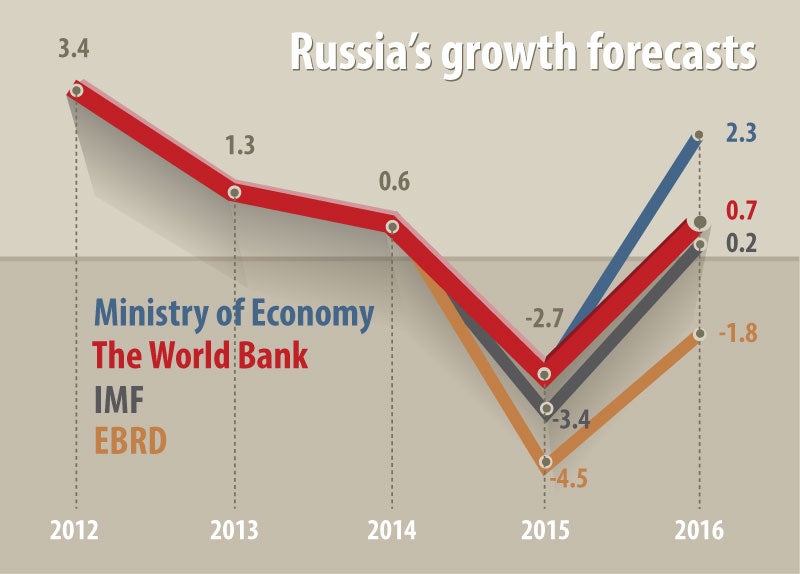

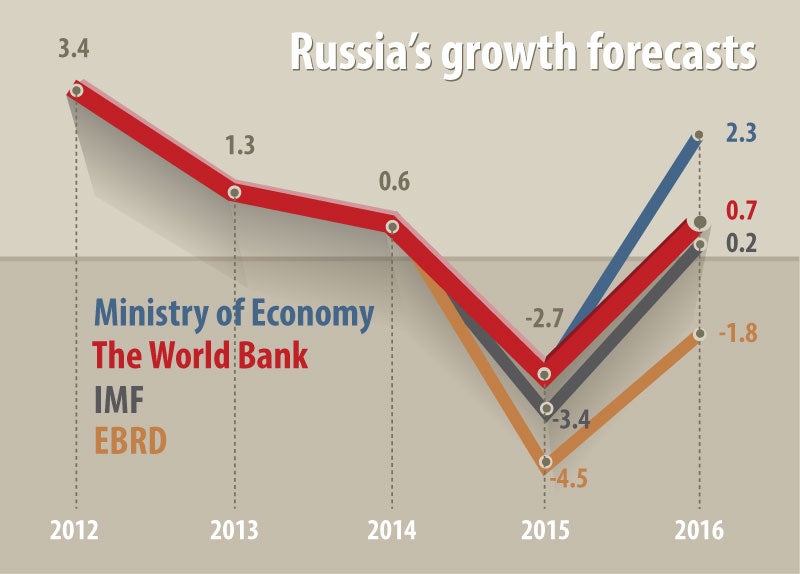

2015 is set to be a year of recession for Russia – with economic growth likely to come out somewhere between -2 and -4 percent.

The latest World Bank forecast for June projects a 2.7 percent contraction (based on an oil price of US$ 58 per barrel), which has been revised up from 3.8 percent (based on US$ 53 per barrel).

Growth is likely to bottom-out in the second quarter of 2015, with a gradual recovery in the later part of the year. For 2016 and beyond, the forecasts appear to diverge: some analysts assume a faster cyclical rebound, while others expect a protracted period of low-growth – see graph below.

But it is important to ask: what is Russia’s medium-term growth path? And what – beyond oil prices – is likely to determine that growth most?

I would argue that Russia’s growth will depend largely on structural reforms. And, for the period 2016-2018 in particular, it will depend on how quickly and extensively those reforms are implemented – as illustrated in our update from September 2014.

Russia’s newly updated Economic Reform Framework (in Russian) holds a lot of promise – with its broad commitment to addressing many of the key structural challenges facing the economy today. Overall, it aims to support greater private investment and entrepreneurship.

Specifically, the Framework makes the following commitments: the creation of a more competitive environment with better conditions for investment and innovation; improvement of efficiency of labor, capital and energy resources; an increase in the quality of government institutions, with greater effectiveness of budget expenditure; and less state involvement in the economy.

