Illustrated Pakistani rupees along with lightbulb, rocket, and machinery

Illustrated Pakistani rupees along with lightbulb, rocket, and machinery

Anyone who works on Pakistan or follows the country in the news is aware of the country’s growth dilemma. Growth has remained low and sporadic. While there are several factors that have prevented the economy from growing at the rate required to create jobs for the millions of people entering the labor force every year, one key stumbling block has been access to finance. Finance is required for public and private investment which is needed to power economic growth. The importance of investment, and in particular private investment, for growth is highlighted by the fact that low levels of private investment in Pakistan limit its growth potential to between 2.5-3% per annum.

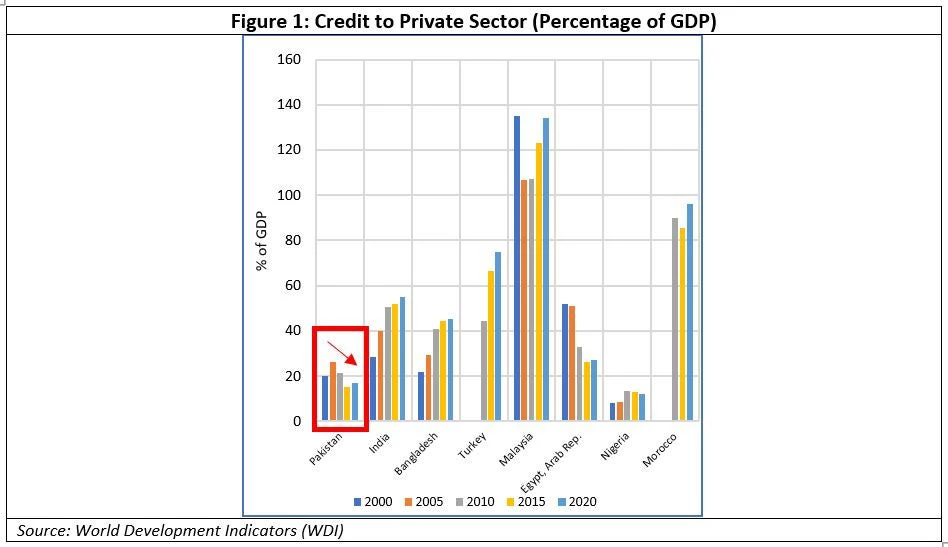

The importance of finance for investment and growth implies that the financial sector is central to the growth agenda in Pakistan. And yet, Pakistan’s financial sector has under-delivered on its role as a financier of growth and as an intermediary of capital to the private sector. This is not to say that the financial sector has not grown and developed in recent years. Quite the contrary, as the financial sector in Pakistan has undergone significant structural shifts in recent years to become larger, more innovative, and efficient. We have seen the emergence of new and innovative financing mechanisms and vehicles such as real estate investment trusts, private equity funds and housing finance companies, all of which are changing the ways the financial sector operates. The problem, however, is that compared to its peer economies, Pakistan’s financial sector remains small and plays only a minor role in financing the private sector.

The one metric which showcases the current state of affairs is credit or loans to the private sector as a percentage of GDP. While credit to the private sector in Pakistan has increased in recent year in absolute terms with more rupees being funneled to the private sector, it has declined as a percentage of GDP, from a high of 29 percent in 2008 to 17 percent in 2020. Credit to the private sector in Pakistan is also significantly lower than Pakistan’s comparator economies such as India, Bangladesh, Malaysia, and Egypt.

