Globally, around 2 billion people do not use formal financial services. In Southeast Asia, there are 264 million adults who are still “unbanked”; many of them save their money under the mattress and borrow from so-called “loan sharks”, paying exorbitant interest rates on a daily or weekly basis. Recognizing the importance of financial inclusion for economic development, the leaders of the Association of South East Asian Nations (ASEAN) have made this one of their top priorities for the next five years.

Last week, the World Bank Group presented the latest data on financial inclusion in ASEAN to senior representatives of the ministries of finance and central banks of all 10 ASEAN member countries (Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam). The session, held in Kuala Lumpur, is one of the joint activities the new World Bank Research and Knowledge Hub and Malaysia is undertaking to support financial inclusion around the world.

For ASEAN countries, levels of financial inclusion are not homogeneous. While Singapore, Malaysia, Thailand, and Brunei Darussalam have achieved almost universal financial inclusion, other countries in ASEAN still face various challenges. Here’s a snapshot of some of the major challenges according to the 2014 Global Findex:

-

Low levels of account ownership

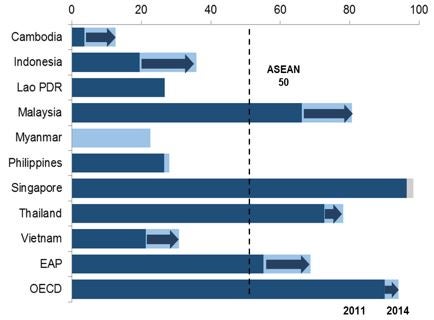

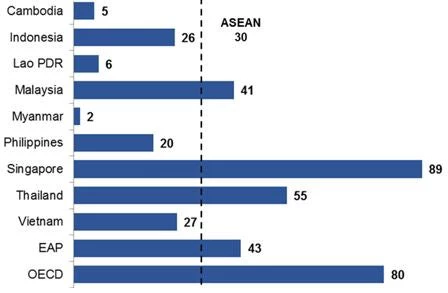

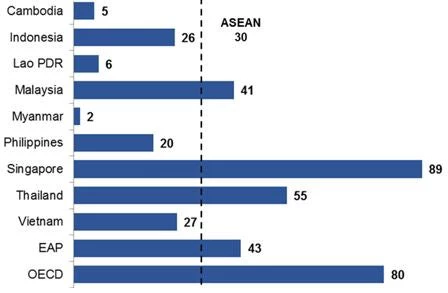

Currently, only 50% of adults in ASEAN have an account at a financial institution. ASEAN is discussing a specific financial inclusion target for 2020. There is a consensus to set the target at around 70% for 2020.

Rates of financial “exclusion” are higher among the poor, those living in rural areas, and those who are less-educated. Interestingly, neither gender nor age are relevant factors that explain financial exclusion in ASEAN countries.

Adults with an account (%)

Rates of financial “exclusion” are higher among the poor, those living in rural areas, and those who are less-educated. Interestingly, neither gender nor age are relevant factors that explain financial exclusion in ASEAN countries.

Adults with an account (%)

-

Wage payments made mostly in cash

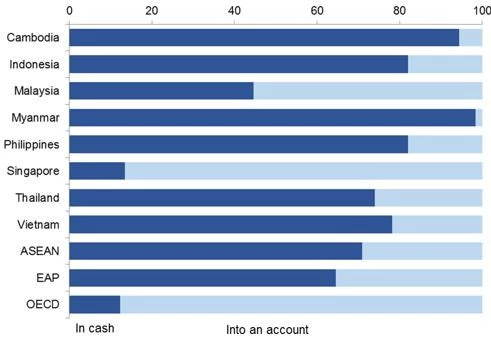

In ASEAN countries, only 29% of workers reported receiving their monthly salaries through an account from a financial institution, while the remaining 71% is paid in cash by their employers. Paying salaries in cash can be risky for employers and workers alike. In contrast, making salary payments directly into the accounts of workers at financial institutions is safer and can help workers not only save their money in a safer manner, but also build their credit histories to access new type of services, such as consumer credit, mortgages, education loans, insurance products, etc.

The group discussed the urgent need to take actions to digitize payments conducted by government institutions and private sector enterprises, while ensuring customers are not charged excessive fees or misled by financial institutions.

Adults receiving wage payments by method (%)

The group discussed the urgent need to take actions to digitize payments conducted by government institutions and private sector enterprises, while ensuring customers are not charged excessive fees or misled by financial institutions.

Adults receiving wage payments by method (%)

-

Low levels of debit and credit card penetration

In ASEAN countries, only 30% of adults reported having a debit card and 9% reported having a credit card. Cash is still used extensively, even by people that already have bank accounts.

Adults with a debit card (as % of all adults)

Adults with a debit card (as % of all adults)

The road ahead

Demand for financial services will rise as economies continue to grow and more people move into the middle class. One of the immediate actions to accelerate financial inclusion is to digitize all government payments (wages, social transfers, and payments to suppliers). This action alone would bring millions of people into the formal financial system in ASEAN countries.

A second possible action is to formalize remittance flows. In ASEAN countries, a large volume of domestic remittances is still cash-based. The challenge is to channel more remittances transactions through financial institutions, money transfer operators or mobile phone operations, so that the 52% of adults who reported sending remittances in cash shift to safer and cheaper ways to do so in their home countries.

For more information, download the Financial Inclusion in ASEAN presentation or visit the World Bank financial inclusion website.

Join the Conversation