On a recent rainy Saturday in Istanbul, the mood was so gloomy that a roomful of macro-economists were at pains to admit that the sharp fall in the oil price since June 2014 would actually benefit a lot of people. On display was an impressive assortment of "two handed economists", who saw almost as many losers as winners. They cited negative effects on fiscal balances in oil exporting countries, investment declines because of uncertainty, and demand shortfalls in countries in which consumers are still deleveraging after the Global Crisis. In addition, the gains in many countries would be tempered by government interventions, which may reduce subsidies or raise taxes without translating fiscal space into higher spending.

The workshop was organized by the Central Bank of Turkey ahead of the G20 Finance Ministers’ Meeting in Istanbul on February 9-10. It brought together practitioners and researchers from G20 central banks, investment banks, academia, the OECD, and the World Bank for an exchange of views under "Chatham House rules" - which means I will not attribute what was said to individual participants.

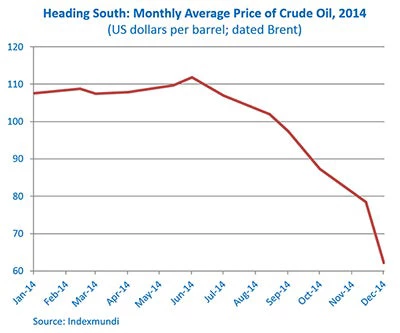

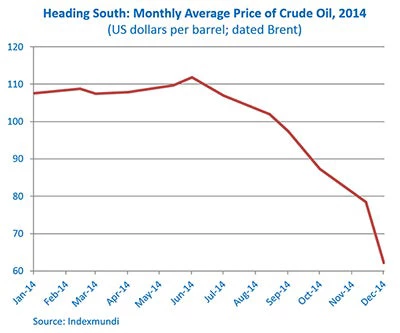

The background: after four years of relative stability around $110 per barrel, the monthly average price of crude oil fell by 55 percent between June 2014 and January 2015, with the for-now lowest point of $45 on January 13th. It created budget worries in oil exporting countries, and led to significant changes in asset prices, with oil company valuations falling, while stocks of energy intensive producers rose. Exchange rates of oil exporting countries— if not pegged—depreciated, while at the same time the US dollar appreciated, not exclusively because of the oil price decline.

Allow me one exception to the Chatham House rule and cite an academic who presented a for-publication paper. Lutz Kilian, of the University of Michigan, "explained" the recent oil price collapse on the basis of his econometric model built on "fundamentals". Using only data available at end-June 2014, the model would have predicted a fall in the oil price to $84 per barrel in December 2014. The decline is thus "explained" by continuing high oil production in the face of weakening economic activity and oil demand. However, the model’s forecast error is quite large, with the oil price actually reaching $62 per barrel in December (the model "got" about 55 percent of the decline), due to an unexpected decline in the demand for storage in July, while in December, global economic activity was significantly weaker than expected.

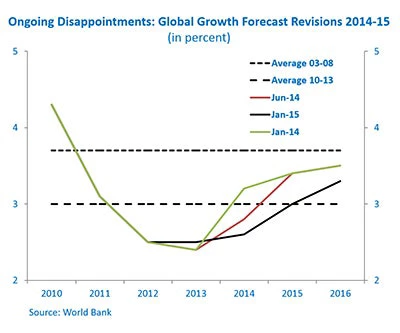

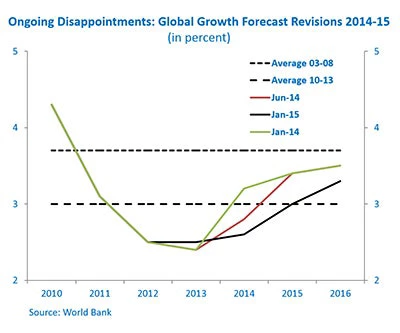

The latter might explain some of the gloomy mood this Saturday. Global growth consistently disappointed over the last 18 months, forcing negative revisions in the growth forecasts in the last three World Bank reports on Global Economic Prospects. But surely, lower prices paid at gas stations must leave consumers with extra pocket money to spend, thus create demand and jobs? This is far from clear. Consumers in the US, most probably, would be the one bright spot: they would spend the annual $600 average per-household savings from lower oil prices to buy more stuff. With the high import component of US consumer spending, the US would thus provide a market for exports from the rest of the world.

