Download the January 2018 Global Economic Prospects report.

Global growth accelerated to 3 percent in 2017, supported by a broad-based cyclical recovery encompassing more than half of the world’s economies, and is expected to edge up to 3.1 percent in 2018. Global trade regained significant momentum, supported by an upturn in investment.

As headwinds ease for commodity exporters, growth across emerging and developing economies is expected to pick up. However, risks to the outlook remain titled to the downside, such as the possibility of disorderly financial market adjustment or rising geopolitical tensions.

A major concern in the subdued pace of potential growth across emerging market and developing economies, which is expected to further decline in the next decade. Structural reforms will be essential to stem this decline, and counter the negative effects of any future crisis that could materialize.

The broad-based recovery should continue

Global growth accelerated markedly in 2017, supported by a broad-based recovery across advanced economies and emerging market and developing economies (EMDEs), and it is expected to edge up in 2018.

Growth

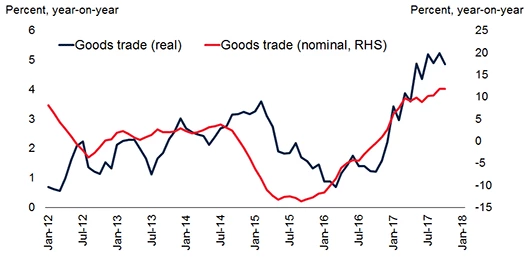

Global trade has gained momentum

Amid a recovery in global manufacturing and investment, global trade accelerated substantially, supporting export growth in most emerging market and developing economy regions.

Global goods trade growth

Headwinds in commodity-exporting EMDEs have eased

As headwinds eased in commodity-exporting emerging market and developing economies, investment and activity bottomed out. Several large economies—including Brazil, Nigeria, and Russia—emerged from recession in 2017.

Investment growth in commodity-exporting EMDEs, by region

Global financing conditions remain benign

Despite prospects of further monetary policy normalization in advanced economies, global financing conditions remain benign, which has been supporting strong demand for emerging market and developing economy assets and continued capital inflows to emerging market and developing economies.

Capital inflows to EMDEs

The near-term EMDE outlook is solid

In a favorable international economic environment, as the recovery in global investment and trade continues and as commodity prices firm, the near-term outlook for emerging market and developing economies is solid. Growth in emerging market and developing economies is expected to pick up over the forecast horizon, as commodity exporter growth accelerates and activity in commodity importers remain robust. However, per capita income is expected to remain subdued in commodity exporters.

EMDE growth

However, the outlook is subject to various downside risks, such as disorderly financial market movements…

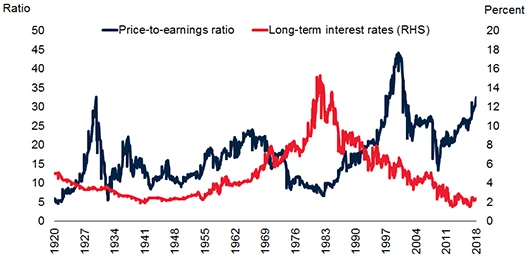

The outlook remains subject to various downside risks. A critical one is the possibility of disorderly financial market adjustments, given that asset valuations are elevated and interest rates at historical lows.

U.S. equity prices and long U.S. interest rates

… as well as rising policy uncertainty and geopolitical tensions

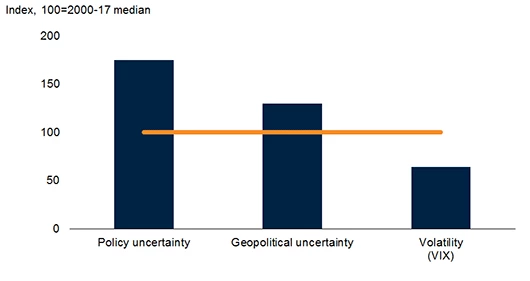

Although global policy uncertainty has moderated recently, it remains elevated, while geopolitical risks are also above historical norms. In addition, financial market volatility is unusually low and could spike.

Global economic policy uncertainty, geopolitical risks, and financial market volatility

EMDEs have limited policy space to counter negative shocks

Amid persistent downside risks to growth, emerging market and developing economies face substantial policy challenges, including limited fiscal space—particularly among commodity exporters—to counter negative shocks.

Fiscal sustainability gaps in EMDEs

Slowing potential growth among EMDEs is a major concern

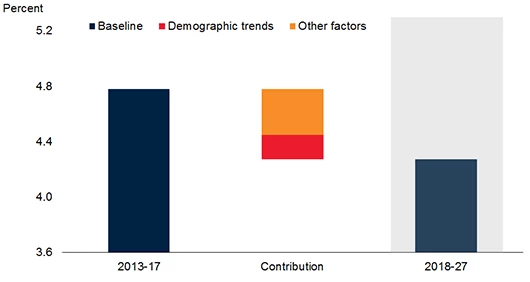

Particularly worrying are longer-term risks and challenges associated with subdued potential growth—the rate at which an economy can expand using its full capacity. This is expected to further slow in the coming decade across emerging market and developing economies, with negative implications for improving living standards and alleviating poverty.

EMDE potential growth

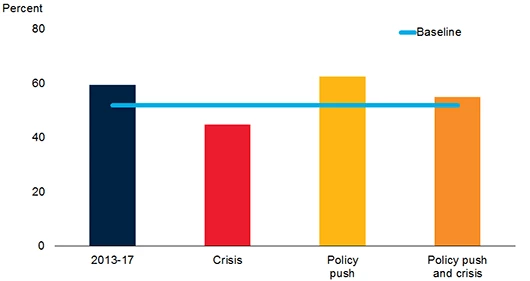

Absent reforms, a crisis could exert substantial costs

If there is an economic or financial crisis in the next decade, as is historically the norm, the already weakening outlook for potential growth would degrade even further. This highlights the urgency of pursuing structural reforms that boost long-term growth. A sustained policy push may even lift potential output above current levels, and could offset the effects of a crisis should one materialize.

EMDE cumulative potential output change, 2018-27

Join the Conversation