variation, we also examine associations between governance structures and a number of firm characteristics. For example, we find that foreign-owned firms, exporters, larger firms, and better-managed ones are more likely to use governance structures that complement bilateralism with the legal system or with paid third-parties.

While study of variations in the use of governance structures is illuminating, our prime objective was to show the validity of the methodology, that is the survey questions and the analysis of the responses using LCA. We have provided datasets that allow researchers to go further than we have done, by linking our data to other ES variables, or by finding the governance structures of firms that they interview, if the interview simply included the six-part question given above.

Join the Conversation