E-commerce is enabling small firms transcend the constraints of local markets. Photo: NEERAZ CHATURVEDI/Shutterstock

E-commerce is enabling small firms transcend the constraints of local markets. Photo: NEERAZ CHATURVEDI/Shutterstock

Tasmia runs a small bakery in Dhaka, Bangladesh. She delivers fresh baked goods daily to a nearby grocery store. Her products are selling well, and Tasmia wants to expand her business. But convincing grocery stores in distant neighborhoods to stock her products and delivering them to those stores daily would entail large upfront investments. As a small informal entrepreneur, Tasmia does not have access to the funds needed to make such investments.

A new opportunity arises: Tasmia is approached by an online retailer who likes her product. After helping her get the necessary licenses, the retailer’s website begins to feature her products. Now, Tasmia can sell directly to customers throughout the city by delivering her products to a single sourcing hub. Her products do well and in time, she is able to afford the website’s premium advertising services, helping her gain even more customers and grow much more than she could ever have by working with brick- and-mortar grocery stores.

Stories such as Tasmia’s may become increasingly common in South Asia. The fact is, e-commerce is enabling small firms transcend the constraints of local markets, as our latest South Asia Economic Focus, Shifting Gears: Digitization and Services-Led Development, shows.

Explosion of e-commerce across South Asia

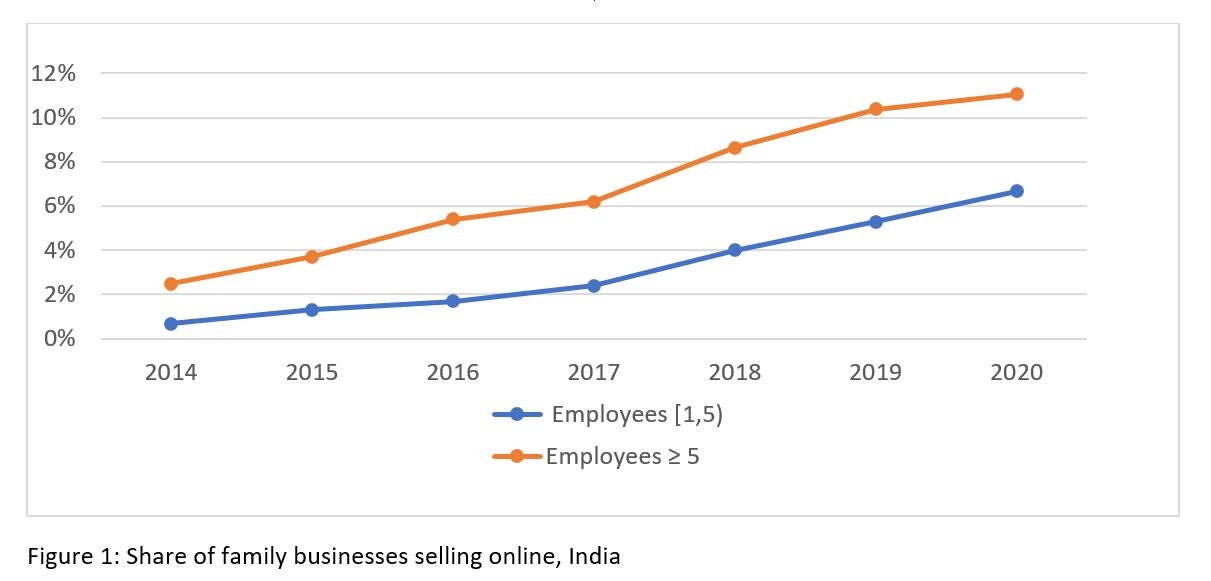

Most firms in South Asia are tiny, informal, and family run, even after decades of rapid economic growth. These firms sell locally and continue to use traditional technologies and business practices (“Informality in South Asia”, Bussolo and Sharma, a forthcoming World Bank publication). But in recent years, the spread of e-commerce has begun to change how many of these firms operate. For example, in 2014, only 2.5 percent of family-run Indian firms with five or more hired workers were using online sales channels. By 2020, this share increased to 11 percent. Even family businesses with less than five workers saw a rapid increase in the usage of online sales channels.

The growing use of e-commerce services by small firms to sell their product may become central to the services-led growth prospects of South Asia. This trend has likely accelerated with the growing consumer adoption of e-commerce precipitated by the COVID-19 crisis. In Bangladesh, for example, total e-commerce revenues increased by 70-80 percent in the space of a few months during 2020.

