A substantial literature exists that argues for the alleviation of barriers to imports in general. However, more recently the spotlight has been on the imports of intermediate inputs. The potential benefits from such imports include not just cheaper inputs based on the principle of comparative advantage of fixed costs in production, but also greater adoption of technologies embedded in foreign inputs and potential complementarities between foreign and domestic inputs. The suggested far-reaching rewards in alleviating import restrictions on intermediate inputs include greater private sector development and an eventual increase in economic growth. However, far less has been established regarding the relationship between such imports and their barriers. Can a negative relationship be ascertained, and what is the magnitude of such a relationship?

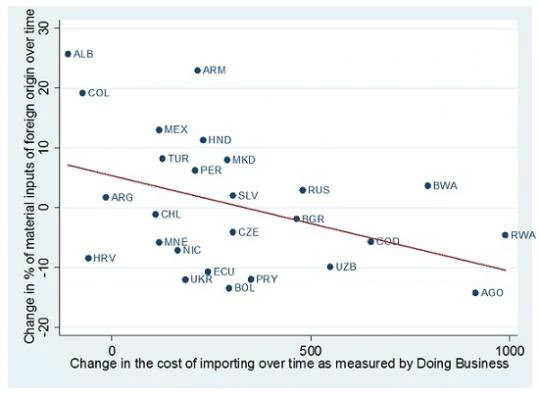

When my co-author and I embarked on the study of imports and import costs (forthcoming in Applied Economics Letters), we expected a rather straightforward negative relationship. We opted for firm-level data and thus used Enterprise Surveys for manufacturing firms in 26 developing countries between 2004 and 2011, culminating to a total of about 14,000 observations. The key survey variable was the enumeration of percentage of inputs of foreign origin. For our measure of import barriers we used the Doing Business measure of costs of importing, which is defined as the costs (in USD and for a standardized container) associated with all procedures required to import goods, including documents, administrative fees for customs clearance and technical control, customs broker fees, terminal handling charges, and inland transport. As you can see below, we obtained the relationship we expected.

However, the twist in the tale arose when we explored potential non-linearity in the data. The basic idea is whether the relationship between import costs and imports varies by the degree of import costs prevailing in the economy. What we found is quite interesting – the relationship between imports and import cost is stronger (more negative) for economies with low import costs, and weaker (less negative) for economies with high import costs. For example, a unit increase in import costs reduces the share of imported inputs by 0.025 percentage points at the highest value of import cost in our sample and by 0.037 percentage points at the lowest value of import cost. What could explain this? Unfortunately we cannot make any claims with full certainty, but we believe two possibilities may account for the bulk of the explanation. One, when the import cost is high, it may be the case that firms import proportionately more essential inputs and thus any further increase in import costs has relatively lower effects on imports. The other reason concerns fixed costs. It may be that the fixed costs of increasing imports imply a substantial reduction in the cost of importing before imports can increase. That is, with high levels of fixed costs, high import costs may decrease the flexibility of the firm to import. However, low import costs may bolster firms’ ability to overcome fixed costs and thus have a greater capacity to increase imports.

Our findings are unique given the combination of data sources, and the potential non-linear relationship uncovered. Both these findings should assist in informing trade policy design. However, this is only a starting point and a number of interesting issues concerning imports of intermediate inputs remain to be explored. For example, how does “remoteness” of a country affect its imports of intermediate inputs vs. those of consumption goods? What about behind the border measures related to, for example, transportation and government subsidies in how they affect these two types of imports? These and other such questions offer a rich agenda for future research.

Join the Conversation