Global Economic Prospects January 2020 - Europe and Central Asia

Global Economic Prospects January 2020 - Europe and Central Asia

On 8 January, we released our latest Global Economic Prospects report – Slow Growth, Policy Challenges. The main message is that global growth is expected to recover to 2.5 percent in 2020—up slightly from the post-crisis low of 2.4 percent registered last year amid weakening trade and investment.

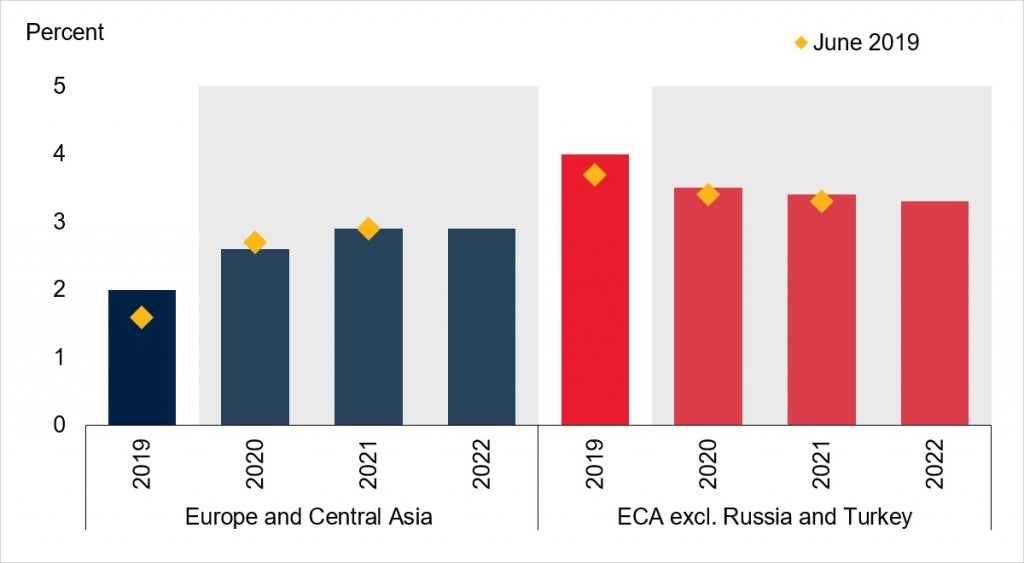

Let’s take a look at the latest projections for the Europe and Central Asia region. After decelerating to a three-year low of 2 percent in 2019, which reflected substantial weakness in trade and investment, growth in the region is expected to firm to 2.6 percent in 2020.

Earlier weakness predominately reflected a sharp slowdown in Turkey as a result of acute financial market pressure in 2018, as well as in the Russian Federation due to weak demand and cuts in oil production.

The following 5 charts highlight some key takeaways from our report.

1 – Recovery in Turkey and Russia Should Help Spur Growth

Growth in Europe and Central Asia is projected to firm in 2020, as activity recovers in Turkey and Russia, and to stabilize at 2.9 percent in 2021-22.

Aggregate growth rates calculated using GDP weights at 2010 prices and market exchange rates. Shaded areas indicate forecasts. Data for 2019 are estimated. Yellow diamonds correspond to forecasts from the June 2019 Global Economic Prospects report. Source: World Bank.

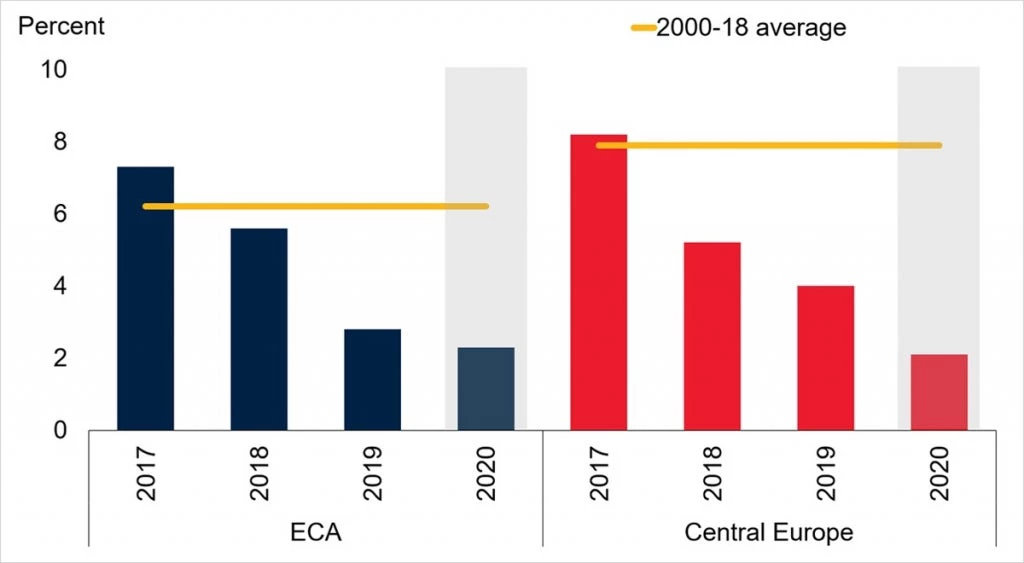

2 – Export Growth is on Track to Stay Modest

Export growth weakened significantly and is expected to remain subdued, particularly in Central Europe, which is tightly connected to the Euro Area through value chains.

Aggregate growth rates calculated using GDP weights at 2010 prices and market exchange rates. Shaded areas indicate forecasts. Data for 2019 are estimated. Central Europe includes Bulgaria, Croatia, Hungary, Poland, and Romania. Source: World Bank.

3 – Narrow Fiscal Space Limits Options

The ability to confront growth headwinds is reduced by limited fiscal space, as increased public spending and low tax capacity have contributed to historically high debt levels.

ECA = Europe and Central Asia, South Cauc. = South Caucasus, Gov. = government, Ext. = external. Sample includes 24 economies. Source: International Monetary Fund; World Bank.

4 – Productivity Growth has Slumped

Productivity growth in the region fell to 1.6 percent in the post-crisis period (2013-18) from roughly 5.5 percent pre-crisis—the sharpest decline of any emerging and developing region—a reflection of a substantial deceleration in total factor productivity growth in Eastern Europe, the South Caucasus, and the Western Balkans, and investment weakness in Russia and Central Europe.

Unless otherwise specified, productivity refers to labor productivity, defined as output per worker. Aggregate growth rates calculated using GDP weights at 2010 prices and market exchange rates. The unbalanced sample includes 21 ECA economies. Source: Penn World Tables; The Conference Board; World Development Indicators, World Bank.

5 – Fundamental Drivers of Productivity are Slowing

The deceleration of productivity in the region reflects slower improvements in a broad range of the fundamental drivers of productivity. A comprehensive policy approach is needed to improve the provision and quality of factors of production, boost firm productivity, promote productivity-enhancing sectoral reallocation, and establish a more growth-friendly business environment.

Source: APO productivity database; Haver Analytics; International Country Risk Guide; ILOSTAT; Observatory of Economic Complexity; Organisation of Economic Co-operation and Development STAN; Penn World Tables; United Nations; World Bank; World KLEMS.

The main external risks to regional growth include spillovers from weaker-than-expected activity in the Euro Area, disruption related to Brexit, and escalation of global policy uncertainty. The region also remains vulnerable to disorderly commodity and financial market developments.

Read more about the latest growth outlook for Europe and Central Asia.

Download the January 2020 Global Economic Prospects report (PDF).

Join the Conversation