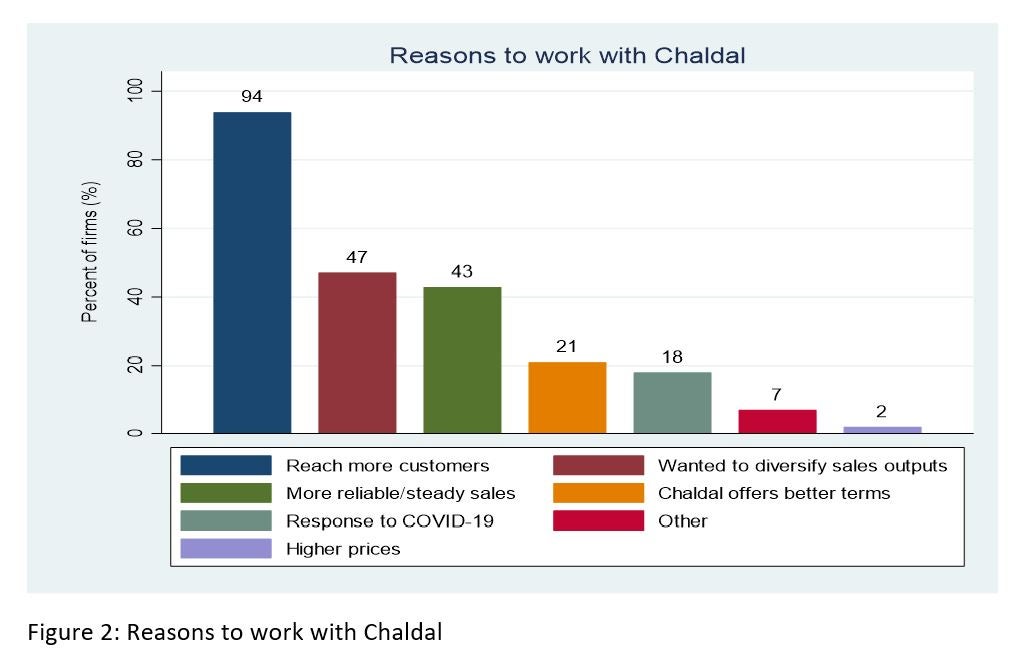

Our survey of sellers on the Bangladeshi e-commerce platform Chaldal, which specializes in groceries, brings new evidence to bear on this important issue (“How Selling Online is Affecting Informal Firms in South Asia”, Bussolo et al., a forthcoming World Bank publication). As illustrated by the vignette of Tasmia’s bakery, firms join e-commerce platforms mainly to gain better market access. When firms selling on Chaldal were asked why they joined the platform, 94 percent of the respondents stated it was to reach more customers. The next two reasons for joining the platform were also about getting access to more diverse and reliable sources of demand: to “diversify sales outlets” (47 percent) and to get “more reliable or steady sales” (43 percent).

Besides helping the firm gain access to a larger market, platforms such as Chaldal also help:

- Build consumer trust and ultimately create branding through customer ratings of sellers and strategies such as liberal product return policies

- Provide secure digital transactions

- Put small businesses on the path toward modernization and formalization, a goal that business formalization programs have struggled to achieve (See a World Bank Policy Research Working Paper on this issue). A firm may be more willing to adopt new practices and comply with regulations if doing so is necessary to access the e-commerce market.

A word of caution…

Despite the findings above, not all firms may be able to reap the benefits of e-commerce.

A finding from the Chaldal survey should give pause: the firms selling on these platforms are atypical. Their managers have above-average education and asset levels, and they are also younger in age. For example, 79 percent of owners/managers of businesses selling on Chaldal have a BA or higher degree. The average for the manufacturing sector is only 55 percent.

Perhaps this is because many entrepreneurs in the informal sector lack access to digital infrastructure. Others may not have the know-how to be successful in selling online. Tellingly, some artisanal producers who had signed on to Chaldal had to drop out because they failed to achieve compliance with Chaldal’s regulatory and packaging standards despite the platform’s advice on these matters.

Governments in South Asia are excited about the potential of e-commerce, and our findings in Shifting Gears on how it is expanding market access for firms show why. At the same time, there is a concern that informal firms will be polarized into those able to thrive in the digital marketplace and eventually formalize, and those whose livelihood is threatened by competition from e-commerce.

This underlines the importance of providing access to digital infrastructure and training which could help small business owners become more capable of leveraging e-commerce. It is also important to extend social protection to the informal sector so that it becomes less vulnerable, can face more risks and, ultimately, be more growth oriented.

This blog is part of a series centered around the latest edition of our South Asia Economic Focus (SAEF)- Shifting Gears: Digitization and Services-Led Development.

Join the Conversation