seamstress clothing industry embroidery industrial embroidery sewing machine

seamstress clothing industry embroidery industrial embroidery sewing machine

A native of Visakhapatnam on India’s southeastern coast, Pavani has witnessed the dramatic changes foreign investment can bring. She was the first employee hired in 2008 when Sri Lankan firm Brandix Lanka Limited opened an apparel factory near the city. Since then, Pavani has risen to become Senior Executive in charge of training for the plant’s 2,000 workers.

Although the state of Andhra Pradesh is India’s third-largest cotton producer, apparel manufacturing was slow to get started until Brandix Lanka Limited arrived. Now, an entire industrial park devoted to textiles and apparel employs thousands of local women, reducing poverty, stimulating exports, and encouraging new investment from inside and outside the region.

For Brandix, the investment reflected a willingness to venture into an environment that other firms may have perceived as risky, based partly on historical family ties with India. Another factor was the state government’s active courting of Brandix with a strong business case for creating an apparel park in Visakhapatnam. The project was ultimately implemented as “Brandix India Apparel City”, a public-private partnership with Brandix, the Andhra Pradesh government, and India’s central government. Today, it is an innovative and thriving facility that employs about 20,000 people.

This transformative investment highlights the potential of intraregional investment to stimulate trade, attract further investment, and enhance the flow of information and network formation. The latter is known as knowledge connectivity – how well firms know the economic and investment environment in another country. Capturing and sharing formal and informal knowledge is highly valued by companies to help them operate more efficiently and make investment decisions. Better knowledge connectivity reduces the cost of doing business in a country.

A portrait of intraregional investment

Our new report, Regional Investment Pioneers in South Asia: The Payoff of Knowing Your Neighbors, builds a comprehensive portrait of investment in the region.

Intraregional investment is small in South Asia. Worth $3 billion in 2017, intraregional investment stocks accounted for only for 0.6 percent of inward foreign direct investment (IFDI) from the world, and 2.7 percent of outward foreign direct investment (OFDI) to the world.

Nevertheless, there are encouraging signs of growth in intraregional investment in South Asia. Various types of investments are emerging. For example, businesses with small volumes of trade may invest in liaison offices, and investments are also occurring in service operations and production.

Investments from smaller nations are growing although Indian investment remains large. Our report captures companies’ gradual approach to investing in the region, where firms learn from their prior experience as exporters, or initially invest in less expensive forms of investment.

Knowledge connectivity at the forefront

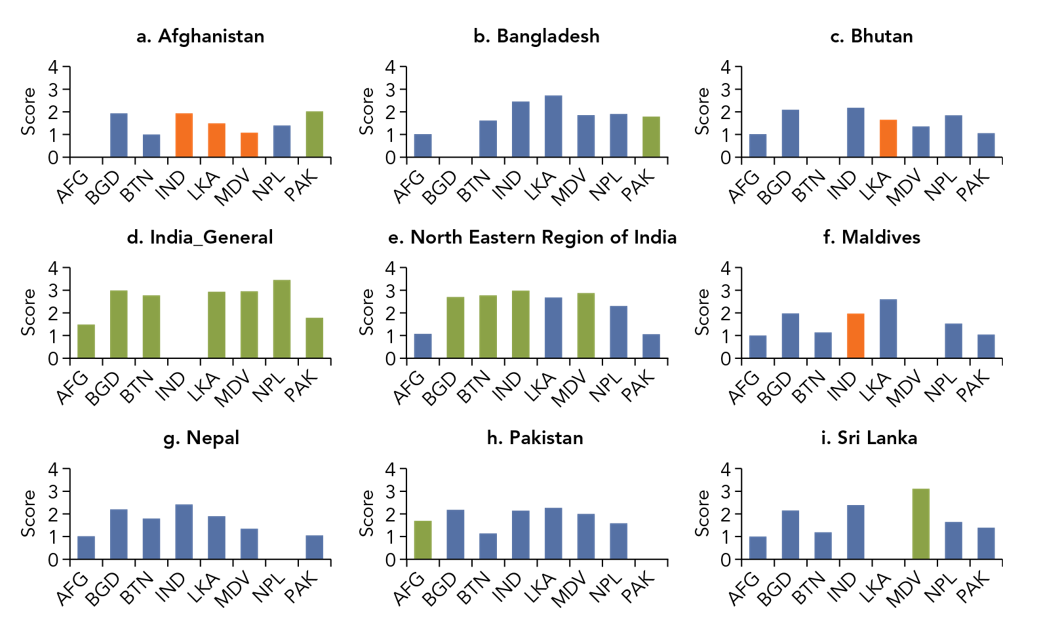

Our research also captures for the first time an indicator of knowledge connectivity for pairs of countries in the region. Overall, South Asia has low and polarized knowledge connectivity. On a scale of 1 to 4 (where 4 reflects the highest level of knowledge) the average bilateral knowledge connectivity score for South Asia is 1.9, falling between ‘not at all’ and ‘not very well’ informed.

The figures below show private sector individuals’ knowledge about business opportunities in each South Asian nation. The height of the bars reflects knowledge connectivity -- larger bars show greater knowledge. Constraints on the flow of business information, limited networking, and bilateral mistrust reflect the high costs for a firm to search, match and contract across borders.

The figures also indicate the private sector tends to know more about nearby neighbors, and less about other countries in the region. For example, the figure for Sri Lanka indicates that Maldives’s private sector (green bar) knows significantly more about opportunities in Sri Lanka than it knows about other countries. On the other hand, the figure for Maldives shows India knows less (orange bar) about Maldives relative to how much India knows about other countries. Similarly, Bhutan is significantly less known to the Sri Lankan private sector compared with the latter’s knowledge of other countries.

Limited knowledge connectivity in South Asia, by destination:

Investment pioneers are well-connected

Higher knowledge connectivity can lower costs of doing business across borders and facilitate international entry of firms. Survey data from 1,274 investment pioneers confirm the importance of information and networks for investment decisions. For services firms weighing potential investments, the presence of a social or ethnic network is a more important factor than productivity improvements.

Because firms’ international strategies typically involve trade, IFDI, and OFDI, we recommend that policymakers:

- Support knowledge connectivity initiatives to help intraregional investment and trade. Examples include support for business associations, industry meetings, match-making events, investment missions abroad, and cross-border women’s networks. These interventions can make investment more inclusive, through providing opportunities to smaller and less socially connected firms.

- Relax OFDI regimes in a progressive manner, both from a competitiveness perspective and the need to be agile during the COVID-19 pandemic and beyond. For example, trade-supporting outward investments with low start-up costs are crucial for Bangladeshi apparel manufacturers to improve access to global buyers.

- Implement smart IFDI promotion strategies and investment facilitation. Small economies may find it practical to target affiliates of global firms in regional hubs that have already incurred high entry costs to invest in the region. They can also target traders and businesses for investments in the form of technology licensing and contract manufacturing.

- Enhance digital connectivity to reduce trade costs and increase investment and trade flows.

Despite COVID-19 related setbacks, South Asia is likely to return to being one of the fastest-growing regions. It could grow even faster with more intraregional economic engagement. We hope firms and policymakers will support deeper investment and trade within the region to empower business growth, create jobs, and build an environment for more trusting bilateral relationships.

The report, Regional Investment Pioneers in South Asia: The Payoff of Knowing Your Neighbors, received funding from the Program for Asia Connectivity and Trade, a trust fund supported by the United Kingdom’s Foreign, Commonwealth and Development Office.

Join the Conversation