Photo: Flore de Preneuf / World Bank

Photo: Flore de Preneuf / World Bank

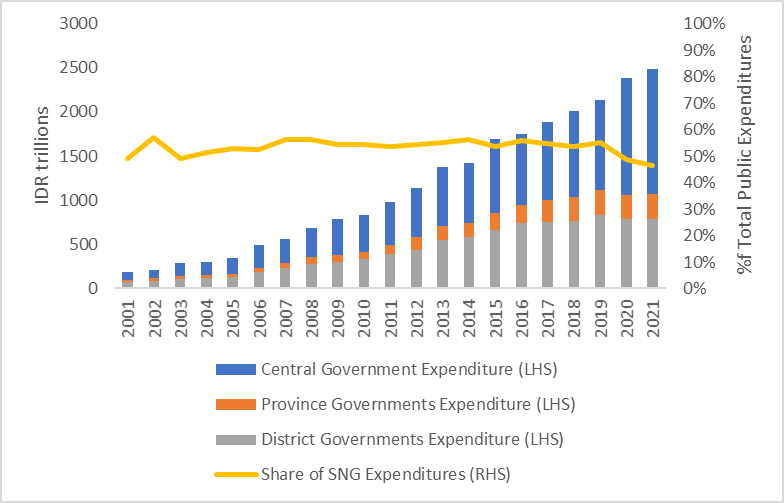

Indonesia’s 2001 Big Bang of fiscal decentralization transferred significant spending responsibilities to subnational governments (SNGs). This led to a high share of SNG spending (both provincial and district) of around 50 percent of total government expenditure, excluding subsidies, interest payments, and transfers (see graph 1 for the trajectory).

Graph 1. Public expenditure by level of government

SNGs rely primarily on central government (CG) transfers to finance their spending, making them their largest revenue source. However, SNG reliance on CG transfers has steadily decreased over the last two decades due to successive rounds of fiscal decentralization. CG transfers accounted for 82 percent of SNG revenue in 2001 which reduced to 48 percent in 2020.

Stepping up SNG revenue mobilization is important as it achieves two objectives. First, it allows SNGs more fiscal independence. A heavy reliance on CG transfers diminishes incentives for prudent local budget execution, weakening the fiscal contract between government and people. Second, better tax policy and compliance at the subnational level can help close Indonesia’s overall tax gap, which, we estimated at 6 percent of GDP for 2018.