A concerted effort towards achieving these goals could help boost Russia’s growth over the next few years, and help accelerate stabilization and adjustment of the economy.

Uncertainty remains, however, about commitments being translated into a concrete policy action plan. The government’s new 2016-2017 budget proposal promises to tell us more – let’s see in September, when it is released.

The promise of important reforms notwithstanding, a critical question arises: will there be enough political determination to see such reforms through the next election round in 2018? One thing is certain: Russia’s medium-term growth outlook is going to be shaped by the quality of the structural reform measures and the composition of the reform implementation plan.

Given the commitment articulated by the government so far, an acceleration of reforms seems to be expected.

Most importantly, reform measures would help to boost private sector confidence and lead to a faster recovery in investment growth – especially if supported by conducive external conditions. Stabilizing oil prices would allow the Central Bank to continue its monetary easing at a more rapid pace and make credit cheaper. And, household consumption would increase at a faster rate, due to better credit access and subsiding devaluation expectations.

In such a scenario, we project growth could reach 0.7 percent in 2016, and then climb to over 2 percent in 2017. On the other hand, if structural reform efforts are slow, growth in 2016 is likely to remain near zero, only reaching 1.0 to 1.5 percent in 2017.

Ultimately, Russia’s medium- to long-term outlook is likely to be determined by its own policy efforts to create growth potential in the near future.

Related Links:

The latest World Bank forecast for June projects a 2.7 percent contraction (based on an oil price of US$ 58 per barrel), which has been revised up from 3.8 percent (based on US$ 53 per barrel).

Growth is likely to bottom-out in the second quarter of 2015, with a gradual recovery in the later part of the year. For 2016 and beyond, the forecasts appear to diverge: some analysts assume a faster cyclical rebound, while others expect a protracted period of low-growth – see graph below.

But it is important to ask: what is Russia’s medium-term growth path? And what – beyond oil prices – is likely to determine that growth most?

I would argue that Russia’s growth will depend largely on structural reforms. And, for the period 2016-2018 in particular, it will depend on how quickly and extensively those reforms are implemented – as illustrated in our update from September 2014.

Russia’s newly updated Economic Reform Framework (in Russian) holds a lot of promise – with its broad commitment to addressing many of the key structural challenges facing the economy today. Overall, it aims to support greater private investment and entrepreneurship.

Specifically, the Framework makes the following commitments: the creation of a more competitive environment with better conditions for investment and innovation; improvement of efficiency of labor, capital and energy resources; an increase in the quality of government institutions, with greater effectiveness of budget expenditure; and less state involvement in the economy.

A concerted effort towards achieving these goals could help boost Russia’s growth over the next few years, and help accelerate stabilization and adjustment of the economy.

Uncertainty remains, however, about commitments being translated into a concrete policy action plan. The government’s new 2016-2017 budget proposal promises to tell us more – let’s see in September, when it is released.

The promise of important reforms notwithstanding, a critical question arises: will there be enough political determination to see such reforms through the next election round in 2018? One thing is certain: Russia’s medium-term growth outlook is going to be shaped by the quality of the structural reform measures and the composition of the reform implementation plan.

Given the commitment articulated by the government so far, an acceleration of reforms seems to be expected.

Most importantly, reform measures would help to boost private sector confidence and lead to a faster recovery in investment growth – especially if supported by conducive external conditions. Stabilizing oil prices would allow the Central Bank to continue its monetary easing at a more rapid pace and make credit cheaper. And, household consumption would increase at a faster rate, due to better credit access and subsiding devaluation expectations.

In such a scenario, we project growth could reach 0.7 percent in 2016, and then climb to over 2 percent in 2017. On the other hand, if structural reform efforts are slow, growth in 2016 is likely to remain near zero, only reaching 1.0 to 1.5 percent in 2017.

Ultimately, Russia’s medium- to long-term outlook is likely to be determined by its own policy efforts to create growth potential in the near future.

Related Links:

- Press Release: World Bank Revises its Growth Projections for Russia for 2015 and 2016

- Russia Economic Report #33 – The Dawn of a New Economic Era

- Russia Economic Report #32 – Policy Uncertainty Clouds Medium-Term Prospects

- World Bank Monthly Economic Updates for Russia

- World Bank in Russia

- Russia’s Economic Reform Framework (in Russian)

Join the Conversation