In contrast, European and Japanese consumers will not benefit equally from lower oil prices. High taxes put a wedge between crude oil prices and what they pay at the pump. In other countries, in particular in some emerging markets, government intervention may completely neutralize the impact of the oil price decline: governments may decide to reduce subsidies or even raise extra revenue, but then not use the fiscal space they gained and instead repair fiscal balances.

The meeting even found fault with the one bright spot - increased US consumer spending. The high import content would increase global imbalances, with a rising US current account deficit mirrored by an increasing surplus in Germany and China. The financing of the deficit would soak up international liquidity, reducing capital flows to emerging markets.

When a much brighter day dawned in Istanbul on Sunday, we shook off the gloomy mood: lower oil prices are good news, after all. Turkey would have paid something like $40 billion for oil imports in 2015 without the price decline. Now, its current account deficit, which at one point had put the country on the top of the list of countries most vulnerable to a currency crisis, is expected to narrow to about 4 percent of GDP in 2015, from double-digit levels a few years ago. Economic growth in 2015 is expected to reach 3.5 percent. This is not the stellar rate of growth of the mid-2000s, but enough to sip a hot çay at Ortaköy under the magnificent span of the Bosphorus Bridge, and contemplate the interconnectedness of the world.

The workshop was organized by the Central Bank of Turkey ahead of the G20 Finance Ministers’ Meeting in Istanbul on February 9-10. It brought together practitioners and researchers from G20 central banks, investment banks, academia, the OECD, and the World Bank for an exchange of views under "Chatham House rules" - which means I will not attribute what was said to individual participants.

The background: after four years of relative stability around $110 per barrel, the monthly average price of crude oil fell by 55 percent between June 2014 and January 2015, with the for-now lowest point of $45 on January 13th. It created budget worries in oil exporting countries, and led to significant changes in asset prices, with oil company valuations falling, while stocks of energy intensive producers rose. Exchange rates of oil exporting countries— if not pegged—depreciated, while at the same time the US dollar appreciated, not exclusively because of the oil price decline.

Allow me one exception to the Chatham House rule and cite an academic who presented a for-publication paper. Lutz Kilian, of the University of Michigan, "explained" the recent oil price collapse on the basis of his econometric model built on "fundamentals". Using only data available at end-June 2014, the model would have predicted a fall in the oil price to $84 per barrel in December 2014. The decline is thus "explained" by continuing high oil production in the face of weakening economic activity and oil demand. However, the model’s forecast error is quite large, with the oil price actually reaching $62 per barrel in December (the model "got" about 55 percent of the decline), due to an unexpected decline in the demand for storage in July, while in December, global economic activity was significantly weaker than expected.

The latter might explain some of the gloomy mood this Saturday. Global growth consistently disappointed over the last 18 months, forcing negative revisions in the growth forecasts in the last three World Bank reports on Global Economic Prospects. But surely, lower prices paid at gas stations must leave consumers with extra pocket money to spend, thus create demand and jobs? This is far from clear. Consumers in the US, most probably, would be the one bright spot: they would spend the annual $600 average per-household savings from lower oil prices to buy more stuff. With the high import component of US consumer spending, the US would thus provide a market for exports from the rest of the world.

In contrast, European and Japanese consumers will not benefit equally from lower oil prices. High taxes put a wedge between crude oil prices and what they pay at the pump. In other countries, in particular in some emerging markets, government intervention may completely neutralize the impact of the oil price decline: governments may decide to reduce subsidies or even raise extra revenue, but then not use the fiscal space they gained and instead repair fiscal balances.

The meeting even found fault with the one bright spot - increased US consumer spending. The high import content would increase global imbalances, with a rising US current account deficit mirrored by an increasing surplus in Germany and China. The financing of the deficit would soak up international liquidity, reducing capital flows to emerging markets.

When a much brighter day dawned in Istanbul on Sunday, we shook off the gloomy mood: lower oil prices are good news, after all. Turkey would have paid something like $40 billion for oil imports in 2015 without the price decline. Now, its current account deficit, which at one point had put the country on the top of the list of countries most vulnerable to a currency crisis, is expected to narrow to about 4 percent of GDP in 2015, from double-digit levels a few years ago. Economic growth in 2015 is expected to reach 3.5 percent. This is not the stellar rate of growth of the mid-2000s, but enough to sip a hot çay at Ortaköy under the magnificent span of the Bosphorus Bridge, and contemplate the interconnectedness of the world.

Join the Conversation