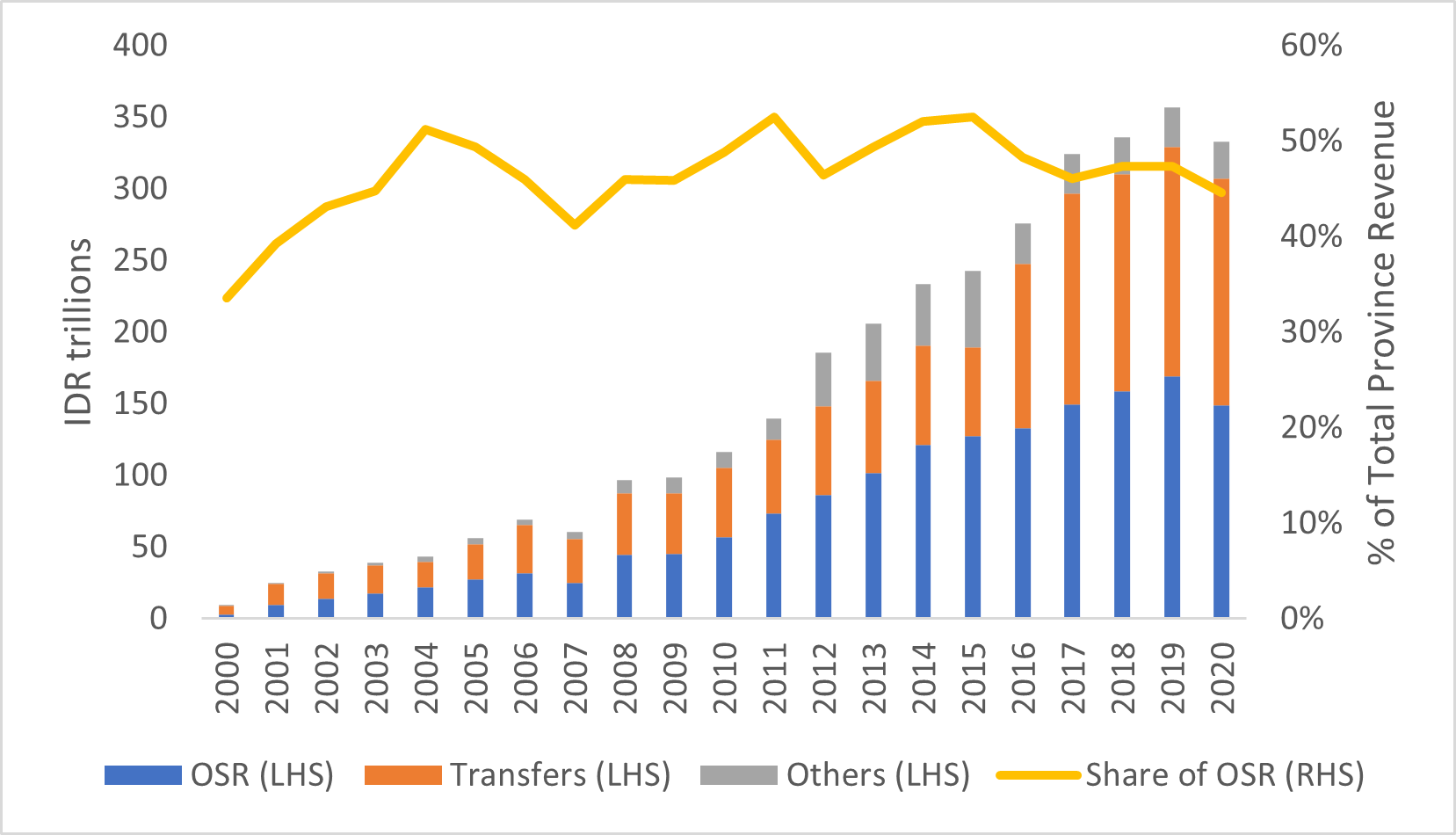

Over the last decade, the share of own source revenue (OSR) in total revenue for the provinces has remained high and stable (graph 2). However, when it comes to districts, the situation is different. While fiscal independence has slowly improved, thanks to increasing OSR in both nominal terms as well as a share of local revenues (graph 3), districts still have the potential to improve OSR collection.

This progress in districts till now can be partly attributed to the central government’s strong commitment to fiscal decentralization, which it has accomplished by giving local governments control over significant income sources, including property tax. Decentralization of these tax bases includes giving SNGs the freedom to determine tax rates below a CG-specified ceiling and the power to administer these taxes.

Graph 2. Revenue Composition, Provinces

Graph 3. Revenue Composition, Districts

Additionally, the new Law 1/2022 takes several important steps to further improve district revenue mobilization. These include an increase in the ceiling tax rate for the property tax and the simplification of several consumption-based taxes into a common sales tax.

World Bank Support

While the reforms are steps in the right direction, there is still plenty of room to further enhance district revenue mobilization. To address the revenue mobilization challenge, the World Bank has partnered with the Ministry of Home Affairs, the Ministry of Finance, and a few district governments in Indonesia to provide technical assistance on revenue administration in these districts. This activity is broadly divided into two steps:

- District tax diagnostics: Conducting a revenue administration baseline diagnostic to identify constraints to district revenue administration in the respective districts.

- Technical assistance to pilot districts: Working closely with the district government to provide technical advice on ways to improve revenue mobilization, based on the diagnostic work.

The idea is to jointly work with partners to, first, provide good, micro-founded evidence of revenue mobilization constraints, such as informality and tax policy distortions. This evidence will then form the basis for a technical assistance program to address important constraints. The work will generate valuable lessons for all important stakeholders which will help with the scalability of reforms for districts across Indonesia. This in turn, will help address the overall revenue mobilization challenge in Indonesia.

Join the Conversation