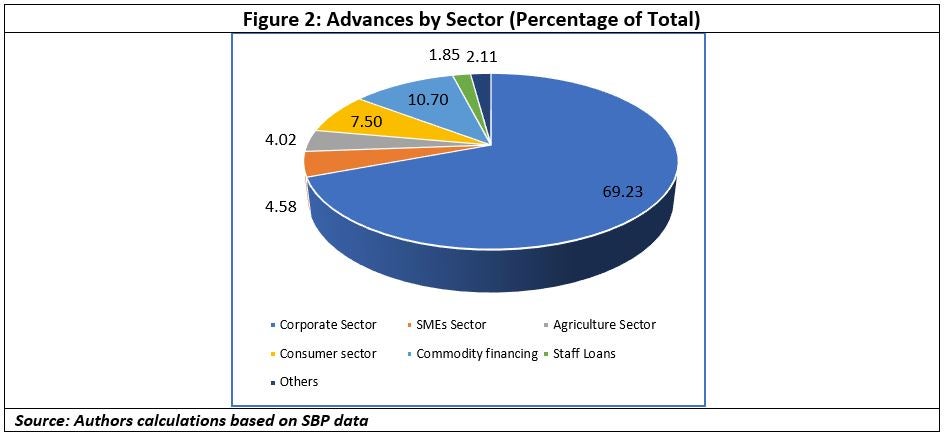

The little credit that is going to the private sector also remains significantly concentrated and short term in nature. The corporate segment accounts for close to 70 percent of the loan book of banks and this share has been trending upwards in recent years. What this means is that other critical segments and sectors of the economy such as the Small and Medium Enterprises (SMEs) and the agriculture sector, despite accounting for a sizable percentage of the GDP and jobs, remain deprived of financing. This is financing that private firms in these sectors require to invest, to grow, to create jobs and to increase their productivity.

Credit to the SME sector accounted for only approximately 6.3 percent of total private sector financing in June 2021, catering to the financing needs of only 172,893 SMEs, slightly lower than a decade earlier. At less than 1 percent of GDP, SME financing also pales in comparison to Pakistan’s peers. Similarly, while Agriculture financing has grown remarkably in recent years and achieved a major milestone of PKR1 trillion in disbursements in 2019, it is currently catering to the needs of less than 25 percent of the agricultural households in the country as per the Pakistan Agriculture Census 2010. Outstanding agriculture finance also only accounts for just 5.6 percent of private sector financing, a trivial amount for a sector which accounts for close to 20 percent of GDP and over 40 percent of the jobs in the country.

What is preventing the financial sector from financing the private sector in Pakistan?

There is no one reason. The status quo is the outcome of a complex interplay of factors both on the supply side or the financial sector and the demand side, which includes individuals, households and firms that borrow from the financial sector.

The single biggest impediment on the supply side is government borrowing. Credit extended by the banking sector to the government has surged by 442 percent over the period FY11-21, crowding out credit to the private sector. The rapid expansion in the financing of the government has led to credit to the government accounting for 66.8 percent of all the credit extended by the banking sector as of December 2021. On the demand side, a large informal sector has been a major impediment. A large informal sector means that most of the households, individuals and firms in Pakistan don’t have the documentation they need to access the financial sector. These economic agents instead rely on internal financing or informal financing which is typically extended at exorbitant interest rates.

The structural impediments to the enhanced flow of finance to the private sector require concerted efforts by the government, regulators, and stakeholders to resolve. The solutions to many of these challenges are complex and necessitate a whole-of-system approach. Reducing the Government’s dependence on borrowing from the financial sector to free up resources for the private sector, for instance, requires a reduction in the fiscal deficit. This in turn requires greater resource mobilization and expenditure consolidation measures. Greater formalization, similarly, requires a reduction in the regulatory burden and upgrade of firm capabilities, among other things. The solutions to the structural impediments, however, can only be implemented in the medium to long term.

In the immediate term, there are 5 growth areas on the supply side which offer significant potential to unlock greater flows of financing to the real economy.

These are:

- Digital Finance, which is giving access to finance to those traditionally excluded from the system leveraging digital technologies;

- Risk Capital, which is spurring the growth and development of the innovation and start-up eco-system;

- Microfinance, which is supporting the provision of access to finance to those at the bottom of the pyramid and also making loans accessible to people in far-flung areas;

- Development Finance, which is catalyzing enhanced flow of financing to the traditionally excluded segments; and

- Capital markets, which are supporting the origination of greater flows of long-term finance in addition to freeing up liquidity in the banking system.

Join the Conversation